by Marie | Mar 25, 2016 | Bookkeeping 101, Customer Setup & Management, Financial Statements & Reports

Accounts Receivable is a current asset that is only established in the form of Income to be received from a Customer that has been Invoiced. It is the amount a company has a right to collect because it sold goods or services on credit to a customer. In general, when a customer is Invoiced for goods or services you provide them, the total Invoice amount will be shown on both the Income or Profit and Loss Statement, as well as the Balance Sheet.

If a downpayment or deposit was received for the goods or services, the total Invoice amount would still be shown on the Income Statement; however, the deposit would be applied to the Invoice and entered or deposited in the bank account in which it was actually deposited, while the remaining balance that is owing and unpaid would be entered in the Accounts Receivable account. In other words, any monies that a company is owed by a customer, is a receivable.

It is very important for a company to monitor its Accounts Receivable and to immediately follow up with any customer who has not paid as agreed as per the terms of agreement be it 15 days, 30 days, etc. There is an aging of accounts receivable report tool in software such as QuickBooks that will help to monitor each customer’s Accounts Receivable, and as a general rule, the older a Receivable gets, the less likely it will be collected in full.

While Current Assets are cash or cash equivalent, such as Accounts Receivable and Inventory, Other Current Assets are small less significant items on a balance sheet lumped together because they do not include the major current assets, and as such are not important enough to be listed separately. They are not cash or cash equivalents, and represent a limited source of liquidity for a company – for example advances paid to suppliers or employees. Notations are usually available for the breakdown of these minor assets.

by Marie | Mar 24, 2016 | Bookkeeping 101, Business Types & Accounting, Personal and Business Expenses, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reimbursements and Investments

As a business owner myself, I know that it is unavoidable at times – mixing business with personal funds, but this is not good business practice and should be avoided as much as possible. Why? Because, it is very easy to overlook business expenses that are paid with personal funds, and it is the best way to have IRS auditors going through all your personal affairs even though an issue is a business one. Since those monies do not directly affect the business bank or credit card accounts, you will need to make a concerted effort to track those expenses and record them appropriately on the business books.

Entering business expenses paid for with personal credit card or cash on the business books will depend on the structure of the business:

- For a Sole Proprietor or Single-Member LLC, the expenses should be entered to the relevant expense categories via Owner’s Draw/Equity. You will use this account for monies going in and out of the business by the owner. The Owner’s Draw/Equity accounts may have negative balances from time to time which will look odd on the balance sheet. So, it’s important to prepare a journal entry zero-ing out or offsetting these balances at the end of each month, quarter, or year.

- For a Partnershp or Multi-Member LLC, the expenses should be entered via Member Contribution if the owner is investing it, or loan based on the partnership’s operating agreement.

- For a Corporation, the expenses should be entered as loan if the owner will need to recoup the funds, or Equity Contribution if the owner wants to invest it in the business. If they are to be entered as loan, you will need to make the loan official, with repayment terms, interest, etc. Also, bear in mind that the IRS sometimes re-characterizes loan repayments as dividends – with serious tax implications. In this regard, a CPA should be consulted before deciding how to book these monies in QuickBooks.

In addition to the above mentioned effects of mixing business and personal funds, the mixing of business and personal funds can also pierce the corporate veil, and expose corporate business owners to personal liability which defeats the purpose of having a corporation to begin with. Sole proprietors already have personal liability, but not a corporation as it is an individual entity in itself. Separate business and personal financials at all cost, but if you do not, remember to enter them in their appropriate places and keep a record of receipts in the business files.

by Marie | Mar 20, 2016 | Importing Files & Forms To QuickBooks, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reconciliations, Third Party Applications - QuickBooks Compatible

Reconciling Paypal account in QuickBooks is similar to reconciling a bank or credit card account in QuickBooks. You want to ensure that your beginning balance in QuickBooks matches the beginning balance for the period you are reconciling, and subsequently selecting the period end date then checking off the transactions that are on Paypal transaction printout with its corresponding transaction in QuickBooks.

