Why Are All My 1099 Vendors Not Showing Up On My 1099 Summary Report In QuickBooks?

This is a question I have been asked multiple times during this 1099 preparation season, and as such have decided to address it here.

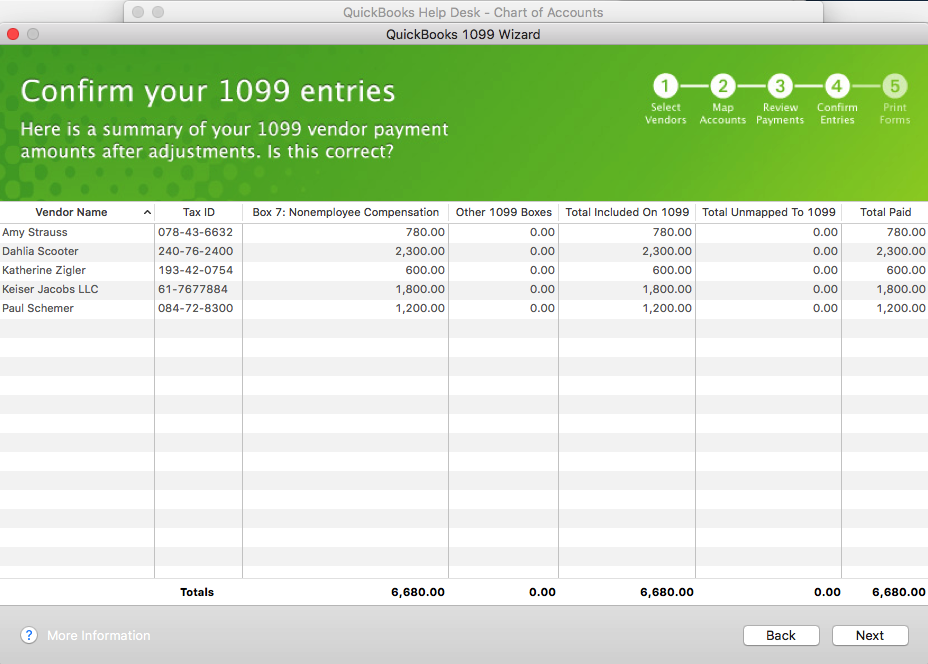

- In order for QuickBooks to generate your 1099 forms, you will need to ensure that the vendor accounts are accurately setup with the tax id option checked, and the account(s) used for each vendor mapped in the 1099 setup window notifying your QuickBooks to include them. Nothing will show up on the 1099 reports unless the vendor accounts are mapped, the tax id option checked, and the appropriate box chosen for each account mapped. Here is the Step by Step Instructions on how to accurately setup your 1099’s in QuickBooks.

- Another important thing to note, is that payments made to vendors using a credit card, debit card, or other third party payment network such as Paypal, should not be included on the vendor’s 1099 form. These companies will be sending their form 1099k to the IRS which will include the payments they made on your behalf. QuickBooks has made it easier to track and separate such payments; however, you have to ensure you include the payment number detail in the check number field when you enter vendor payments in QuickBooks. See Intuit’s Marking Payments for Exclusions from From 1099-Misc

- Debit

- Debitcar

- DBT

- DBT card

- DCard

- Debit cd

- Visa

- Masterc

- MC

- MCard

- Chase

- Discover

- Diners

- PayPal

Notations You Can Enter in Your Check Number Field for QuickBooks 1099 Help

According to Intuit, you can enter any of these notations in your check number field to identify to you what methods of payments were used, as well as allow QuickBooks to exclude payments from 1099’s based on information entered in this field. They are:

Also, I recommend generating a “Transaction by Vendor” report for each vendor to ensure that the numbers tally with the 1099’s before printing them. You want to ensure accuracy in all aspects of your business.

Recent Comments