by Marie | Jun 3, 2019 | Bookkeeping 101, QuickBooks Essentials, QuickBooks Online, Resources

Test QuickBooks Online Before Purchasing

QuickBooks creators are generous and they have created a mock site where you can literally try out a lot of their features and see how QuickBooks operate – if it’s a right fit – before you make your purchase. This is awesome! (The Miz style awesome:)

Here is the Sample QuickBooks Online Test Drive File that you can practice in before jumping right in to your own “real” company file. It’s a great way to get a feel of QuickBooks without fear of making a mess of your company file. It does not save any data you put in, and so you’ll need to finish any processes you are doing – in one sitting. When it refreshes, all the work you’ve done in it will be lost, and if left idle for more than 30 minutes it will log you out.

So go ahead and check it out. Let me know how it has helped you. If you have any QuickBooks questions, don’t hesitate to send me your questions.

NOTE: QuickBooks Online is available in 4 subscription options. See a list of QuickBooks Online subscription options.

FREQUENTLY ASKED QUESTIONS

ALL QUICKBOOKS OPTIONS:

by Marie | Jun 2, 2019 | Bookkeeping 101, Classes & Location, Company Setup & Management, Preferences & Customization, QuickBooks Online

There are four (4) levels of Quickbooks Online subscription: 1) Simple Start, 2) Essential, 3) Online Plus, (4) Advanced. Class tracking is only available in the Online Plus and Advanced editions.

To Turn on Class Tracking in QuickBooks Online:

Step 1. Click on the Gear icon at top right of screen (your company name) and select Account and Settings under the Your Company tab

Step 2. Click the Advanced button in the left menu bar, then click the pencil icon at Categories to edit preference.

Step 3. Check the box at Track classes (You may also want to check the box at Warn me when a transaction isn’t assigned a class)

Step 4. Click Save.

Now when you go to create your Invoices, bills, checks etc. the class option will be available for use.

by Marie | Jun 2, 2019 | Bookkeeping 101, Classes & Location, Preferences & Customization, QuickBooks for Mac

To Turn on Class Tracking in QuickBooks Mac:

Step 1. Click on QuickBooks in the top menu bar, then Preferences to open the Preferences window.

Step 2. Click on the Transactions under Workflow and check the box that says Use class tracking.

Step 3. Click Ok.

Now when you go to generate your Invoices, bills, checks, etc. the class option will be available for use.

by Marie | Jun 2, 2019 | Bookkeeping 101, Classes & Location, Preferences & Customization, QuickBooks for Windows

To Turn on Class Tracking in QuickBooks Windows – Pro, Premier, Enterprise:

Step 1. Click on Edit, then Preferences in the main menu to open the Preferences window.

Step 2. Click on the Accounting icon in the left pane of the Preferences window.

Step 3. Select the Company Preferences tab in the right pane.

Step 4. Checkmark the Use class tracking item on the Company Preferences tab.

Step 5. Click OK to close the Preferences window.

Now when you go to generate your Invoices, bills, checks, etc. the class option will be available to use.

by Marie | Mar 18, 2017 | Bookkeeping 101, Customer Setup & Management, Invoicing & Receivables, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

Yesterday while consulting with my newest client  , the renowned owner of an upscale beauty Salon here in New York City, she asked a question that I was not expecting to hear asked. Meaning, I thought this would be something everyone knew the answer to. I mean, I did give her an answer, you know explained fully, but not before pausing and digesting it. So, I had to poll my Facebook group on this one, as I often do. Lo and behold, a whopping 68%

, the renowned owner of an upscale beauty Salon here in New York City, she asked a question that I was not expecting to hear asked. Meaning, I thought this would be something everyone knew the answer to. I mean, I did give her an answer, you know explained fully, but not before pausing and digesting it. So, I had to poll my Facebook group on this one, as I often do. Lo and behold, a whopping 68%  did not know the difference. I was wrong! I know we all have things in different fields of studies that we are not knowledgeable about but as far as the extent of common knowledge, what is and isn’t, do vary. So, in light of finding that out, I have decided to answer this specific question, “Should I be issuing customers sales receipts or Invoices in QuickBooks?” here so that others may be able to find the answer. That’s what I am about here at Step by Step QuickBooks Tutorial!

did not know the difference. I was wrong! I know we all have things in different fields of studies that we are not knowledgeable about but as far as the extent of common knowledge, what is and isn’t, do vary. So, in light of finding that out, I have decided to answer this specific question, “Should I be issuing customers sales receipts or Invoices in QuickBooks?” here so that others may be able to find the answer. That’s what I am about here at Step by Step QuickBooks Tutorial!

So, here’s the deal! If you are a business offering goods and/or services on credit to your customers, or allow for partial payments/payment deposits, then you should create and issue your customers Invoices. This will allow you to track your customers balances for Individual Invoices in the accounts receivables ledger, as well as have a comprehensive view of your total outstanding customer receivables. The Invoice connects the sales transactions to accounts receivables; the sales receipt on the other hand, does not.

If you require full payment at time of sale/service, then you should issue your customers Sales Receipts. Sales Receipts do not affect accounts receivables and thus will not allow for the tracking of any customer balances.

Businesses, such as my client’s beauty salon, that operate on a “buy/now pay/now” basis, do not need to Invoice their customers since they will not need to track payments owing to them – there won’t be any. Instead, they should issue sales receipts which is for the total amount of the sale. Thanks to today’s technological advancement, these businesses have the option of using a Point of Sale system, and most can be linked to an accounting software such as Intuit’s QuickBooks, and have the transactions easily downloaded to QuickBooks instead of manually.

So there you have it! Use an Invoice when you need to track customer balances, and a Sales receipt when you do not.