Manually Entering or Downloading Transactions in QuickBooks Prior to Reconciliation

Depending on the number of transactions you have in Paypal and how you want to track them, will be the deciding factor on the method you use. I have a few clients that need each Paypal transaction to be entered individually because each transaction can be for something different. In this case, I have to produce a Sales Receipt for each one and apply the money to the correct item. I then make a deposit using the Undeposited Funds account just like I would any other deposits.

The one difference is that when you have selected all the items that you are depositing you then need to subtract the total Paypal fees. These should not be subtracted from each person/entity you received funds from because you need to show that you received the full amount of the money. Therefore, on the Make Deposit screen I use the next available empty row to add the Paypal fees. If you have an account that you are using specifically for tracking these, then that account will be used in the From Account column.

In the Memo field you can enter Paypal Fees if you would like, and you can insert “PP” for Paypal in the “Payment Method” field. The key to this working is when you enter the cost for the fees in the “Amount” column, they need to be entered as negative numbers. The total deposit should equal the amount that was transferred from PayPal into your bank account. This way the full cost of whatever was purchased will show in their proper accounts and the proper Expense account will be increased by the Paypal Fees.

If you usually have a lot of transactions for Paypal, you may choose to use Simple Port to import your Paypal transactions to QuickBooks. Once you have set the PayPal download to the correct format you will never have to do it again, and when it is configured correctly, Simple Port imports each transaction as a sales receipt, makes the deposit, and records the PayPal fees. The setup process can be a bit daunting, but they do offer free phone help and support and once they are through, your settings will be perfect and you won’t need to change them again. It has helped me tremendously with clients that have hundreds of Paypal transactions to contend with. Within 30 minutes, I usually get about 600 PayPal transactions into QuickBooks if I have to separate by sales tax jurisdiction, and less than 10 minutes if sales tax is not an issue.

Reconciling Paypal Account With QuickBooks

Now, all you have to do is go to Banking, Reconcile, select the Paypal Account from the dropdown menu, insert the period end date, ending balance and click Ok. Check off each transaction on the statement with its corresponding transaction in QuickBooks. When you are through, the difference at the bottom of the reconcile window should be $0.00. If it is not, then you will need to locate the discrepancy. If you do not see the transactions in QuickBooks, even though they are on the Paypal printout, you will need to manually enter them.

Conversely, if there are transactions in QuickBooks for the period you are reconciling but not on the Paypal printout, you will need to query them and delete or transfer them to the account for which they belong. This can sometimes occur when the download/import is not the option used to enter transactions in QuickBooks.

Note: To get the Paypal report that includes Paypal fees as well as a running balance, go to Activity, Activity (including balance & fees), and run a report for the period.

How to Download Paypal Transactions to QuickBooks

How to Download Paypal Transactions to QuickBooks

by Marie | Mar 20, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, Financial Statements & Reports, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

