by Marie | Oct 2, 2016 | Banking Setup & Management, Chart of Accounts Setup & Management, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

First, I want to say that you need to be absolutely sure that both accounts are for the same bank account before making the merge. Once merged, it cannot be un-merged! Also, if you are using a desktop edition of QuickBooks, do make a backup before proceeding with this merger. It is good practice to make a backup copy before doing anything major in your QuickBooks company file.

How to Merge Two Bank Accounts in QuickBooks

First you’ll want to go to the Chart ofAccounts and select the bank account that you want to be gone. Next, edit this account and make the spelling of the name be the exact as the one you are keeping. (A pop up box will open with a message “This name is already being used. Would you like to merge them?”) Answer Yes then Merge Accounts if asked, and your bank accounts will be merged.

- Go to List and select Chart of Accounts

- Select the bank account you do not want to keep, and click Edit at bottom left.

- Type the name of the Account you are keeping, the exact way it is on the one you are keeping, and click Ok.

- You will now be asked to confirm if you really want to go ahead with the merge. Answer Yes then Merge Accounts if asked, and your accounts will be merged.

Note: This is the same method used to merge other chart of accounts, vendors, or customers.

by Marie | Aug 25, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

Cost of Goods Sold are those costs that are directly associated with the production of a good or goods, or with direct service that leads to a sale. Expenses are all the other costs that are not COGS. See list of COGS and Expenses below:

Cost of Goods Sold Accounts

- Blueprints and Reproduction: Blueprints, photostats, and other printing expense

- Bond Expense: Construction bonds expenses directly related to jobs

- Construction Materials Costs: Construction materials costs

- Contracted Services: Direct labor costs for contract (non-employees) performing services for clients

- Equipment Rental for Jobs: Rent paid for rented equipment used on jobs

- Freight and Shipping Costs: Freight-in and shipping costs for delivery to customers

- Freight Costs: Costs of freight and delivery for merchandise purchased

- Job Materials Purchased: Construction materials used on jobs

- Linens and Lodging Supplies: Costs of linens and other supplies for guest rooms

- Materials Costs: Cost of materials used on jobs

- Media Purchased for Clients: Print, TV, radio, and other media purchased for clients

- Merchant Account Fees: Credit card merchant account discount fees, transaction fees, and related costs

- Other Construction Costs: Other costs directly related to jobs such as waste disposal, onsite storage rental, etc.

- Other Job Related Costs: Other costs directly related to jobs such as waste disposal, onsite storage rental, etc.

- Parts Purchases: Purchases of parts for use on customer repairs or resale

- Purchases – Hardware for Resale: Purchases of hardware items for resale that are not tracked or counted in inventory

- Purchases – Resale Items: Purchases of items for resale that are not tracked or counted in inventory

- Purchases – Software for Resale: Purchases of software items for resale that are not tracked or counted in inventory

- Subcontracted Services: Subcontracted services for customer service orders

- Subcontractors Expense: Subcontracted services performed by other contractors

- Tools and Small Equipment: Purchases of tools or small equipment used on jobs

- Worker’s Compensation Insurance: Worker’s compensation insurance premiums

Expense Accounts

- Advertising and Promotion: Advertising, marketing, graphic design, and other promotional expenses

- Auto and Truck Expenses: Fuel, oil, repairs, and other maintenance for business autos and trucks

- Automobile Expense: Fuel, oil, repairs, and other automobile maintenance for business autos

- Bank Service Charges: Bank account service fees, bad check charges and other bank fees

- Business Licenses and Permits: Business licenses, permits, and other business-related fees

- Car and Truck Expenses: Fuel, oil, repairs, and other car and truck maintenance

- Chemicals Purchased: Costs of chemicals used in farming operations

- Computer and Internet Expenses: Computer supplies, off-the-shelf software, online fees, and other computer or internet related expenses

- Continuing Education: Seminars, educational expenses and employee development, not including travel

- Depreciation Expense: Depreciation on equipment, buildings and improvementsDues and Subscriptions: Subscriptions and membership dues for civic, service, professional, trade organizations

- Equipment Rental: Rent paid for rented equipment used for business

- Fertilizers and Lime: Fertilizers and lime purchased for farm operations

- Freight and Trucking: Amounts paid for freight or trucking of farm products

- Gasoline, Fuel and Oil: Gasoline, fuel or oil used for farm machinery

- Insurance Expense: Insurance expenses

- Insurance Expense: General Liability Insurance: General liability insurance premiums

- Insurance Expense: Life and Disability Insurance: Employee life and disability insurance premiums

- Insurance Expense: Professional Liability: Professional liability (errors and omissions) insurance

