Why Is My QuickBooks Profit and Loss Report Not Showing Owner’s Draw?

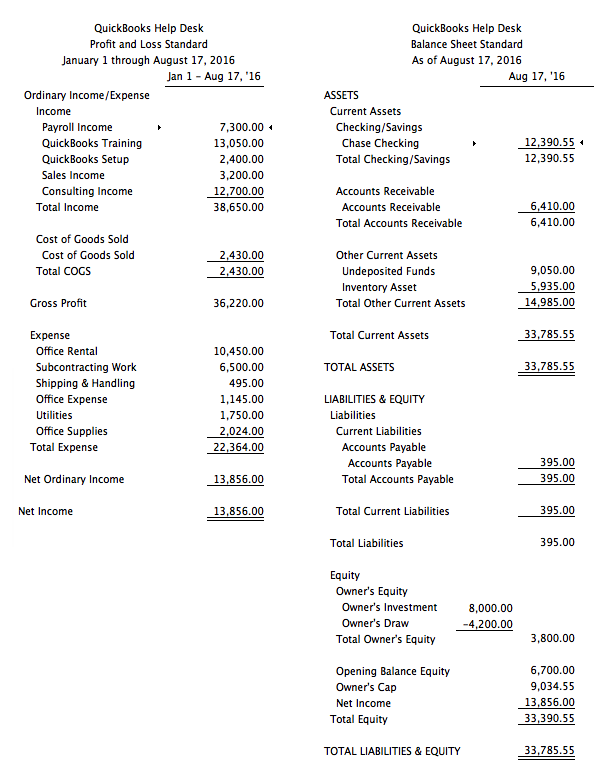

Your Profit and Loss Report is not showing Owner’s Draw because Owner’s Draw does not belong on a Profit & Loss Report and should not be there. Owner’s draws are not expenses so they do not belong on the Profit & Loss report. They are equity transactions shown at the bottom of the Balance Sheet.

The fact that you are asking this question, tells me that you do not have basic accounting knowledge, and you should not be doing any form of bookkeeping or accounting without this basic knowledge. You need basic understanding of a Chart of Accounts and how certain accounts feed to either a Balance Sheet or Profit & Loss report. Balance Sheet accounts, such as bank account, loan, and equity fluctuate as time goes on and a Balance Sheet is a snapshot of the balances in the accounts on the day requested. Income and Expense accounts accumulate figures and usually increase until closed out at year end, and the cycle starts again for each new year. That is why a Profit and Loss asks for a date range or period, while the Balance Sheet uses an “as at” date.

Profit & Loss Reports show:

- Revenue or Gross Sales

- Expenditures

- the resulting Profit or Loss

Balance Sheet Reports show:

- Assets

- Liabilities

- Equity

Regardless of the software – QuickBooks or others, none will make sense until you understand how the puzzle works and the unique ways certain kinds of companies must flow. If you do not know what you are doing, you could end up making a huge mess that will be very costly to clean up and reconcile. There are many bookkeeping and accounting classes out there, and it will be well worth your while to take a basic accounting course at your local community college. If you are a bookkeeper for a company, your employer may be willing to pay for this class since it will be a direct benefit to his/her business.

Also, since you are using the term “Owner Draw”, it tells me that the entity is a Sole Proprietorship. If the entity is not a Sole Proprietor, you should not be using an Owner’s Draw account. These are things that you will learn in a basic accounting class.

Key Differences Between Balance Sheet and Profit & Loss Account

- The Balance Sheet is prepared at a particular date, usually the end of financial year, while the Profit and Loss account is prepared for a particular period.

- The Balance Sheet reveals the entity’s financial position, whereas the Profit and Loss account discloses the entity’s financial performance.

- A balance Sheet gives an overview on assets, equity and liabilities of the company, but the Profit and Loss account is a depiction of entity’s revenue and expenses.

- The major difference between the two entities is that the Balance Sheet is a statement while the Profit and Loss account is an account.

- The Balance sheet is prepared on the basis of the balances transferred from the Profit and Loss account.

Recent Comments