by Marie | Oct 10, 2016 | Employee Setup & Management, Printing & Print Customization, QuickBooks Online

To print payroll checks in QuickBooks Online, you will need a payroll subscription in addition to having a QuickBooks Online subscription.

To Print Employees Paychecks in QuickBooks Online:

- Click the Gear Icon at top right of screen (your company name) and select Payroll Settings under the Settings column to start configuring your pay checks. (You will only see this option if you have subscribed for payroll)

- Next click Preferences then Paycheck Printing Settings option to configure how the checks will print.

- Select the preprinted check option – if you are using preprinted checks from Intuit, and check the appropriate Print 1 stub or Print 2 stubs.

- Click Ok, and you will be taken to the Printer Setup screen.

- Next, setup your employees by adding them in the Payroll Setup under Employees. Here you can configure their hourly rates, and choose whether to pay via direct deposit or paper check. You can also configure their deductions, and see a sample view of their paycheck on the right of screen.

- Click Done at bottom right. You will now be taken to the current pay period screen. In this section, you can enter the employee’s hours, and change the pay date. You can click the Preview button at bottom right to display the current pay period’s paychecks, total amounts, with employee taxes and net pay.

- If all looks well, click the Submit payroll button at bottom right and the paychecks will now be ready to print.

- Enter the check number(s) and click Finish payroll.

How to Locate and Reprint a Paycheck in QuickBooks Online

- Click on Reports in left menu bar to take you to the report screen.

- Click on the “Go to report” search bar, and type in Paycheck. The Paycheck List will now be generated.

- Click on the Paycheck List to run the report. When it loads, go ahead and adjust the date range to display the period with the check(s) you need to print.

- Now, checkmark the boxes to the left of the check(s) you need to print, then click the Batch action dropdown at top left and select Print.

You can also go to the individual employee to locate and print their paycheck. Just go to Employees in left menu bar, click the dropdown to the right of the employee and select Run report. Now, click the Customize button at top right, then Filter to choose date and Run report.

You may find these Paycheck Printing videos helpful as well.

RELATED:

by Marie | Aug 25, 2016 | Employee Setup & Management, Payroll Setup & Management, Preferences & Customization