- Insurance Expense: Workers Compensation: Worker’s compensation insurance premiums

- Interest Expense: Interest payments on business loans, credit card balances, or other business debt

- Janitorial Expense: Janitorial expenses and cleaning supplies

- Landscaping and Groundskeeping: Landscape maintenance, gardening, and pool maintenance costs

- Marketing Expense: Advertising, marketing, graphic design, and other promotional expenses for our company

- Meals and Entertainment: Business meals and entertainment expenses, including travel-related meals (may have limited deductibility)

- Office Supplies: Office supplies expense

- Payroll Expenses: Payroll expenses

- Postage and Delivery: Postage, courier, and pickup and delivery services

- Printing and Reproduction: Printing, copies, and other reproduction expenses

- Professional Fees: Payments to attorneys and other professionals for services rendered

- Rent Expense: Rent paid for company offices or other structures used in the business

- Repairs and Maintenance: Incidental repairs and maintenance of business assets that do not add to the value or prolong its life

- Research Services: Research costs including legal library and subscriptions for research services

- Salon Supplies, Linens, Laundry: Costs of supplies used in the course of business (includes linens and laundry services)

- Seeds and Plants Purchased: Seeds and plants purchased for producing farm income

- Shop Expense: Miscellaneous shop supplies and related shop expenses (rags, hand cleaning supplies, etc.)

- Small Tools and Equipment: Purchases of small tools or equipment not classified as fixed assets

- Storage and Warehousing: Amounts paid to store farm commodities

- Taxes – Property: Taxes paid on property owned by the business, franchise taxes, excise taxes, etc.

- Telephone Expense: Telephone and long distance charges, faxing, and other fees Not equipment purchases

- Travel Expense: Business-related travel expenses including airline tickets, taxi fares, hotel and other travel expenses

Uniforms: Uniforms for employees and contractors

- Utilities: Water, electricity, garbage, and other basic utilities expenses

by Marie | Aug 24, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, Deposits & Undeposited Funds, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

Tenant security deposits are not income and as such, they are to be held until tenant is giving up lease or given notice to leave. If at this point there are repairs to be done, the cost of the total repairs will be deducted and the remainder of the deposit returned to the tenant.

Here is how you enter tenant security deposits correctly in QuickBooks:

- Create an account in your chart of accounts called Tenant Security Deposit, with its type “Other Current Liability”. To do this: a) Select List from the top menu bar, then Chart of Accounts. b) At bottom left, click on the plus sign (in the mac version) or Account then New (in the Windows version – Pro, Premier, Enterprise). Next:

- Go to Banking, Make Deposits and enter the correct date, the tenant’s name in the “Received From” column, select the liability account you just created in the “From Account” column, and enter the payment type, reference number, memo, and amount of the deposit. Be sure to select the bank account you will deposit the tenant’s security deposit to, at the “Deposit to:” drop down option at top left.

- Click Save, Save and New or Save and Close.

In QuickBooks Online, a) Go to Transactions in the left menu bar, then select Chart of Accounts then New at top right of screen. Next:

- Go to the Plus sign at top center of screen, then select Bank Deposit under “Other”

- Enter the correct date, the tenant’s name in the “Received From” column, select the liability account you just created in the “Account” column, and enter the payment type, reference number, description, and amount of the deposit. Be sure to select the bank account you will deposit the tenant’s security deposit to, at the top left drop down option.

- Click Save and New or Save and Close at bottom right.

Any question(s), please feel free to browse our Frequently Asked Questions categories or drop Marie a note.

by Marie | Mar 26, 2016 | Bookkeeping 101, Business Types & Accounting, Chart of Accounts Setup & Management, Personal and Business Expenses, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reimbursements and Investments

The way in which these startup expenses are entered will depend on how the owner wants to treat them – loan or investment, the way the business is structured – Sole Proprietor or Single Member LLC, Partnership or Multi Member LLC, or Corporation, as well as when these expenses were incurred.

What are Startup Expenses or Costs?

Before we get into the above, let’s start off with the main question: What are startup expenses or costs? Not everything is a startup cost and to determine what is and isn’t a startup cost we have to look at whether the costs were incurred prior to the start date of the business (costs to be amortized) or subsequent to the start date of the business (costs to be expensed). Startup costs are those expenses that were incurred prior to the start date of the business, and are amortized over a number of years so they are not a total expense in the first year. Initial costs – market research, advertising the future opening of your business, salaries for training employees before the business opened, incorporation costs, trademarks and the likes are startup costs.