Don’t forget to like us on Facebook, follow us on Twitter and Linked In, plus One us on Google +, and leave a comment right here on this blog. Tall order, thank you!

by Marie | Mar 13, 2017 | Billing & Payables, Bookkeeping 101, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Troubleshooting, Vendor Setup & Management

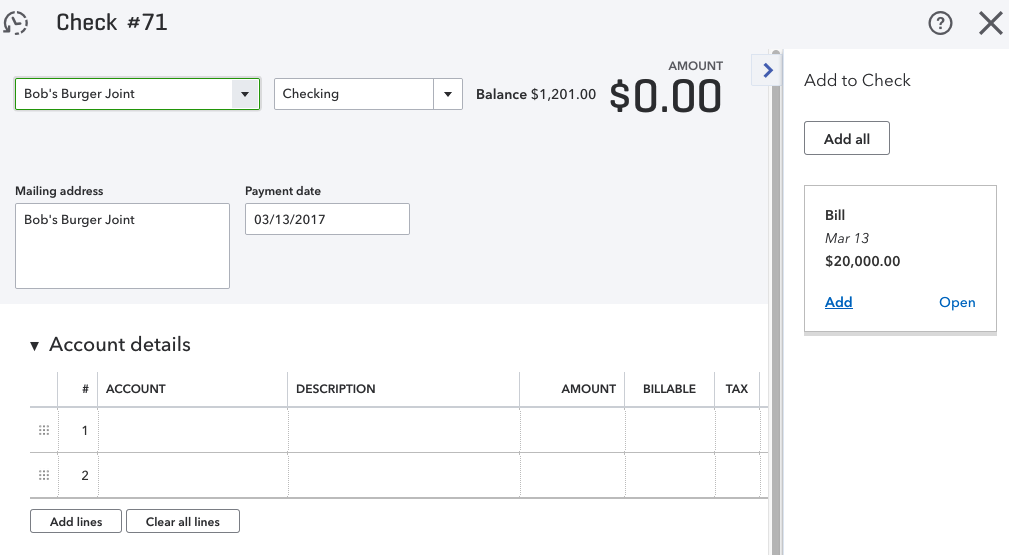

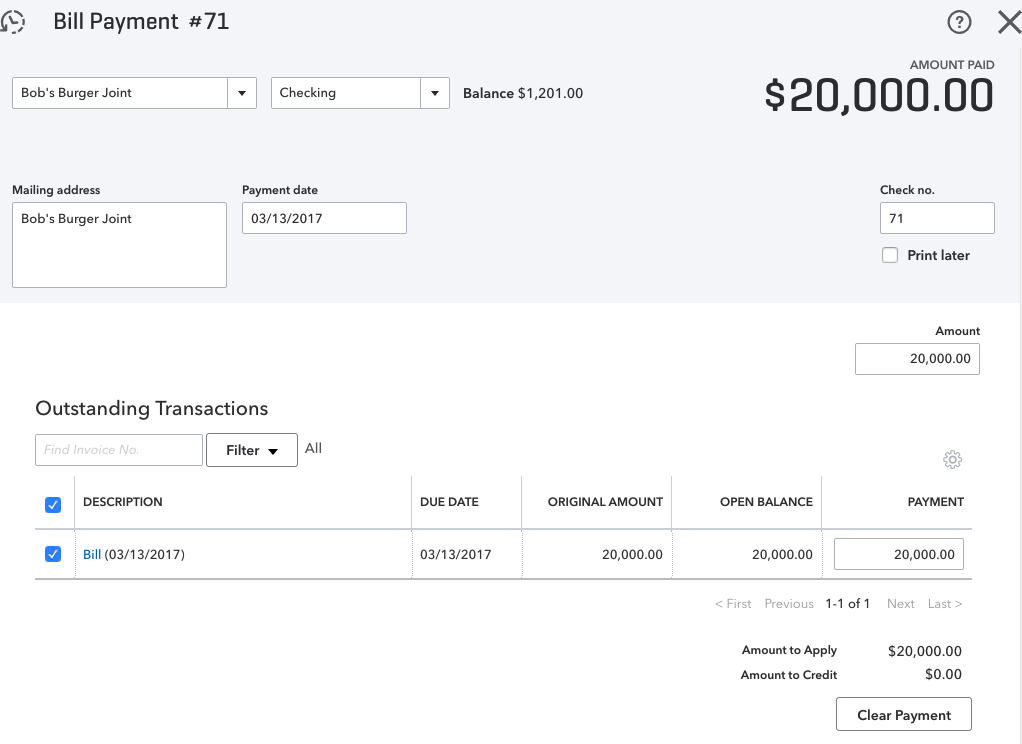

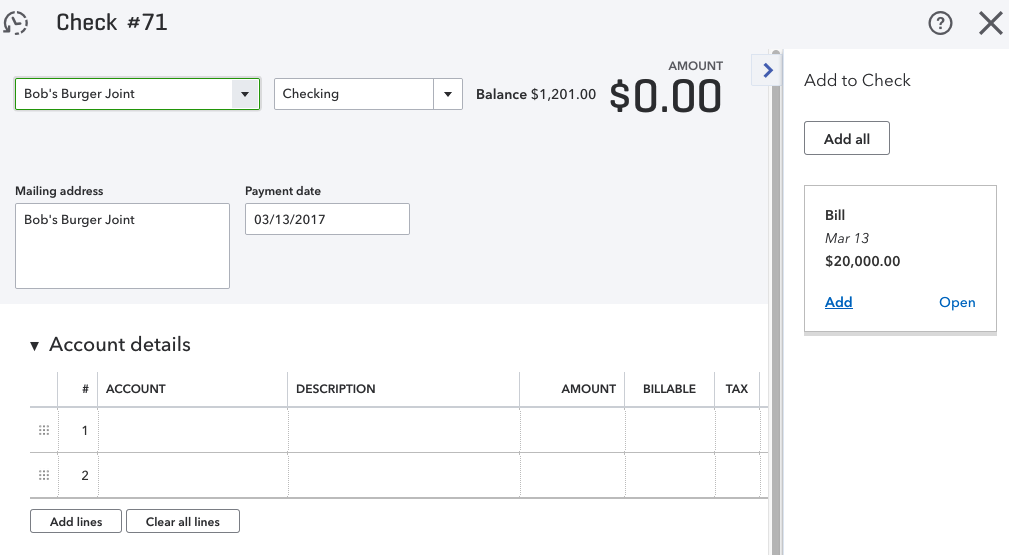

If you try to write a check to a vendor who has an open bill in QuickBooks Online, a tab will open to the right showing the open bills for that vendor, and asking if you wish to add the bill to the check (as shown in screenshot below). When you click Add, the payment will automatically link to the bill which will zero it out from the vendor balance as well as the accounts payable.

