Why is My Bank Balance Not Matching the Bank Balance in QuickBooks Online?

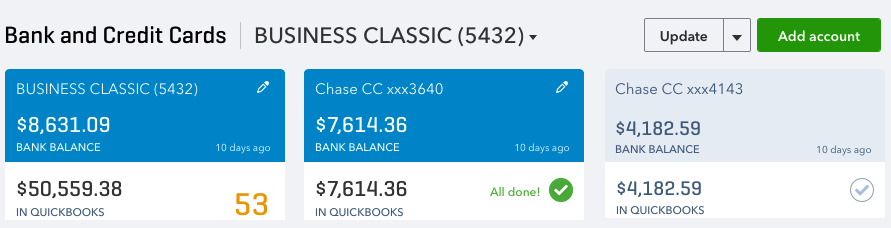

This is one of the most common questions I get asked by new QuickBooks Online users, and you may be surprised to know that more often than not, both bank and QuickBooks balances are never matched simultaneously. However, if you have updated your bank downloads, reviewed and added them all to the QuickBooks register for a specific period or timeframe, and your balances are not matching there may be cause for concern. Here are three main reasons why your actual bank balance does not equal the bank balance in QuickBooks Online.

Three Main Reasons Your Actual Bank Balance Does Not Match Your Bank Balance in QuickBooks:

- You or someone else may have manually added some transactions to QuickBooks and then added them again from the download screen. (This is one reason why it is important to establish and use only one method of inputting your transactions in QuickBooks which is either a) adding transactions via the QuickBooks banking download option, or b) manually adding individual transactions. Adding transactions via the download option is my personal preference and recommendation, as it saves time as well as minimize data entry errors. Subsequently, if you are reconciling your account and realize there are transactions missing that were not downloaded, you can manually enter those missing transactions that are on your bank or credit card statement but not in QuickBooks. It’s very rare for this to happen, but it does!)

- You have manually written check(s) directly in QuickBooks and those checks have not yet been presented to your bank to be cashed. (This will cause your QuickBooks balance to be less than your actual bank balance by the check or checks amount.)

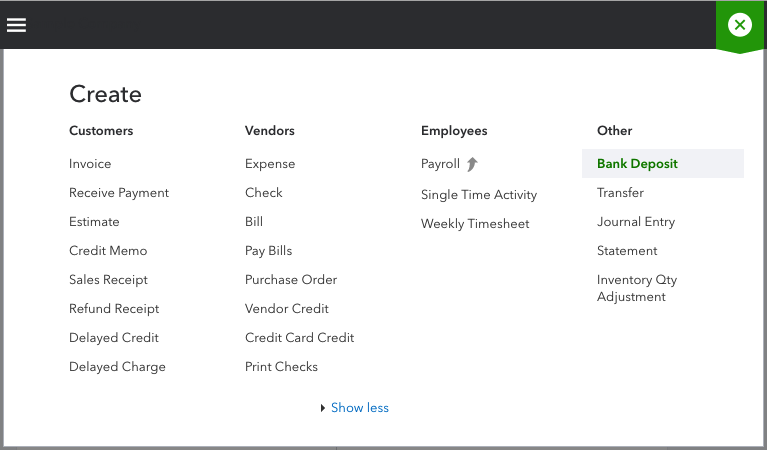

- You have received and applied customer payment(s) to their Invoices in QuickBooks, and also deposited them to the bank account in QuickBooks; however, you have not yet deposited those payments to your actual bank account or you have but they are not yet recorded by your bank. (This will cause your QuickBooks balance to be more than than your actual bank balance by the total of the deposit(s). (When you receive customer payments, you want to apply them to their respective Invoices for the dates that you receive them; however, you may not always deposit them to your actual bank account on the date that you receive them. This is where the undeposited funds account comes in; use the undeposited funds account to house those customer payments until you actually deposit them to your real bank account. When you have made the deposits to your actual bank account, use the Bank Deposit option at the plus sign top right of screen (as shown in the screenshot below) to transfer those payments in the undeposited funds account to the bank account in QuickBooks.)

How to Ensure Your Actual Bank Account Balance and QuickBooks Bank Balance are in Synch

In addition to the above-mentioned, if you track your cash flow on a daily basis, you will always be able to see what is causing your QuickBooks bank balance and your actual bank balance to be out of synch. Also, it is imperative that you reconcile your bank and credit card accounts regularly – at least on a monthly basis. Reconciliation is one of the most important aspect of accounting, and as such, reconciling your bank and credit card accounts on a monthly basis is the foundation of keeping healthy data and maintaining accurate books. Here are some mistakes that reconciliation can help you uncover:

- Missing transactions

- Duplicate transactions

- Transactions entered in error

- Transactions entered to the wrong period or bank/credit card account

- Incorrect transaction amount entered in QuickBooks

- Incorrect or no opening bank balance entered in QuickBooks

- Transactions previously reconciled have been changed or deleted

So, there you have it! The three (3) main reasons why your QuickBooks bank balance and your actual bank balance are not matching, and what you can do about it. Feel free to leave your questions or comments below.

Recent Comments