As for amortization, that’s just a fancy accounting term accountants like to use when they refer to the process of spreading costs out to more than one year. They are usually intangible costs like legal fees, government filing fees and the likes. Fortunately, amortization is generally a straight-line process; you take the costs and divide them by the number of years and expense by that portion. It is always important to consult a CPA prior to booking startup costs.

If there are technology equipment such as computers or furniture in the initial purchases, you will need to separate them if they are used in the business, since they will need to be depreciated. Depreciation is generally for tangible items such as buildings, equipment, computers, furniture, vehicles, etc. Again, speak with your CPA about what was purchased in order to have all the startups entered accurately, as well as to get the help in setting up a depreciation schedule. For tax purposes, the IRS has specified fixed asset lifespan depending on what kind of fixed assets they are.

Journal entries are the best method to use when entering startup costs, regardless of the type of startup, the type of business structure, or whether the startup is a loan or an investment to the business. You will create an “Other Asset” account under which you can make sub accounts where you will be debiting the transactions, and an equity or loan account where you will be crediting them – depending on if the owner is investing or lending the monies to the company – respectively.

If some of these startup expenses are fixed assets, you will need to create individual Fixed Asset accounts for each, with the corresponding entry going to the Equity or Loan account. If there are multiple small transactions to be entered, you can enter them via the asset account register or the Equity or Loan account register you created. This way you will be able to enter as much information as possible including the dates of each transaction.

Whatever you do, just make sure that you get the correct equity balance to start off with; that is, how much did the owner(s) put in the business to start the business? In taxes, the equity accounts will be used to track the owner’s basis, which is adjusted up for income, owner’s contributions and other items, and down for losses, draws, and other items. Depending on the type of structure – sole proprietorship, LLC, partnership, C-corporation, S-Corporation, business losses may or may not be deductible for tax purposes if the owner does not have enough basis to deduct them against.

You should also speak with your CPA about whether it is better to consider these startup costs a contribution by the owner to the business, or a loan to the business to be paid back at some point in the future, as it relates to taxes.

Another way to enter these initial expenses on QuickBooks for a Sole Proprietor or Single Member LLC, is by using a Credit Card Account called something like “Owed to owner” and entering the expenses from there. This will increase the liability balance while allocating the expenses to their relevant business expense account. If the business pays it back, use the credit card account on the check which will zero out the credit card account. If it does not pay the monies back, use a journal entry to transfer it to the owner’s contribution account. Of course, this is based on what the initial startup costs are.

This is an option used by many QuickBooks users, and although it will make the accounts “accurate”, I do not recommend it from an accounting standpoint. Bookkeeping should be seamless and trackable! Just imagine that someone takes over the bookkeeping and trying to figure out the books, they will no doubt be looking for a business credit card since one would have been entered. For this reason I do not recommend using this method. Why add a credit card to the business in QuickBooks when there isn’t actually one for the business?

Similar Articles:

by Marie | Mar 20, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, Financial Statements & Reports, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