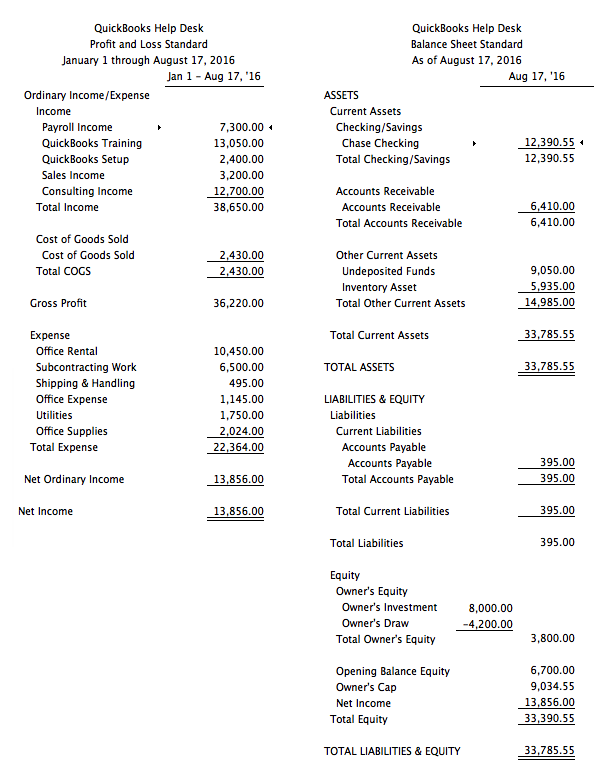

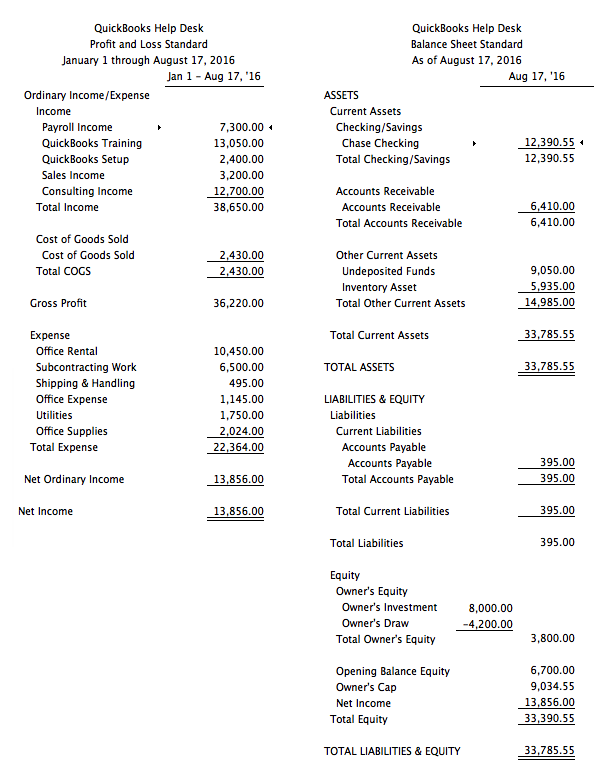

Your Profit and Loss Report is not showing Owner’s Draw because Owner’s Draw does not belong on a Profit & Loss Report and should not be there. Owner’s draws are not expenses so they do not belong on the Profit & Loss report. They are equity transactions shown at the bottom of the Balance Sheet.

The fact that you are asking this question, tells me that you do not have basic accounting knowledge, and you should not be doing any form of bookkeeping or accounting without this basic knowledge. You need basic understanding of a Chart of Accounts and how certain accounts feed to either a Balance Sheet or Profit & Loss report. Balance Sheet accounts, such as bank account, loan, and equity fluctuate as time goes on and a Balance Sheet is a snapshot of the balances in the accounts on the day requested. Income and Expense accounts accumulate figures and usually increase until closed out at year end, and the cycle starts again for each new year. That is why a Profit and Loss asks for a date range or period, while the Balance Sheet uses an “as at” date.

Profit & Loss Reports show:

- Revenue or Gross Sales

- Expenditures

- the resulting Profit or Loss

Balance Sheet Reports show:

- Assets

- Liabilities

- Equity

Regardless of the software – QuickBooks or others, none will make sense until you understand how the puzzle works and the unique ways certain kinds of companies must flow. If you do not know what you are doing, you could end up making a huge mess that will be very costly to clean up and reconcile. There are many bookkeeping and accounting classes out there, and it will be well worth your while to take a basic accounting course at your local community college. If you are a bookkeeper for a company, your employer may be willing to pay for this class since it will be a direct benefit to his/her business.

Also, since you are using the term “Owner Draw”, it tells me that the entity is a Sole Proprietorship. If the entity is not a Sole Proprietor, you should not be using an Owner’s Draw account. These are things that you will learn in a basic accounting class.