Click for Larger Image

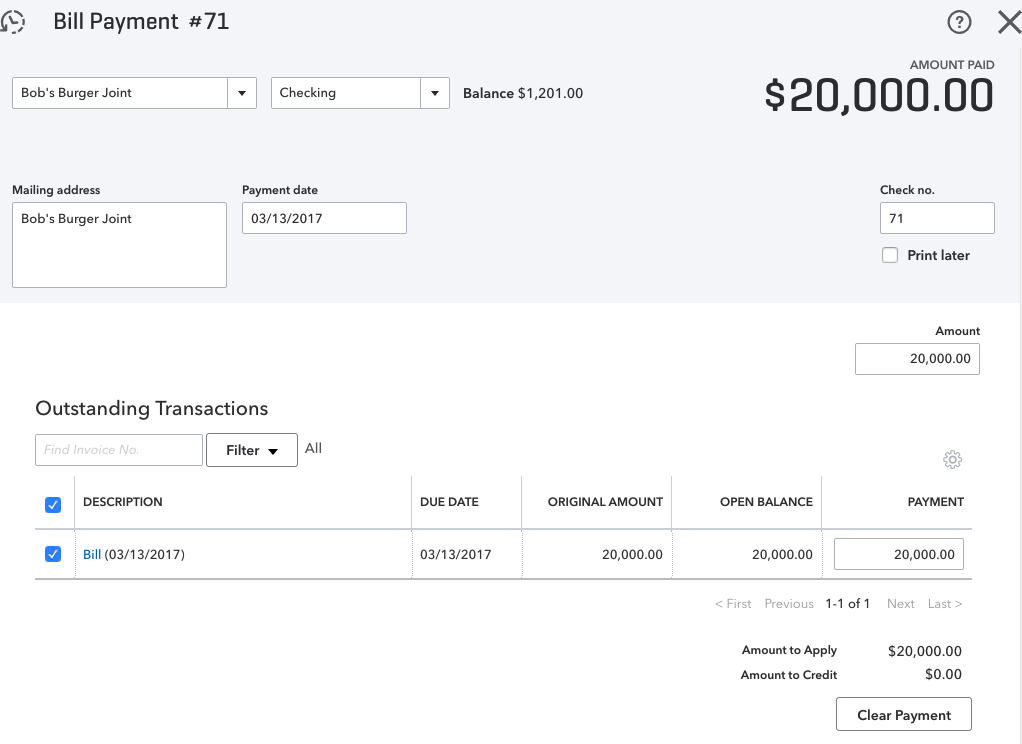

Click for Larger Image

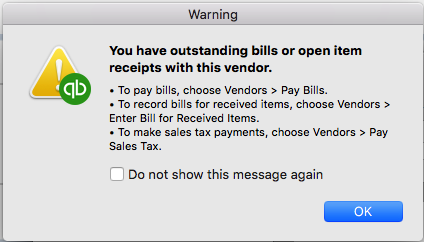

Click for Larger Image

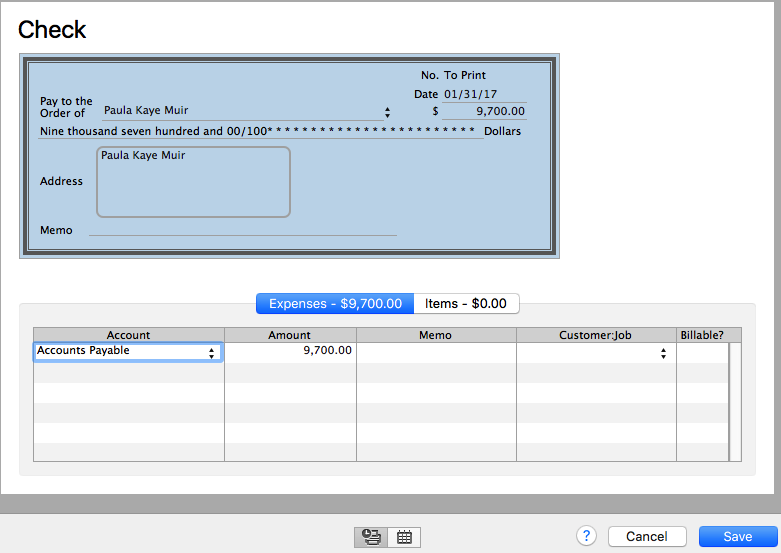

Click for Larger Image

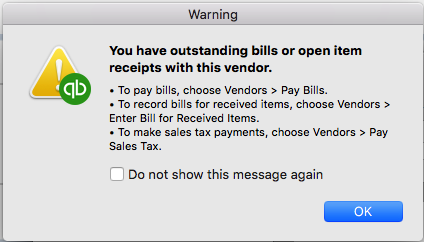

If you attempt to write a check for a vendor who has an open bill in QuickBooks Desktop versions – Pro, Premier, or Enterprise, you will get a warning (as shown in screenshot below) or similar. If you continue to write the check for a bill instead of using the pay bills feature, not only will that bill remain open and unpaid in QuickBooks, but you will have doubled your expenses for that particular expense or cost of goods sold account.

