by Marie | Feb 21, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, Personal and Business Expenses, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reimbursements and Investments

The correct way to enter business expenses that you have paid for with your personal credit card, debit card, or cash in your company’s QuickBooks, will be based on whether you want to invest this money in your company or reimburse yourself for it, as well as the type of business structure your company is setup as – Sole proprietor, Single member LLC, Multi member LLC, or Corporation. With QuickBooks, there are usually more than one ways to deal with various scenarios. Here are a few to deal with this one:

Option 1 – Reimburse Yourself

- Setup yourself in QuickBooks as a vendor and create a bill for your expenses, allocating them to the relevant business expenses the funds were used for. Then, pay yourself with a check using the “Pay Bill” feature when you are ready to take your reimbursement. This option can be used regardless of your business structure.

- Create a Current Liability account and call it something like “Owed to Owner”, then enter the transactions in this account where the credit card and other expenses will be easy to track in the event of an audit, with the exact amounts and vendor details listed. You will then write a check to yourself using this current liability account in order to clear the balance and reimburse yourself. This option is not suitable for a Corporation.

- Fill out an expense report just as you would expect any other employee to do, in order to be reimbursed. All receipts that are company related that the funds were used for, should be attached to this expense report so that all vendor details are part of the company records. In addition, keep a copy of the personal credit card statement in the business files to serve as backup for the expenses. Then, write a check for the expense report total, allocating each expense to its relevant company expense. This option is most suitable for a Corporation. (NOTE: Use the “Write Check” feature only if you are paying the full reimbursement. If you will be taking the reimbursement in portions, you should create a bill with all the expenses listed, then use the “Pay Bill” feature to pay the portion of the bill you want to receive. When you are ready to reimburse yourself for the balance, you will again use the “Pay Bill” feature to complete the payment. Also, be sure to keep receipts as backup for the cash purchases you make with your personal funds on behalf of your business.)

Option 2 – Invest the Funds in Your Business

- Create a Current Liability account and call it something like “Owed to Owner”, then enter the transactions in this account where the credit card expenses will be easy to track in the event of an audit, with the exact amounts and vendor details listed. Next, create an Equity account and call it something like “Owner Contributions”, and transfer the total of all the transactions in the current liability account to this Equity account to invest it in your business. This option is not suitable for a Corporation.

- Create a Liability account and call it something like “Loan from Shareholder”, then enter the individual transactions in this account, so that you will be able to allocate each to its relevant expense. Next, create an Equity account and call it something like “Shareholder Investment”. When you are through entering the transactions in the “Loan from Shareholder” account, transfer the total balance to the “Shareholder Investments” account. This option is most suitable for a Corporation.

Mixing personal funds with business funds is never a good idea! Avoid co-mingling funds at all cost – especially for a Corporation. You could expose yourself to the kind of liability you formed the Corporation to avoid, in the first place.

Get The Help You Need: Sign Up For “One on One” QuickBooks Training:

by Marie | Oct 24, 2014 | Company Setup & Management, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

I got a call a few days ago from a concerned small business owner saying that some of the transactions she is entering into QuickBooks is simply disappearing and nowhere to be found. When I got there she opened the QuickBooks file in question, and indicated to me all the transactions she entered and where they should have been. I told her not to worry that I would find the transactions especially because it is impossible for them to just vanish into thin air. Possible Scenarios:

- Work is being done in more than one backup files of the same company, and the transactions in question were entered in more than one – depending on which was opened at the time data were entered. (Only with Mac)

- More than one company files were created for the same company, and transactions were entered into more than one – alternately – depending on which was opened at the time data were entered.

- The company file was replaced or overwritten by an older version of the file when a backup was restored. (Only with PC)

I have been using QuickBooks for such a long time that it did not take much time for me to realize that there had to be another file housing the “missing” transactions, and so I set out to view the other QuickBooks files that were on the Mac. Sure enough, the transactions were entered in three different QuickBooks files. There were like 10 transactions in one file, which were possibly entered in one sitting, then the next 17 in another, and another 38 in the next. That is one very big difference between the Mac and PC versions of QuickBooks; unlike the PC versions, each time QuickBooks is backed up on a Mac, it creates a different backup file with an image titled “Disk Image”. This makes it particularly easy to use a different QB file each time an update is done, without actually noticing until you really need to. To prevent this happening again:

- Always open the file (of the company in question) from within QuickBooks (instead of the desktop or wherever the file is stored) by going to File, then Open Recent and selecting the file on top, which would be the most recent file used.

- Turn of automatic backup so it does not create multiple backup “Disk Images” which can be quite confusing (Mac users). To do this, go to QuickBooks and select Preferences, then in the Preferences window double click Backup. This will then take you to a new window with backup options. Uncheck all boxes to turn off automatic backup, or you can customize to suit your needs. I usually only check the Overwrite last backup box, which is not a wise choice for someone prone to making mistakes.

- If you would prefer to keep the automatic backup running, and also open your files from wherever they are stored (instead of within QuickBooks), be sure to view the date each file was last modified and continue to use the one with the latest modification date.