Key Differences Between Balance Sheet and Profit & Loss Account

- The Balance Sheet is prepared at a particular date, usually the end of financial year, while the Profit and Loss account is prepared for a particular period.

- The Balance Sheet reveals the entity’s financial position, whereas the Profit and Loss account discloses the entity’s financial performance.

- A balance Sheet gives an overview on assets, equity and liabilities of the company, but the Profit and Loss account is a depiction of entity’s revenue and expenses.

- The major difference between the two entities is that the Balance Sheet is a statement while the Profit and Loss account is an account.

- The Balance sheet is prepared on the basis of the balances transferred from the Profit and Loss account.

by Marie | Mar 20, 2016 | Bookkeeping 101, Importing Files & Forms To QuickBooks, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Third Party Applications - QuickBooks Compatible

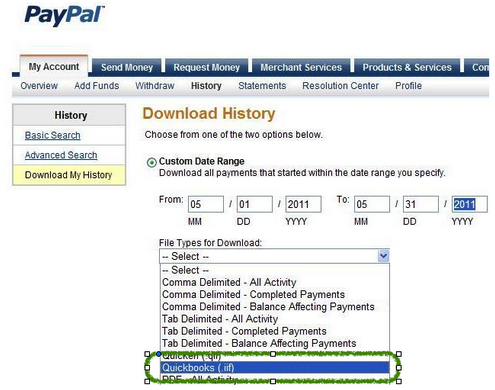

There are two ways to download Paypal transactions to QuickBooks: 1) via .iif file and 2) via .csv or Excel. I do not recommend the IIF approach as it does not allow for editing before uploading to QuickBooks, and Paypal transactions are not as seamless as bank transactions – they require editing. Instead, export the reports to Excel where you will be able to do the necessary editing before uploading to QuickBooks.

How to Import Paypal Transactions into QuickBooks

- Log in to your PayPal account

- Click the Activity tab, and select your date range

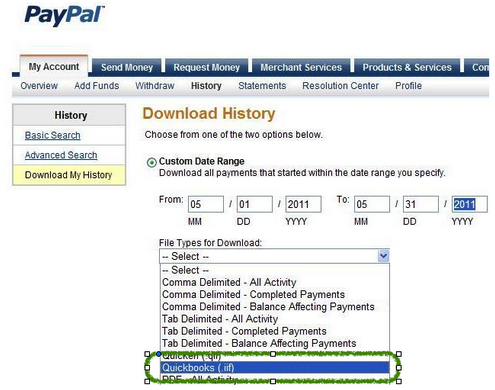

- Click the small Download link to the top right corner of the screen to get to the Download History screen

- Choose your date range, either Custom Date Range or Last Download to Present from the drop-down list

- Choose File Type to Download, file would be QuickBooks (.iif)

- Click Download History

- When prompted to enter the account names, enter the account names exactly as they appear in the Company’s Chart of Accounts:

- Name of PayPal Account

- Name of Other Expenses Account

(Be sure that the expense account being used is not a sub-account of another expense account or it will be turned into a bank account when it is imported into QuickBooks).

(If Accounts Payable balances are being paid by PayPal transactions, you can enter the name of your Accounts Payable account here, but the Vendor names in PayPal must match the names in QuickBooks).

- Name of Other Income Account

(Also, be sure that the income account being used is not a sub-account of another income account or it will be turned into a bank account when it is imported into QuickBooks).

(If Accounts Receivable balances are being paid by PayPal transactions, you can enter the name of your Accounts Receivable account here, but the Customer names in PayPal must match the names in QuickBooks).

Note: You will have to fill in all of the boxes, or you will receive a message from PayPal stating: You must complete the above fields to download your log.

- Save the iif to the desktop

- From the QuickBooks File menu, select Utilities, Import then IIF Files

- Select the iif file located on the Desktop, and click Open

Recent Comments