NOTE: It’s never a good idea to change transactions for past periods, so if you have already filed your taxes based on the information you have in QuickBooks, you will need to speak with your CPA or tax preparer prior to making any changes to those periods that have already been reported.

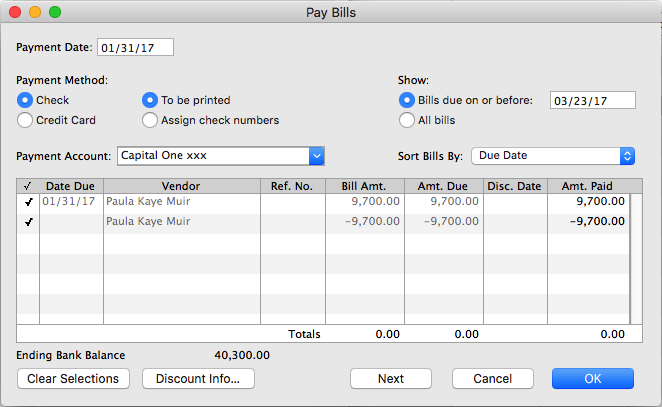

To correct Vendor Balances in the Desktop versions – QuickBooks Pro, Premier or Enterprise, due to the Write Check feature Being Used Instead of the Pay Bills feature, follow these steps:

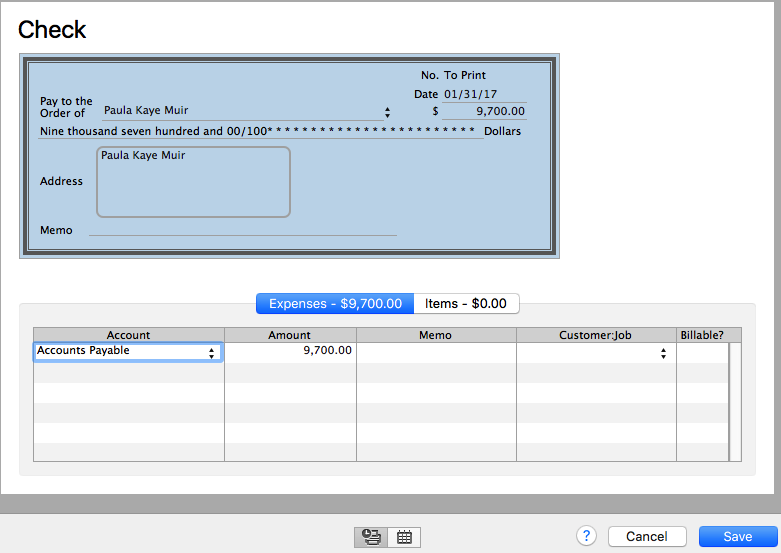

- Open the checks that were paid for each bill, and change the account from the expense used to Accounts Payable (as shown in screenshot below).

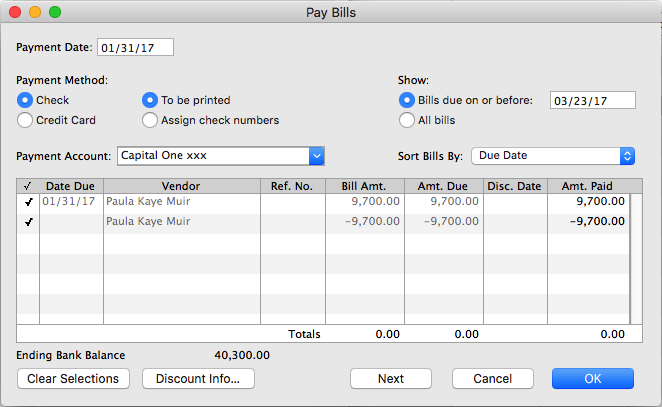

- Next, go to Vendors, then Pay Bills and click to the left of each transaction to checkmark them (as shown in screenshot below) (One is the bill and the other is the check).

- Change the date to reflect date of check used to pay this bill.

- Click OK, Save or Save and Close.

Now when you look at your vendor balance, those amounts should not be included. Also, if you look at your Accounts Payable on your balance sheet, those amounts should not be there. If there are a lot to be done, you may edit all the checks and change their accounts to “Accounts Payable” first, then go to “Pay Bills” and select them all. Just be sure the “Totals” amount in the “Pay Bills” window is zero before hitting that Ok, Save, or Save and Close button.

NOTE: If a portion of the individual bills were paid with the “Write check” feature and the other portion with the “Pay bills” feature, the above-mentioned solution will work as well. Just ensure that the checks you are editing and changing from their respective expense account to Accounts Payable, are the ones that do apply to the respective vendor/vendor bill. Also, whatever you do, do not delete any checks or payments for any period that was already reconciled. It will definitely throw off your reconciliations!

Remember: A bill will remain in open/unpaid status after writing a check if you used the QuickBooks “Write Checks” feature rather than the “Pay Bills” feature to pay it. This is so because the two Accounts Payable features – Enter Bills and Pay Bills, work together. If you use Write Checks with Enter Bills, the check will not be linked to the bill, and the bill will remain in open/unpaid status.

Here are Two (2) General Guidelines to Follow When Deciding How to Make Payments:

- If you pay bills as they arrive and do not need to see reports on how much you owe vendors, use Write Checks.

- If you prefer to pay bills all at once for example on the same day each month, and you want to see reports on how much you owe vendors, or if you usually make partial bill payments, then use Enter Bills and Pay Bills which are both linked to Accounts Payable.