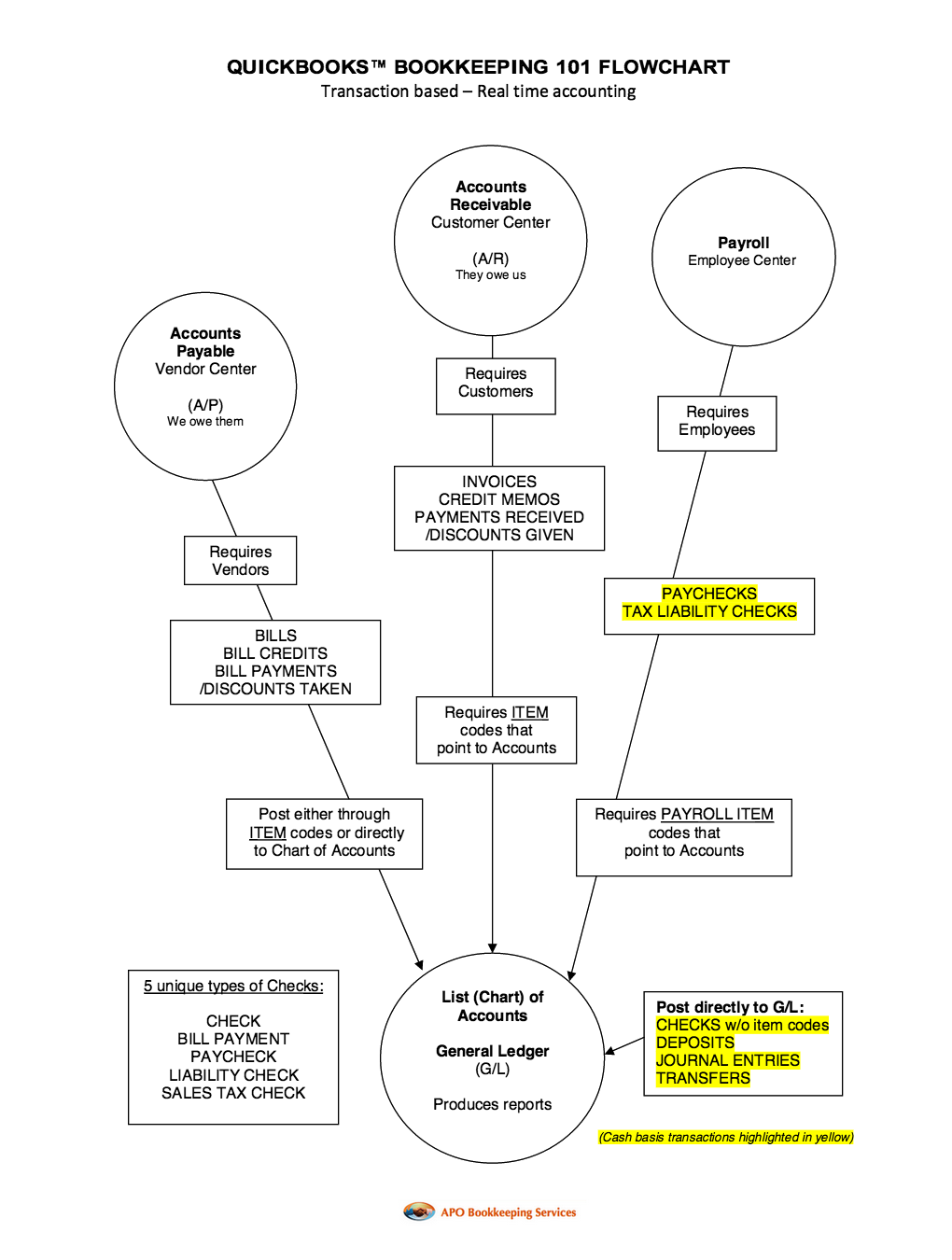

There are several steps needed in order for payroll to flow properly to the job costing reports – especially if you want to include payroll taxes and benefits. The step-by-step instructions below will help guide you through the setup.

You must have a QuickBooks payroll subscription to use these instructions. If you are trying to use job costing with a non-QuickBooks payroll provider, you will not only make your bookkeeping much more time-consuming but also introduce opportunities for errors to be made. QuickBooks offers a complete payroll solution, just like ADP and Paychex, and at a great price too.

Since labor is usually the biggest expense for most companies who are doing job costing, it is vitally important that it be included in your job cost reports. If you don’t include labor, your jobs will seem more profitable than they really are. Even worse, some of them might even be losing money without you even knowing it. This not only affects your present situation, but can lead you to create inaccurate estimates for future jobs.

Here are the steps for setting up payroll for job costing in QuickBooks:

Step 1. Set up Preferences:

- Go to Edit, Preferences, Company Preferences and select Payroll & Employees

- Select “Full Payroll” or “Complete Payroll Customers”

- Check “Job Costing, Class and Item tracking for paycheck expenses”

- Go to Time & Expenses

- Select Yes under “Do you track time?”

- You may also want to check “Create invoices from a list of time & expenses”

Step 2. Set up Payroll Items:

- Go to Lists, Payroll Items

- Next, edit every Addition and Company Contribution item to ensure that “Track expenses by job” is checked

- Payroll items can only be mapped to one expense account, so you may want to setup separate ones for Cost of Goods Sold (COGS) and overhead payroll expense

Step 3. Set up Employee Records:

Step 4. Set up Default for New Employees:

- Go to the Employee Center and select Manage Employee Information, then Change Employee Default Settings

- Check “Use time data to create paychecks”

Step 5. Set up Workers Comp:

- Go to Employees, Workers Compensation, then Setup Workers Comp

- Setup your workers comp codes at Employees, Workers Compensation, then Workers Comp List

- Next, go to Lists, Payroll Items to double-check that the Workers Comp payroll item has “Track expenses by job” checked

Step 6. Using TimeSheets

- Go to Employees, Enter Time, then Use Weekly Timesheet

- Complete all information including both a payroll item & a service item. Mark as billable if you do time & material billing

- You may want to add a customer:job called Overhead, so you will have a place to place other entries in order not to forget to make allocation

- Consider using “Time Tracker” or “WorkTrack Time Card” so employees can enter their own time

RELATED:

by Marie | Mar 2, 2016 | Bookkeeping 101, Employee Setup & Management, Payroll Setup & Management, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