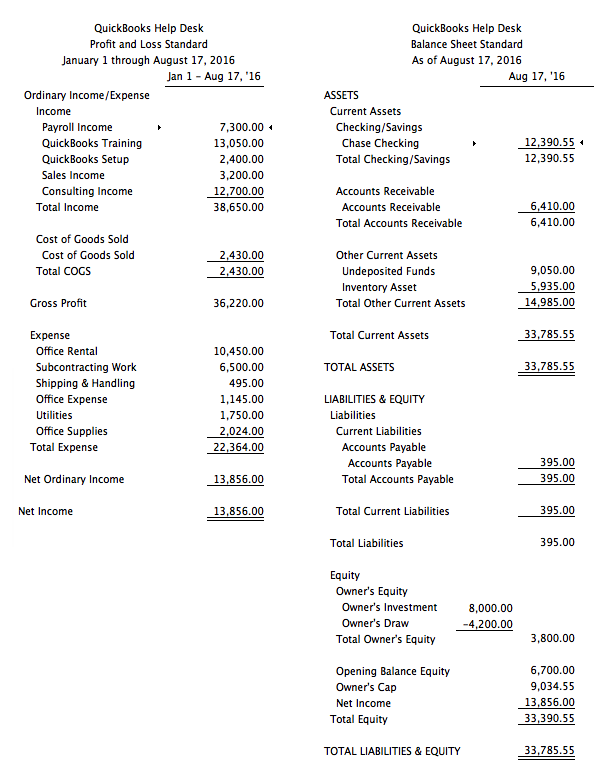

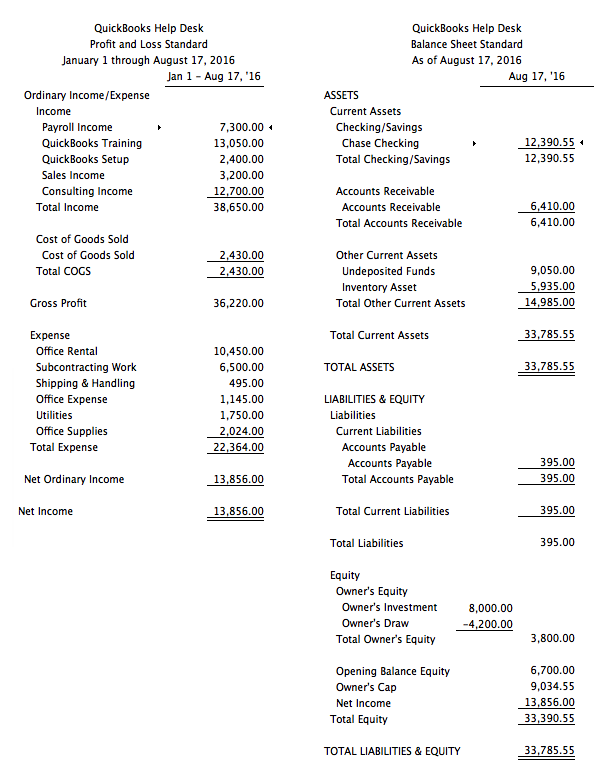

Your Profit and Loss Report is not showing Owner’s Draw because Owner’s Draw does not belong on a Profit & Loss Report and should not be there. Owner’s draws are not expenses so they do not belong on the Profit & Loss report. They are equity transactions shown at the bottom of the Balance Sheet.

The fact that you are asking this question, tells me that you do not have basic accounting knowledge, and you should not be doing any form of bookkeeping or accounting without this basic knowledge. You need basic understanding of a Chart of Accounts and how certain accounts feed to either a Balance Sheet or Profit & Loss report. Balance Sheet accounts, such as bank account, loan, and equity fluctuate as time goes on and a Balance Sheet is a snapshot of the balances in the accounts on the day requested. Income and Expense accounts accumulate figures and usually increase until closed out at year end, and the cycle starts again for each new year. That is why a Profit and Loss asks for a date range or period, while the Balance Sheet uses an “as at” date.

Profit & Loss Reports show:

- Revenue or Gross Sales

- Expenditures

- the resulting Profit or Loss

Balance Sheet Reports show:

- Assets

- Liabilities

- Equity

Regardless of the software – QuickBooks or others, none will make sense until you understand how the puzzle works and the unique ways certain kinds of companies must flow. If you do not know what you are doing, you could end up making a huge mess that will be very costly to clean up and reconcile. There are many bookkeeping and accounting classes out there, and it will be well worth your while to take a basic accounting course at your local community college. If you are a bookkeeper for a company, your employer may be willing to pay for this class since it will be a direct benefit to his/her business.

Also, since you are using the term “Owner Draw”, it tells me that the entity is a Sole Proprietorship. If the entity is not a Sole Proprietor, you should not be using an Owner’s Draw account. These are things that you will learn in a basic accounting class.

Key Differences Between Balance Sheet and Profit & Loss Account

- The Balance Sheet is prepared at a particular date, usually the end of financial year, while the Profit and Loss account is prepared for a particular period.

- The Balance Sheet reveals the entity’s financial position, whereas the Profit and Loss account discloses the entity’s financial performance.

- A balance Sheet gives an overview on assets, equity and liabilities of the company, but the Profit and Loss account is a depiction of entity’s revenue and expenses.

- The major difference between the two entities is that the Balance Sheet is a statement while the Profit and Loss account is an account.

- The Balance sheet is prepared on the basis of the balances transferred from the Profit and Loss account.

by Marie | Feb 21, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, Personal and Business Expenses, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reimbursements and Investments

The correct way to enter business expenses that you have paid for with your personal credit card, debit card, or cash in your company’s QuickBooks, will be based on whether you want to invest this money in your company or reimburse yourself for it, as well as the type of business structure your company is setup as – Sole proprietor, Single member LLC, Multi member LLC, or Corporation. With QuickBooks, there are usually more than one ways to deal with various scenarios. Here are a few to deal with this one:

Option 1 – Reimburse Yourself

- Setup yourself in QuickBooks as a vendor and create a bill for your expenses, allocating them to the relevant business expenses the funds were used for. Then, pay yourself with a check using the “Pay Bill” feature when you are ready to take your reimbursement. This option can be used regardless of your business structure.