Use the above-mentioned method to correct your vendor balances, and remember to always use the “Pay Bills” feature if you used the “Enter Bills” feature, and not the “Write Check” feature – moving forward.

by Marie | Mar 12, 2017 | Banking Setup & Management, Bookkeeping 101, QuickBooks Online, Reconciliations, Troubleshooting

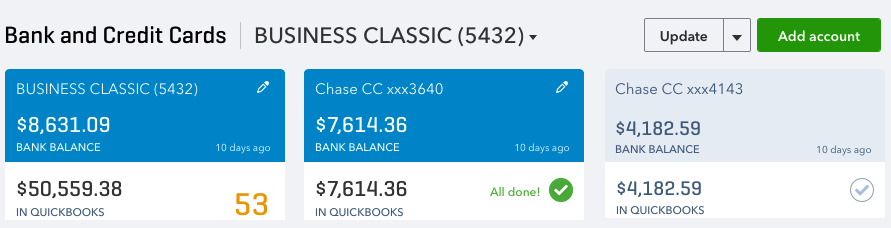

This is one of the most common questions I get asked by new QuickBooks Online users, and you may be surprised to know that more often than not, both bank and QuickBooks balances are never matched simultaneously. However, if you have updated your bank downloads, reviewed and added them all to the QuickBooks register for a specific period or timeframe, and your balances are not matching there may be cause for concern. Here are three main reasons why your actual bank balance does not equal the bank balance in QuickBooks Online.

- You or someone else may have manually added some transactions to QuickBooks and then added them again from the download screen. (This is one reason why it is important to establish and use only one method of inputting your transactions in QuickBooks which is either a) adding transactions via the QuickBooks banking download option, or b) manually adding individual transactions. Adding transactions via the download option is my personal preference and recommendation, as it saves time as well as minimize data entry errors. Subsequently, if you are reconciling your account and realize there are transactions missing that were not downloaded, you can manually enter those missing transactions that are on your bank or credit card statement but not in QuickBooks. It’s very rare for this to happen, but it does!)

- You have manually written check(s) directly in QuickBooks and those checks have not yet been presented to your bank to be cashed. (This will cause your QuickBooks balance to be less than your actual bank balance by the check or checks amount.)

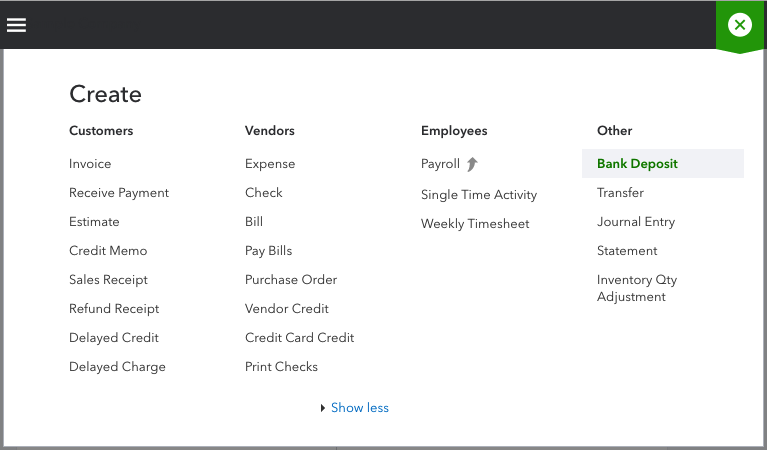

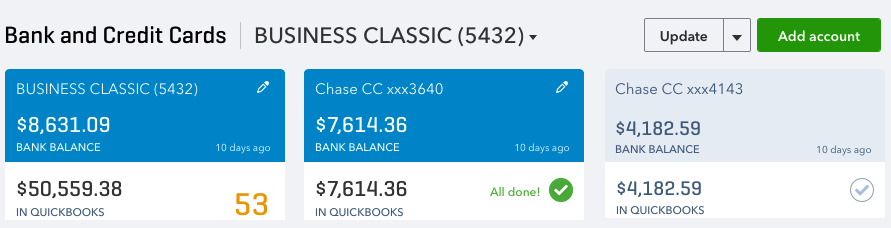

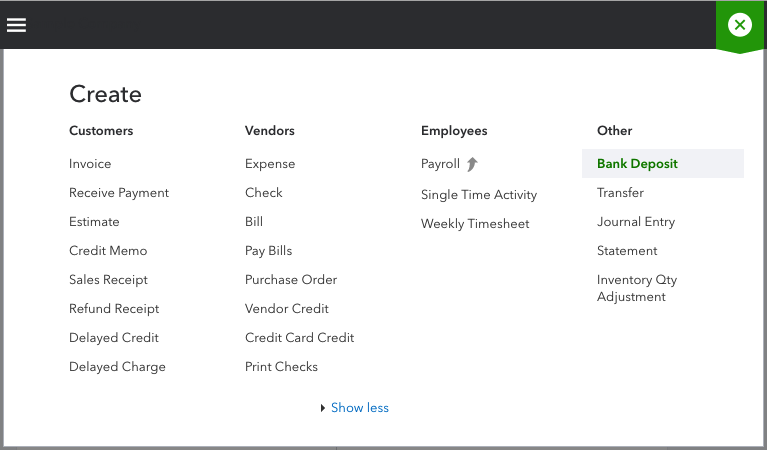

- You have received and applied customer payment(s) to their Invoices in QuickBooks, and also deposited them to the bank account in QuickBooks; however, you have not yet deposited those payments to your actual bank account or you have but they are not yet recorded by your bank. (This will cause your QuickBooks balance to be more than than your actual bank balance by the total of the deposit(s). (When you receive customer payments, you want to apply them to their respective Invoices for the dates that you receive them; however, you may not always deposit them to your actual bank account on the date that you receive them. This is where the undeposited funds account comes in; use the undeposited funds account to house those customer payments until you actually deposit them to your real bank account. When you have made the deposits to your actual bank account, use the Bank Deposit option at the plus sign top right of screen (as shown in the screenshot below) to transfer those payments in the undeposited funds account to the bank account in QuickBooks.)