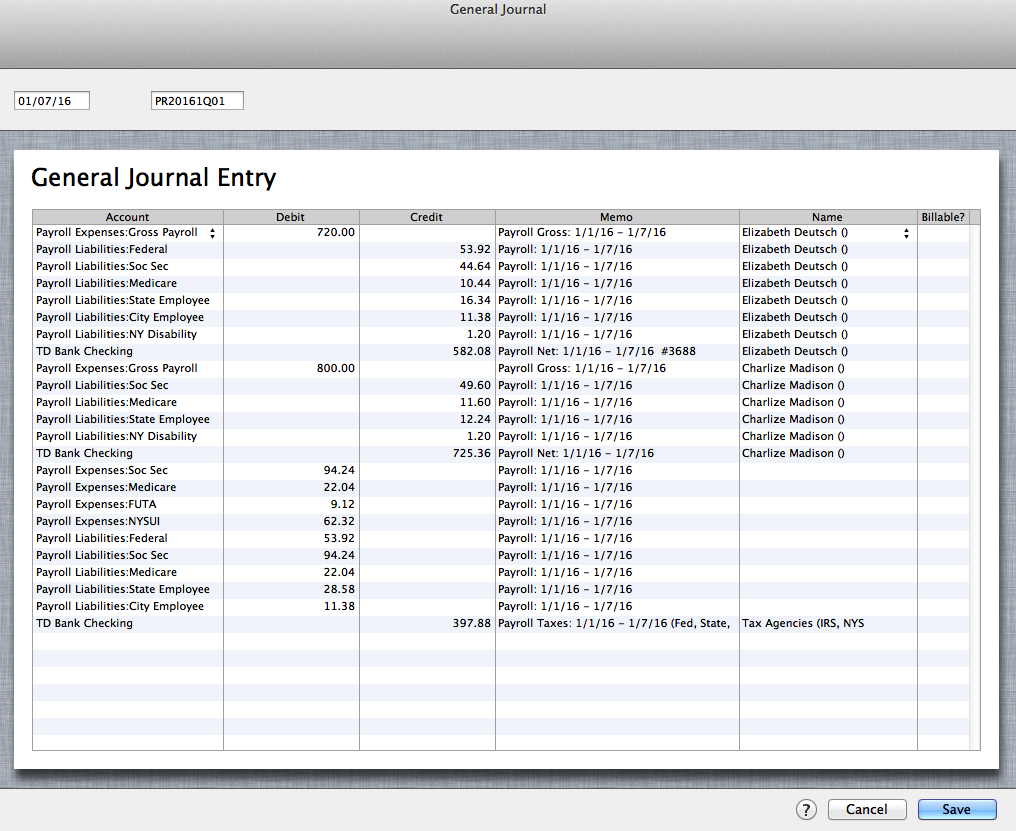

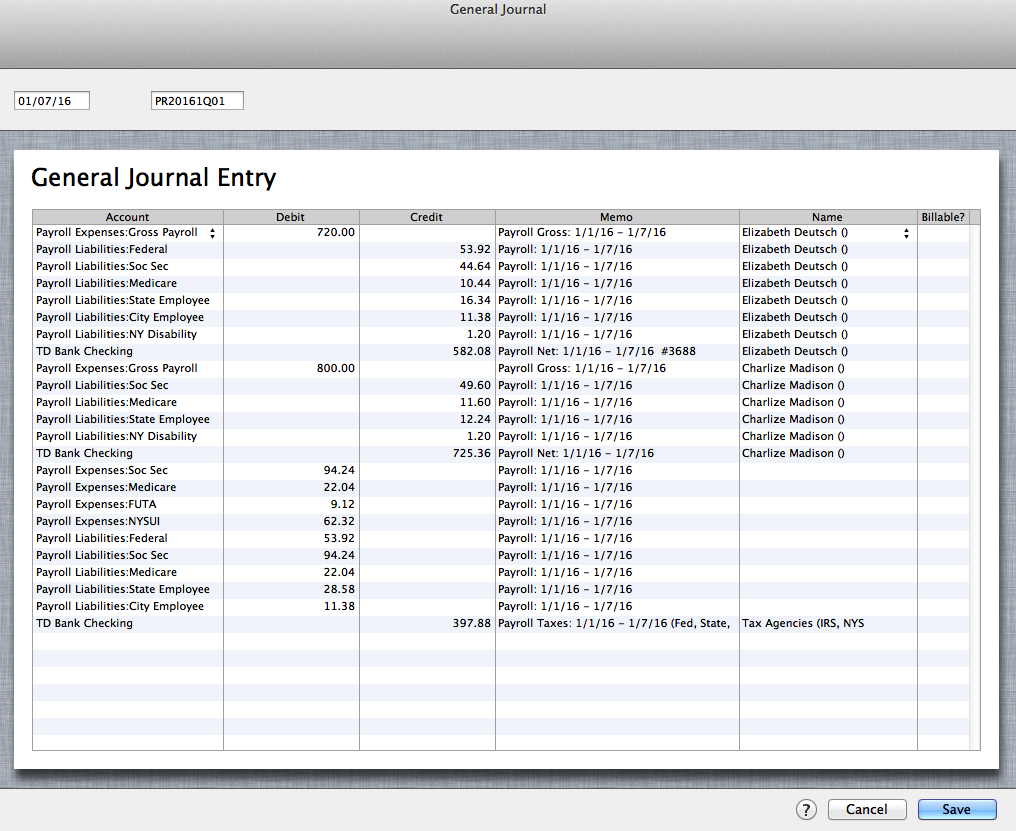

The best and most accurate way to enter third party payroll into QuickBooks is to enter them via Journal Entries. First, you want to setup the expense as well as the liability items of the payroll in the Chart of Accounts. Then you want to enter one journal entry for each pay period, using the payroll items you created in the Chart of Accounts on their correct debit and credit sides, making sure you enter the actual check dates of the paychecks. You will include the employees names in the Name field, and a memo with the pay period as well as net, gross or taxes on each transaction line.

