by Marie | Feb 22, 2016 | Bookkeeping 101, Customer Setup & Management, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

The way you record this payment will depend on your reporting method – Cash or Accrual. However, there is no Bad Debt in cash basis accounting and you therefore must be using an accrual basis system since there was a previous bad debt allocation.

The best way to record this payment is to enter a sales receipt. This will keep your books clean and will not affect historical data for periods already closed out. This payment will also be counted as this year’s income, as it should, when entered this way.

For Accrual Basis:

If you wrote off the original invoice as a bad debt in a prior year, you should enter a sales receipt – especially if sales tax is involved. The income should be recorded as “Other Income” instead of “Sales”, since the original “Sale” was recorded in a prior year and subsequently written off. The sales tax, if any, was also recorded in a prior period and was written off; however, it was never collected and possibly never paid to the state. The sales tax should be recorded as current, and paid with the next sales tax return and payment that is made. If the sales tax was paid to the state, it was probably adjusted or recovered in a later period when the original invoice was written off, which means the sales tax needs to be remitted to the state – again, since it has now been collected.

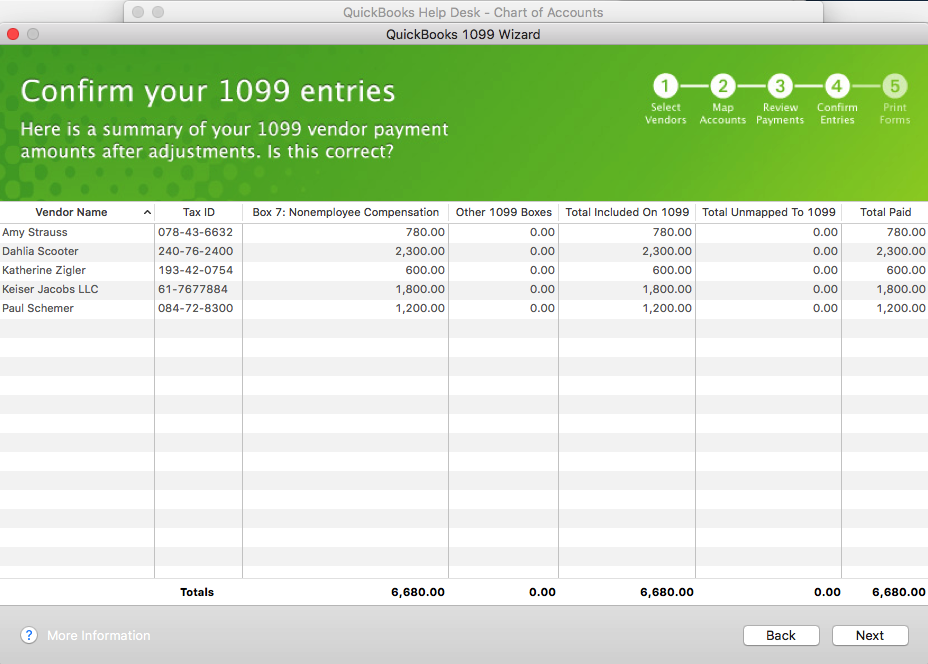

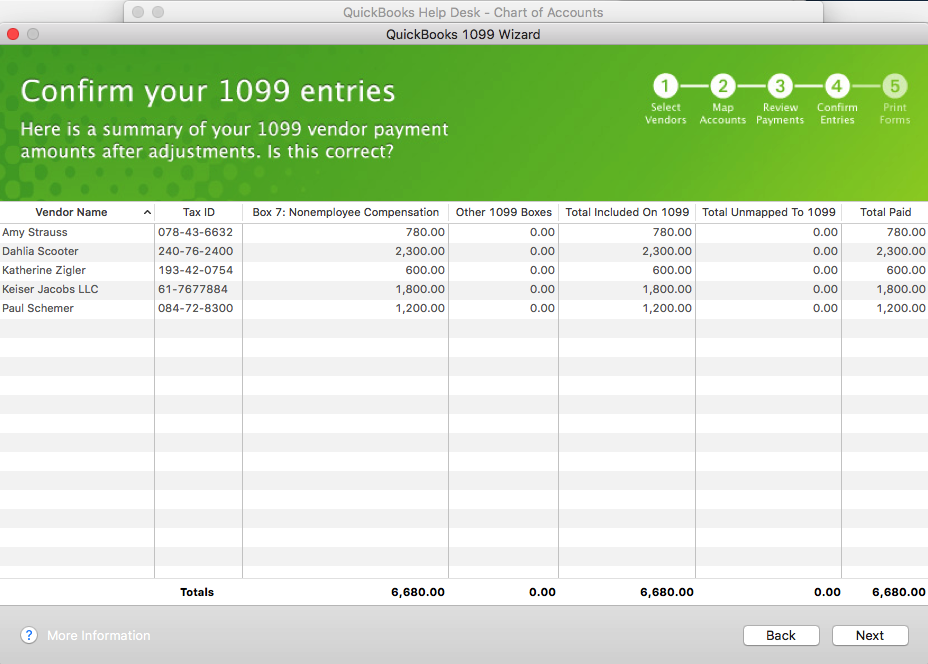

by Marie | Feb 21, 2016 | 1099 Contractor Setup & Printing, Generating & Prinitng Tax Forms, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Vendor Setup & Management

This is a question I have been asked multiple times during this 1099 preparation season, and as such have decided to address it here.

- In order for QuickBooks to generate your 1099 forms, you will need to ensure that the vendor accounts are accurately setup with the tax id option checked, and the account(s) used for each vendor mapped in the 1099 setup window notifying your QuickBooks to include them. Nothing will show up on the 1099 reports unless the vendor accounts are mapped, the tax id option checked, and the appropriate box chosen for each account mapped. Here is the Step by Step Instructions on how to accurately setup your 1099’s in QuickBooks.