How to Ensure Your Actual Bank Account Balance and QuickBooks Bank Balance are in Synch

In addition to the above-mentioned, if you track your cash flow on a daily basis, you will always be able to see what is causing your QuickBooks bank balance and your actual bank balance to be out of synch. Also, it is imperative that you reconcile your bank and credit card accounts regularly – at least on a monthly basis. Reconciliation is one of the most important aspect of accounting, and as such, reconciling your bank and credit card accounts on a monthly basis is the foundation of keeping healthy data and maintaining accurate books. Here are some mistakes that reconciliation can help you uncover:

- Missing transactions

- Duplicate transactions

- Transactions entered in error

- Transactions entered to the wrong period or bank/credit card account

- Incorrect transaction amount entered in QuickBooks

- Incorrect or no opening bank balance entered in QuickBooks

- Transactions previously reconciled have been changed or deleted

So, there you have it! The three (3) main reasons why your QuickBooks bank balance and your actual bank balance are not matching, and what you can do about it. Feel free to leave your questions or comments below.

by Marie | Oct 22, 2016 | Bookkeeping 101, Business Types & Accounting, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

Like pretty much anything else, if you don’t establish the foundation, you will not have anything to build on. If you do not know the basics of accounting, then whatever you attempt to do that relates to accounting, will be futile. Getting the numbers right, can either make or break your business, and if you are like me you want to make your business – not break it.

The first thing we need to do is define accounting and bookkeeping:

Accounting is an entire system of recording information based on specific principles, analyzing those information, and advising on the action to take based on those information. It is often broken down into two parts: the actual entering of the transactions (bookkeeping) and the analysis, interpreting, and communicating of those data (accounting). Thus, accounting is the process of making sense of information previously compiled, and producing financial models using that information. In other words, bookkeeping compiles, while accounting analyze, interprets, and communicate the information to its owner(s). Accounting entails: preparing adjusting entries – recording expenses that have occurred but are not yet recorded in the bookkeeping process, preparing financial statements, analyzing costs of living or business operations, completing income tax returns, assisting the individual or business owner in understanding the impact of financial decisions. Accounting is either accrual or cash basis; however, GAAP only accepts accrual method of accounting.

Bookkeeping is the process of recording daily transactions in a consistent, systematic way so as to output the results in reportable formats from which good business decisions can be made. It consists of: recording financial transactions – posting debits and credits, producing invoices, making purchases and paying bills, maintaining and balancing subsidiaries – general ledgers, and historical accounts, and generating payroll.

Accounting operates on a double entry basis; meaning for every debit, there is a corresponding credit and vice versa, and the entire accounting system is based on a single accounting equation: ASSETS = EQUITY + LIABILITIES. Assets, being what you own, Liabilities, being what you owe, and Equity being the difference between the two, which is what you have left.

The next thing we need to do is to lay out the principles:

Accounting principles are general rules and concepts that govern the field of accounting. These general rules, referred to as basic accounting principles and guidelines, form the groundwork on which more detailed, complicated, and legalistic accounting rules are based. For example, the Financial Accounting Standards Board (FASB) uses the basic accounting principles and guidelines GAAP as a basis for their own detailed and comprehensive set of accounting rules and standards. Generally Accepted Accounting Principles (GAAP) consists of three important sets of rules: (1) the basic accounting principles and guidelines, (2) the detailed rules and standards issued by FASB and its predecessor the Accounting Principles Board (APB), and (3) the generally accepted industry practices.

GAAP is exceedingly useful because it attempts to standardize and regulate accounting definitions, assumptions, and methods. Because of generally accepted accounting principles we are able to assume that there is consistency from year to year in the methods used to prepare a company’s financial statements. And although variations may exist, we can make reasonably confident conclusions when comparing one company to another, or comparing one company’s financial statistics to the statistics for its industry.

Again, accounting is based on principles, and since the bookkeeper usually records the information, he or she will need to know what constitutes the principles in order to accurately complete the bookkeeping task. Accountants and CPA’s rely heavily on bookkeepers for accurate information, and often work closely with bookkeepers to ensure that they do get correct information. If the bookkeeping is incorrect, then more often than not, the accounting is also incorrect and the business will suffer as a result. In addition, the Chart of Accounts, which is the backbone of the accounting system, needs to be structured correctly with each account linking to its accurate account type – expense, income, asset, liability, or equity. So what are the principles?

- Revenue Principle

The revenue principle, also known as the realization principle, states that revenue is earned when the sale is made, which is typically when goods or services are provided. A key component of the revenue principle, when it comes to the sale of goods, is that revenue is earned when legal ownership of the goods passes from seller to buyer. Note that revenue isn’t earned when you collect cash for something.

Cash Basis accounting is not accepted by GAAP standard. However, since GAAP is a standard and not the law, small businesses that earn revenue within a specified threshold, are not publicly traded, and do not carry Inventory may opt to use the cash basis method of accounting.

- Expense Principle

The expense principle states that an expense occurs when the business uses goods or receives services. In other words, the expense principle is the flip side of the revenue principle. As is the case with the revenue principle, if you receive some goods, simply receiving the goods means that you have incurred the expense of the goods. Similarly, if you have received a service, you have incurred the corresponding expense. It doesn’t matter that it takes a few days or a few weeks to get the bill. You incur an expense when goods or services are received.

- Matching Principle

The matching principle is related to the revenue and the expense principles. The matching principle states that when you recognize revenue, you should match related expenses with the revenue. The best example of the matching principle concerns the case of businesses that resell inventory. For example, if you own a natural juice stand, you should count the expense of each juice sold on the day you sell those juices. Don’t count the expense when you purchase the juices or the ingredients; count the expense when you sell them. In other words, match the expense of the item with the revenue of the item.