Entering Third Party Payroll into QuickBooks:

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses

Payroll Expenses

Gross Payroll

Soc Sec Company

Medicare Company

FUTA

NYSUI

Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Payroll Liabilities

Federal Withholding

Soc Sec Employee

Medicare Employee

State Employee NYS

City Employee NYC

NY Disability

The Result: (click image to enlarge)

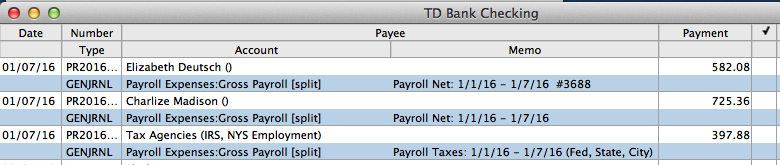

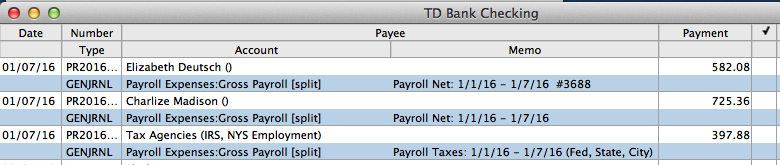

In Bank Register: (click image to enlarge)

Entering third party payroll this way will allow every aspect of the payroll to be accurately accounted for; each paycheck will be listed separately with the gross, employee paid taxes, employer paid taxes, and the net payroll. The paychecks as well as the tax payments made will be easily tracked in the bank account register, and the amounts in QuickBooks will be on par with the third party company figures. Entering third party payroll this way will also make it easily identifiable in the reconcile window when you go to reconcile your bank account, and will show a balance on the balance sheet for any withholding that was not paid over to the relevant tax authority.

RELATED:

by Marie | Aug 7, 2014 | Bookkeeping 101, Chart of Accounts Setup & Management, Company Setup & Management, Payroll Setup & Management

I have gotten so many questions about recording owners salary accurately and allocating payroll for direct labor workers versus admin staff, I have decided to elaborate on it a bit here.

- Cost of Goods Sold includes payroll that is associated with the creation of a sale or sales. For example when an electrician employee goes to work on an electrical assignment that the company invoice for, that payroll cost should be recorded to Cost of Goods Sold otherwise called Cost of Sales. In addition, Cost of Goods Sold includes all expenses that are accumulated as a result of completing a job that leads to an income. Expenses such as raw material, items purchased for resale, cost of parts used to construct a product for resale are all Cost of Goods Sold. If an equipment is rented to aid in the process of a job that will lead to an income, it is also to be classified as Cost of Goods Sold. If an employee uses a portion of his or her day to engage in the direct creation of a product for resale and a portion to engage in administrative tasks, the portion that is related to building the product should be coded to COGS and the admin portion coded to regular payroll expense.

- Officers’ salaries should not be classified as Cost of Goods Sold, even if a sale was derived from his or her direct input. It should be allocated to payroll with an item name such as Officers Salary in order to differentiate it from other payroll items. Regular payroll, Cost of Goods Sold payroll, and Officers’ salaries payroll are each reported separately on Income tax forms. However, in order for a company to be able to pull a Profit and Loss Report for example, and get an accurate synopsis of the overall cost of sales, the amounts for Cost of Goods Sold – including the Officers’ salaries that are direct cost of sales will need to be coded to Cost of Goods Sold. Separating them with their unique item names, will allow you to generate reports that show the total of each so as to include them in their rightful places on your tax forms with ease.

- When we speak of payroll, it is usually to define payments made at regular intervals for work done by employees which includes employees’ deductions as well as employers assigned portions that must be reported and paid to various government agencies. However, for Corporations, payroll includes Officers as well as employees. Owners of Corporations are called Officers, and they are required to include themselves on their company’s payroll, as their company is viewed as a separate person or entity – legally. For Sole Proprietors, and Limited Liability Companies (LLC’s) operating as Sole Proprietors, they are free to withdraw monies and record their drawings as Owners Draw. LLC’s operating as Corporations must follow the same procedure as Corporations discussed above.

Thus, monies paid to staff involved in direct sales – Cost of Goods Sold, Officers, and administrative staff are all classified as payroll.

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Recent Comments