- Another important thing to note, is that payments made to vendors using a credit card, debit card, or other third party payment network such as Paypal, should not be included on the vendor’s 1099 form. These companies will be sending their form 1099k to the IRS which will include the payments they made on your behalf. QuickBooks has made it easier to track and separate such payments; however, you have to ensure you include the payment number detail in the check number field when you enter vendor payments in QuickBooks. See Intuit’s Marking Payments for Exclusions from From 1099-Misc

According to Intuit, you can enter any of these notations in your check number field to identify to you what methods of payments were used, as well as allow QuickBooks to exclude payments from 1099’s based on information entered in this field. They are:

- Debit

- Debitcar

- DBT

- DBT card

- DCard

- Debit cd

- Visa

- Masterc

- MC

- MCard

- Chase

- Discover

- Diners

- PayPal

Also, I recommend generating a “Transaction by Vendor” report for each vendor to ensure that the numbers tally with the 1099’s before printing them. You want to ensure accuracy in all aspects of your business.

by Marie | Feb 21, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, Personal and Business Expenses, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reimbursements and Investments

The correct way to enter business expenses that you have paid for with your personal credit card, debit card, or cash in your company’s QuickBooks, will be based on whether you want to invest this money in your company or reimburse yourself for it, as well as the type of business structure your company is setup as – Sole proprietor, Single member LLC, Multi member LLC, or Corporation. With QuickBooks, there are usually more than one ways to deal with various scenarios. Here are a few to deal with this one:

Option 1 – Reimburse Yourself

- Setup yourself in QuickBooks as a vendor and create a bill for your expenses, allocating them to the relevant business expenses the funds were used for. Then, pay yourself with a check using the “Pay Bill” feature when you are ready to take your reimbursement. This option can be used regardless of your business structure.

- Create a Current Liability account and call it something like “Owed to Owner”, then enter the transactions in this account where the credit card and other expenses will be easy to track in the event of an audit, with the exact amounts and vendor details listed. You will then write a check to yourself using this current liability account in order to clear the balance and reimburse yourself. This option is not suitable for a Corporation.