Accrual-based accounting, which is a term you have probably heard, is what you get when you apply the revenue principle, the expense principle, and the matching principle. In a nutshell, accrual-based accounting means that you record revenue when a sale is made and record expenses when goods are used or services are received.

- Cost Principle

The cost principle states that amounts in your accounting system should be quantified, or measured, by using historical cost. For example, if you have a business and the business owns a building, that building, according to the cost principle, shows up on your balance sheet at its historical cost. You do not adjust the values in an accounting system for changes in a fair market value.

- Objectivity Principle

The objectivity principle states that accounting measurements and accounting reports should use objective, factual, and verifiable data. In other words, accountants, accounting systems, and accounting reports should rely on subjectivity as little as possible. An accountant always wants to use objective data – even if it’s bad, rather than subjective data – even if the subjective data is arguably better.

- Full Disclosure Principle

Full disclosure states that if certain information is important to an investor or lender using the financial statements, that information should be disclosed within the statement or in the notes to the statement. It is because of this basic accounting principle that numerous pages of “footnotes” are often attached to financial statements. As an example, let’s say a company is named in a lawsuit that demands a significant amount of money. When the financial statements are prepared it is not clear whether the company will be able to defend itself or whether it might lose the lawsuit. As a result of these conditions, and because of the full disclosure principle, the lawsuit will be described in the notes to the financial statements. A company usually lists its significant accounting policies as the first note to its financial statements.

- Continuity Assumption

The continuity assumption or going concern principle assumes that a company will continue to exist long enough to carry out its objectives and commitments and will not liquidate in the foreseeable future. The importance of the continuity assumption becomes most clear if you consider the ramifications of assuming that a business won’t continue. If a business will not continue, it becomes very unclear how one should value assets if the assets have no resale value. If a business will not continue operations, no assurance exists that any of the inventory can be sold. If the inventory cannot be sold, what does that say about the owner’s equity value shown in the balance sheet? If the company’s financial situation is such that the accountant believes the company will not be able to continue on, the accountant is required to disclose this assessment.

- Unit-of-measure Assumption

The unit-of-measure assumption assumes that a business’s domestic currency is the appropriate unit of measure for the business to use in its accounting. In other words, the unit-of-measure assumption states that it’s okay for U.S. businesses to use U.S. dollars in their accounting. The unit-of-measure assumption also states, implicitly, that even though inflation and, occasionally, deflation change the purchasing power of the unit of measure used in the accounting system, that’s still okay.

- Separate Entity Assumption

The separate entity assumption states that a business entity, like a sole proprietorship, is a separate entity, a separate thing from its business owner. And the separate entity assumption says that a partnership is a separate thing from the partners who own part of the business. The separate entity assumption, therefore, enables one to prepare financial statements just for the sole proprietorship or just for the partnership. As a result, the separate entity assumption also relies on a business being separate and distinct and definable as compared to its business owners. For legal purposes, a sole proprietorship and its owner are considered to be one entity, but for accounting purposes they are considered to be two separate entities.

- Time Period Assumption

The time period assumption principle assumes that it is possible to report the complex and ongoing activities of a business in relatively short, distinct time intervals such as the three months ended March 31, 2016, or the 13 weeks ended April 1, 2016. The shorter the time interval, the more likely the need for the accountant to estimate amounts relevant to that period. For example, the property tax bill is received on December 16 of each year. On the income statement for the year ended December 31, 2015, the amount is known; but for the income statement for the three months ended March 31, 2016, the amount was not known and an estimate had to be used. It is also very important that the time interval (or period of time) be shown in the heading of each income statement, statement of stockholders’ equity, statement of cash flow, and all other reports. Labeling one of these financial statements with “December 31” is not good enough. The reader needs to know if the statement covers the one week ended December 31, 2015 the month ended December 31, 2015, the three months ended December 31, 2015, or the year ended December 31, 2015.

Of course you do not need to know all of this in order to accurately use an accounting software, but knowing the basics and having an understanding of the elements of accounting, will allow you to enter information correctly and subsequently have accurate numbers from which to run your business as well as file its taxes. Also, the way you set up your Chart of Accounts and enter data will need to be modified to reflect the type of business entity, but the basics – debits, credits, purchases, sales, income, expenses, assets, liabilities – remain the same.

by Marie | Oct 4, 2016 | Adjustments & Corrections, Bookkeeping 101

It is never a good idea to make changes to past accounting periods that you have already filed tax returns for. However, if you must, you need to ensure that the changes you are about to make will not throw off the previous years balance making them out of synch with your latest tax return numbers. Thus if you are correcting it to make it synchronize with your tax return, then by all means you should go right ahead. It simply means your tax preparer made the corrections when filing the tax return but the correction just hasn’t been entered in QuickBooks as yet.

Also, bear in mind that depending on the type of journal entry you are correcting, and the accounts it affects, it may be worth making a new journal in the current year to offset that journal or the parts of it that needs correction.

The fact that you need to correct it means it is incorrect, but if the period is closed by someone else and password protected, making a new one in the current year may be the only option you have.

How to Correct an Error in Revenue or Expenses Made in the Last Tax Year, but Not Discovered Until Current Tax Year

At year-end, net income is closed out to Income Summary, which is then transferred to the owners’ equity account Retained Earnings (corporations) or Capital (partnerships, sole proprietorships). Thus, this account includes last year’s net revenues and expenses. To add back omitted revenues, you credit Retained Earnings or Capital and to add back expenses, you debit one of these accounts. Here are a few pointers with examples:

- To correct an expense omitted or understated in 2015 after the books are closed, debit Retained Earnings (or Capital) to reduce the balance.

- To correct an expense overstated in 2015 after the books are closed, credit Retained Earnings (or Capital) to increase the balance.