- Create a Current Liability account and call it something like “Owed to Owner”, then enter the transactions in this account where the credit card and other expenses will be easy to track in the event of an audit, with the exact amounts and vendor details listed. You will then write a check to yourself using this current liability account in order to clear the balance and reimburse yourself. This option is not suitable for a Corporation.

- Fill out an expense report just as you would expect any other employee to do, in order to be reimbursed. All receipts that are company related that the funds were used for, should be attached to this expense report so that all vendor details are part of the company records. In addition, keep a copy of the personal credit card statement in the business files to serve as backup for the expenses. Then, write a check for the expense report total, allocating each expense to its relevant company expense. This option is most suitable for a Corporation. (NOTE: Use the “Write Check” feature only if you are paying the full reimbursement. If you will be taking the reimbursement in portions, you should create a bill with all the expenses listed, then use the “Pay Bill” feature to pay the portion of the bill you want to receive. When you are ready to reimburse yourself for the balance, you will again use the “Pay Bill” feature to complete the payment. Also, be sure to keep receipts as backup for the cash purchases you make with your personal funds on behalf of your business.)

Option 2 – Invest the Funds in Your Business

- Create a Current Liability account and call it something like “Owed to Owner”, then enter the transactions in this account where the credit card expenses will be easy to track in the event of an audit, with the exact amounts and vendor details listed. Next, create an Equity account and call it something like “Owner Contributions”, and transfer the total of all the transactions in the current liability account to this Equity account to invest it in your business. This option is not suitable for a Corporation.

- Create a Liability account and call it something like “Loan from Shareholder”, then enter the individual transactions in this account, so that you will be able to allocate each to its relevant expense. Next, create an Equity account and call it something like “Shareholder Investment”. When you are through entering the transactions in the “Loan from Shareholder” account, transfer the total balance to the “Shareholder Investments” account. This option is most suitable for a Corporation.

Mixing personal funds with business funds is never a good idea! Avoid co-mingling funds at all cost – especially for a Corporation. You could expose yourself to the kind of liability you formed the Corporation to avoid, in the first place.

Get The Help You Need: Sign Up For “One on One” QuickBooks Training:

by Marie | Aug 7, 2014 | Bookkeeping 101, Chart of Accounts Setup & Management, Company Setup & Management, Payroll Setup & Management

I have gotten so many questions about recording owners salary accurately and allocating payroll for direct labor workers versus admin staff, I have decided to elaborate on it a bit here.

- Cost of Goods Sold includes payroll that is associated with the creation of a sale or sales. For example when an electrician employee goes to work on an electrical assignment that the company invoice for, that payroll cost should be recorded to Cost of Goods Sold otherwise called Cost of Sales. In addition, Cost of Goods Sold includes all expenses that are accumulated as a result of completing a job that leads to an income. Expenses such as raw material, items purchased for resale, cost of parts used to construct a product for resale are all Cost of Goods Sold. If an equipment is rented to aid in the process of a job that will lead to an income, it is also to be classified as Cost of Goods Sold. If an employee uses a portion of his or her day to engage in the direct creation of a product for resale and a portion to engage in administrative tasks, the portion that is related to building the product should be coded to COGS and the admin portion coded to regular payroll expense.

- Officers’ salaries should not be classified as Cost of Goods Sold, even if a sale was derived from his or her direct input. It should be allocated to payroll with an item name such as Officers Salary in order to differentiate it from other payroll items. Regular payroll, Cost of Goods Sold payroll, and Officers’ salaries payroll are each reported separately on Income tax forms. However, in order for a company to be able to pull a Profit and Loss Report for example, and get an accurate synopsis of the overall cost of sales, the amounts for Cost of Goods Sold – including the Officers’ salaries that are direct cost of sales will need to be coded to Cost of Goods Sold. Separating them with their unique item names, will allow you to generate reports that show the total of each so as to include them in their rightful places on your tax forms with ease.

- When we speak of payroll, it is usually to define payments made at regular intervals for work done by employees which includes employees’ deductions as well as employers assigned portions that must be reported and paid to various government agencies. However, for Corporations, payroll includes Officers as well as employees. Owners of Corporations are called Officers, and they are required to include themselves on their company’s payroll, as their company is viewed as a separate person or entity – legally. For Sole Proprietors, and Limited Liability Companies (LLC’s) operating as Sole Proprietors, they are free to withdraw monies and record their drawings as Owners Draw. LLC’s operating as Corporations must follow the same procedure as Corporations discussed above.

Thus, monies paid to staff involved in direct sales – Cost of Goods Sold, Officers, and administrative staff are all classified as payroll.

Recent Comments