- Fill out an expense report just as you would expect any other employee to do, in order to be reimbursed. All receipts that are company related that the funds were used for, should be attached to this expense report so that all vendor details are part of the company records. In addition, keep a copy of the personal credit card statement in the business files to serve as backup for the expenses. Then, write a check for the expense report total, allocating each expense to its relevant company expense. This option is most suitable for a Corporation. (NOTE: Use the “Write Check” feature only if you are paying the full reimbursement. If you will be taking the reimbursement in portions, you should create a bill with all the expenses listed, then use the “Pay Bill” feature to pay the portion of the bill you want to receive. When you are ready to reimburse yourself for the balance, you will again use the “Pay Bill” feature to complete the payment. Also, be sure to keep receipts as backup for the cash purchases you make with your personal funds on behalf of your business.)

Option 2 – Invest the Funds in Your Business

- Create a Current Liability account and call it something like “Owed to Owner”, then enter the transactions in this account where the credit card expenses will be easy to track in the event of an audit, with the exact amounts and vendor details listed. Next, create an Equity account and call it something like “Owner Contributions”, and transfer the total of all the transactions in the current liability account to this Equity account to invest it in your business. This option is not suitable for a Corporation.

- Create a Liability account and call it something like “Loan from Shareholder”, then enter the individual transactions in this account, so that you will be able to allocate each to its relevant expense. Next, create an Equity account and call it something like “Shareholder Investment”. When you are through entering the transactions in the “Loan from Shareholder” account, transfer the total balance to the “Shareholder Investments” account. This option is most suitable for a Corporation.

Mixing personal funds with business funds is never a good idea! Avoid co-mingling funds at all cost – especially for a Corporation. You could expose yourself to the kind of liability you formed the Corporation to avoid, in the first place.

Get The Help You Need: Sign Up For “One on One” QuickBooks Training:

by Marie | Oct 11, 2015 | Bookkeeping 101

Is your bookkeeping system doing the best job it can for you?

Do you have the right accounting system for your business? Your current bookkeeping system can either be helping or hindering your business right now!

The truth about the financial stance of your business, and its ultimate success depends on two things:

- How well you decided to keep your company’s books, and

- How well you have kept them.

Whether you are just starting out or have been in business a while, evaluating your bookkeeping system to ensure it is the best fit and helping you to maximize your business’s potential, is crucial for your business growth and development. Here are a few questions to ask yourself:

- Is the program software I am using for my business the right fit? The right fit should be easy to use, house all the features your business require, and allow you to gain insight into the wellness of your business through multiple reports.

- How easy is it for me to enter data? The best system for your business should allow for efficiency and save you time.

- Can I understand the language it speaks and the program’s functionality? I mean, is it an integrated system or do I need an accounting background to understand how the separate modules work? Your system should be user-friendly, even if you do not have an accounting background.

- Does it give me useful reporting? A good software system should be able to let you know how much you are making and spending, and why.

- Does my system meet government’s record retention requirements? Whether your information is on paper or is stored in an electronic version, it is your responsibility to retain records that an auditor can access – in the event of a tax audit.

Based on the answers to the above-mentioned questions, you may need to evaluate further:

What would make my business flow more efficiently?

- Do I continue to do my books myself or hire a bookkeeper?

- If I decide to hire, should I opt for a part-time, full-time, on the premises, off the premises, employee or freelance bookkeeper?

- If I decide to continue doing my books myself, should I change my current accounting software program? Should I use online (in the cloud) or offline on my desktop?

And what about your paperwork and documents? Are they trackable? Easy to locate? Do you need a formal filing system or will an informal receipts method work?

Any organized system will let you see if your revenue coming in covers your business expenses (including your draw) with some extra room left for a profit. Even simple systems will let know what your profit margin is.

Your system should let you break down your expenses by type so you can see where your largest outlays are. You need this important information if you are going to control your costs. Cutting costs may make sense in the short run but take the time to think about how will it affect your long range plans for your business.

Projecting your cash flow three to six months into the future will give you a heads up if a cash squeeze is coming, allowing you to be proactive and take action.

If your accounting system is doing its job, you should be able to see where your highest profits are so you can direct your time and money there instead of on the less profitable parts of your business. Or maybe you can brainstorm to see if there is a way to increase your profits in these areas.

Bottom Line:

Not keeping accurate, up-to-date books can give you a false sense of security and business health, and over time run your business into the ground. The way in which you conduct your business as well as keep your books and documents will help or hurt your business statistics on which you rely to make good business decisions.

Recent Comments