So, this is what I did! I deleted all the QB files “Disk Images”, leaving only the one that was last modified which was also the one that most of the “missing” transactions were entered in. I then edited the backup preference and selected the option which was best suited to her, and that was, allowing manual QuickBooks backup instead of automatic. When she is ready to backup, she will then go to File, then Back Up…, and select the location (desktop or document) and file she would like to backup to.

Mission accomplished! Problem solved!

by Marie | Jul 26, 2014 | Company Setup & Management, QuickBooks Online, Third Party Applications - QuickBooks Compatible

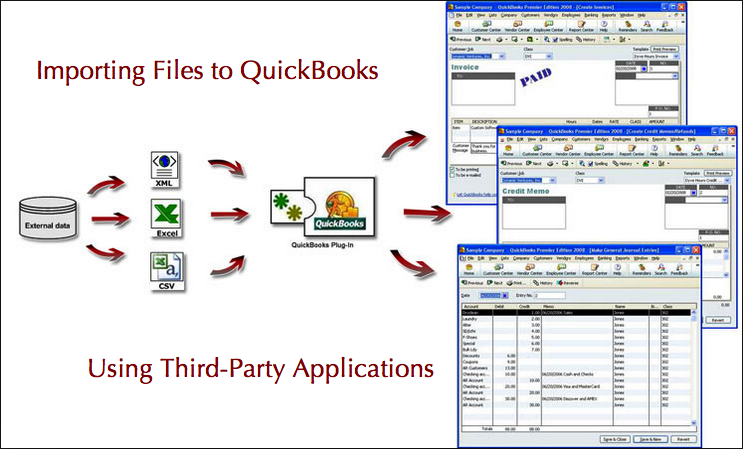

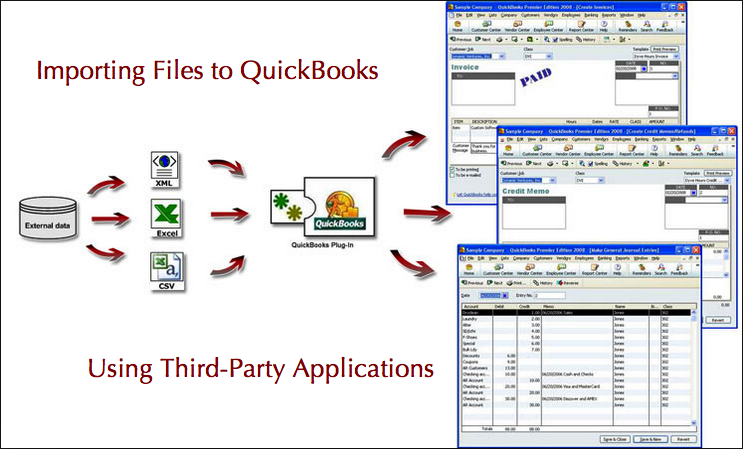

QuickBooks is built to work with interchanging of data from one edition of QuickBooks to another using IIF (Intuit Interchange Format), and from CSV (Comma Separated Values) files such as excel, to QuickBooks. However, there are limitations to the extent that QuickBooks provide and allow. For example, you can import your list of customers, vendors, items, and chart of accounts to QuickBooks, but not your invoices, estimates, or any other forms. This is where third party applications come in, to extend QuickBooks usability beyond its limitations.

With QuickBooks being so popular, many software developers have developed and are still developing applications that work and aim to work seamlessly with QuickBooks to get forms and files into QuickBooks from other media, such as excel, access, text, and ODBC (Open Database Connectivity). Thus, there are many applications available to carry out the various tasks that may need to get done, such as:

- Transfer of data between QuickBooks company files

- Transfer of data between QuickBooks and an e-commerce site

- Transfer of data between QuickBooks and generic file formats

- Transfer of data between QuickBooks and other programs

Albeit that, QuickBooks database is “closed” and access to their data tightly controlled and so only a few developers will be able to gain access to create a system software that effectively integrates with QuickBooks. Two such importers are:

You can view a complete list of Transaction Pro Importer features, and also IIF Transaction Creator Pro features. Transaction Pro Importer currently does not support Mac platform, but IIF Transaction Creator does. There is also a data transfer program that allows interchanging of information strictly between QuickBooks files known as Data Transfer Utility. This program by Karl Irvin most distinct feature is the merging of two QuickBooks company files.

Importing items into QuickBooks via excel is a two step process; first you have to export them to a file (.CSV, .IIF), and subsequently import the file(s) into QuickBooks. With a third party import software such as Transaction Pro Importer, you import files and forms directly through the program. You can always download a free trial for a test run of each importer program before making your purchase. The main detail to remember when using these importing applications is to always make a backup copy of QuickBooks before importing anything into QuickBooks. These programs and software are man-made, and as such, prone to err.

Visit QuickBooks Marketplace and search for a list of third party applications that integrates with QuickBooks for your industry type, and specific need.

Recent Comments