- To correct revenue omitted or understated in 2015 after the books are closed, credit Retained Earnings (or Capital) to increase the balance.

- To correct revenue overstated in 2015 after the books are closed, debit Retained Earnings (or Capital) to reduce the balance.

As usual, it’s always a good idea to consult with your tax preparer/CPA to ensure you are both on the same page with the books. Some changes made after a period’s tax return is filed, may need to be handled with the filing of an amended tax return.

by Marie | Aug 25, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

Cost of Goods Sold are those costs that are directly associated with the production of a good or goods, or with direct service that leads to a sale. Expenses are all the other costs that are not COGS. See list of COGS and Expenses below:

Cost of Goods Sold Accounts

- Blueprints and Reproduction: Blueprints, photostats, and other printing expense

- Bond Expense: Construction bonds expenses directly related to jobs

- Construction Materials Costs: Construction materials costs

- Contracted Services: Direct labor costs for contract (non-employees) performing services for clients

- Equipment Rental for Jobs: Rent paid for rented equipment used on jobs

- Freight and Shipping Costs: Freight-in and shipping costs for delivery to customers

- Freight Costs: Costs of freight and delivery for merchandise purchased

- Job Materials Purchased: Construction materials used on jobs

- Linens and Lodging Supplies: Costs of linens and other supplies for guest rooms

- Materials Costs: Cost of materials used on jobs

- Media Purchased for Clients: Print, TV, radio, and other media purchased for clients

- Merchant Account Fees: Credit card merchant account discount fees, transaction fees, and related costs

- Other Construction Costs: Other costs directly related to jobs such as waste disposal, onsite storage rental, etc.

- Other Job Related Costs: Other costs directly related to jobs such as waste disposal, onsite storage rental, etc.

- Parts Purchases: Purchases of parts for use on customer repairs or resale

- Purchases – Hardware for Resale: Purchases of hardware items for resale that are not tracked or counted in inventory

- Purchases – Resale Items: Purchases of items for resale that are not tracked or counted in inventory

- Purchases – Software for Resale: Purchases of software items for resale that are not tracked or counted in inventory

- Subcontracted Services: Subcontracted services for customer service orders

- Subcontractors Expense: Subcontracted services performed by other contractors

- Tools and Small Equipment: Purchases of tools or small equipment used on jobs

- Worker’s Compensation Insurance: Worker’s compensation insurance premiums

Expense Accounts

- Advertising and Promotion: Advertising, marketing, graphic design, and other promotional expenses

- Auto and Truck Expenses: Fuel, oil, repairs, and other maintenance for business autos and trucks

- Automobile Expense: Fuel, oil, repairs, and other automobile maintenance for business autos

- Bank Service Charges: Bank account service fees, bad check charges and other bank fees

- Business Licenses and Permits: Business licenses, permits, and other business-related fees

- Car and Truck Expenses: Fuel, oil, repairs, and other car and truck maintenance

- Chemicals Purchased: Costs of chemicals used in farming operations

- Computer and Internet Expenses: Computer supplies, off-the-shelf software, online fees, and other computer or internet related expenses

- Continuing Education: Seminars, educational expenses and employee development, not including travel

- Depreciation Expense: Depreciation on equipment, buildings and improvementsDues and Subscriptions: Subscriptions and membership dues for civic, service, professional, trade organizations

- Equipment Rental: Rent paid for rented equipment used for business

- Fertilizers and Lime: Fertilizers and lime purchased for farm operations

- Freight and Trucking: Amounts paid for freight or trucking of farm products

- Gasoline, Fuel and Oil: Gasoline, fuel or oil used for farm machinery

- Insurance Expense: Insurance expenses

- Insurance Expense: General Liability Insurance: General liability insurance premiums

- Insurance Expense: Life and Disability Insurance: Employee life and disability insurance premiums

- Insurance Expense: Professional Liability: Professional liability (errors and omissions) insurance

- Insurance Expense: Workers Compensation: Worker’s compensation insurance premiums

- Interest Expense: Interest payments on business loans, credit card balances, or other business debt

- Janitorial Expense: Janitorial expenses and cleaning supplies

- Landscaping and Groundskeeping: Landscape maintenance, gardening, and pool maintenance costs

- Marketing Expense: Advertising, marketing, graphic design, and other promotional expenses for our company

- Meals and Entertainment: Business meals and entertainment expenses, including travel-related meals (may have limited deductibility)

- Office Supplies: Office supplies expense

- Payroll Expenses: Payroll expenses

- Postage and Delivery: Postage, courier, and pickup and delivery services

- Printing and Reproduction: Printing, copies, and other reproduction expenses

- Professional Fees: Payments to attorneys and other professionals for services rendered

- Rent Expense: Rent paid for company offices or other structures used in the business

- Repairs and Maintenance: Incidental repairs and maintenance of business assets that do not add to the value or prolong its life

- Research Services: Research costs including legal library and subscriptions for research services

- Salon Supplies, Linens, Laundry: Costs of supplies used in the course of business (includes linens and laundry services)

- Seeds and Plants Purchased: Seeds and plants purchased for producing farm income

- Shop Expense: Miscellaneous shop supplies and related shop expenses (rags, hand cleaning supplies, etc.)

- Small Tools and Equipment: Purchases of small tools or equipment not classified as fixed assets

- Storage and Warehousing: Amounts paid to store farm commodities

- Taxes – Property: Taxes paid on property owned by the business, franchise taxes, excise taxes, etc.

- Telephone Expense: Telephone and long distance charges, faxing, and other fees Not equipment purchases

- Travel Expense: Business-related travel expenses including airline tickets, taxi fares, hotel and other travel expenses

Uniforms: Uniforms for employees and contractors

- Utilities: Water, electricity, garbage, and other basic utilities expenses

Recent Comments