How to Setup Payroll for Job Costing in QuickBooks for Contractors

There are several steps needed in order for payroll to flow properly to the job costing reports – especially if you want to include payroll taxes and benefits. The step-by-step instructions below will help guide you through the setup.

You must have a QuickBooks payroll subscription to use these instructions. If you are trying to use job costing with a non-QuickBooks payroll provider, you will not only make your bookkeeping much more time-consuming but also introduce opportunities for errors to be made. QuickBooks offers a complete payroll solution, just like ADP and Paychex, and at a great price too.

Since labor is usually the biggest expense for most companies who are doing job costing, it is vitally important that it be included in your job cost reports. If you don’t include labor, your jobs will seem more profitable than they really are. Even worse, some of them might even be losing money without you even knowing it. This not only affects your present situation, but can lead you to create inaccurate estimates for future jobs.

Here are the steps for setting up payroll for job costing in QuickBooks:

Step 1. Set up Preferences:

- Go to Edit, Preferences, Company Preferences and select Payroll & Employees

- Select “Full Payroll” or “Complete Payroll Customers”

- Check “Job Costing, Class and Item tracking for paycheck expenses”

- Go to Time & Expenses

- Select Yes under “Do you track time?”

- You may also want to check “Create invoices from a list of time & expenses”

Step 2. Set up Payroll Items:

- Go to Lists, Payroll Items

- Next, edit every Addition and Company Contribution item to ensure that “Track expenses by job” is checked

- Payroll items can only be mapped to one expense account, so you may want to setup separate ones for Cost of Goods Sold (COGS) and overhead payroll expense

Step 3. Set up Employee Records:

- Go to the Employee Center and double-click on your employee’s name

- Change Tab to Payroll & Compensation Info

- Check “Use time data to create paychecks”

(Repeat for each employee)

Step 4. Set up Default for New Employees:

- Go to the Employee Center and select Manage Employee Information, then Change Employee Default Settings

- Check “Use time data to create paychecks”

Step 5. Set up Workers Comp:

- Go to Employees, Workers Compensation, then Setup Workers Comp

- Setup your workers comp codes at Employees, Workers Compensation, then Workers Comp List

- Next, go to Lists, Payroll Items to double-check that the Workers Comp payroll item has “Track expenses by job” checked

Step 6. Using TimeSheets

- Go to Employees, Enter Time, then Use Weekly Timesheet

- Complete all information including both a payroll item & a service item. Mark as billable if you do time & material billing

- You may want to add a customer:job called Overhead, so you will have a place to place other entries in order not to forget to make allocation

- Consider using “Time Tracker” or “WorkTrack Time Card” so employees can enter their own time

RELATED:

- How to Setup an Employee in QuickBooks Online

- How to Setup an Employee in QuickBooks for Mac

- How to Setup Payroll in QuickBooks for Mac

- How to Setup an Employee in QuickBooks Windows (Pro, Premier, Enterprise)

- How to Accurately Enter Third-Party Payroll in QuickBooks Online, Mac & Windows (Pro, Premier, Enterprise)

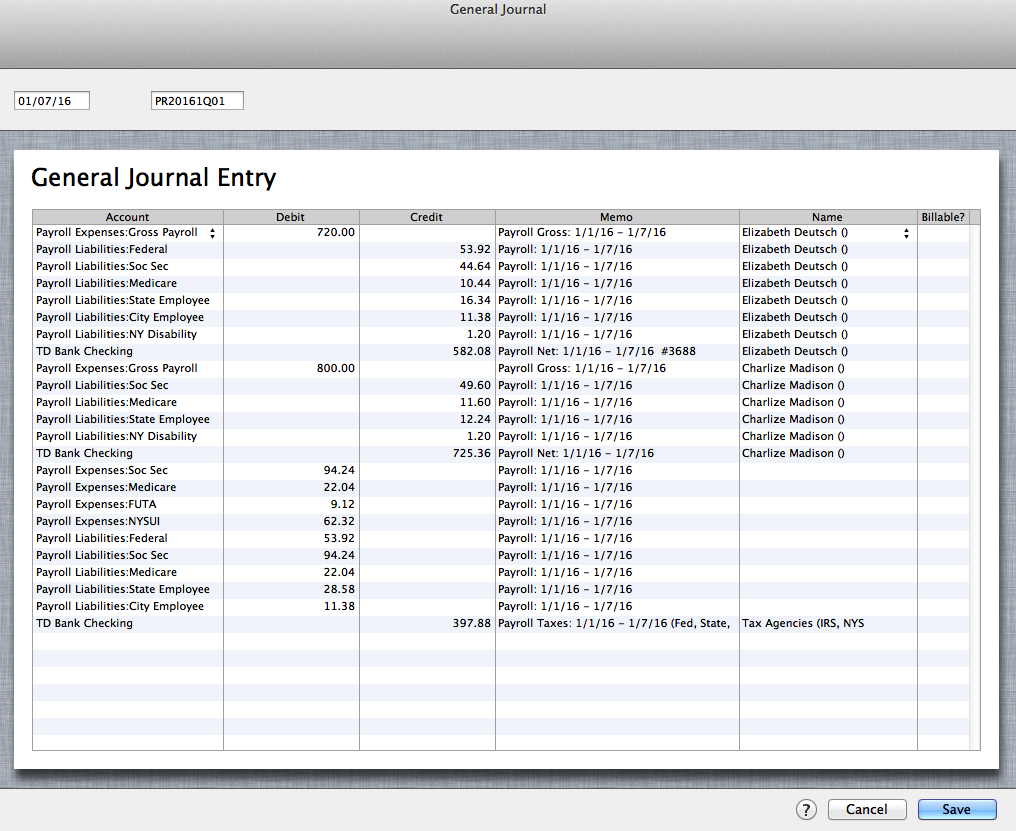

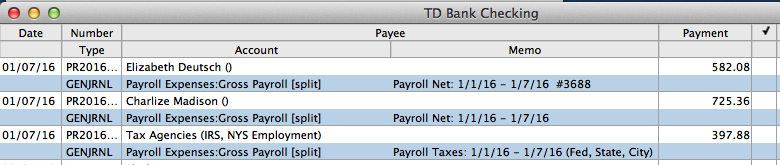

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Recent Comments