Since the accounts were reconciled for the period in which the deposits relate, it means that the same revenues were reentered directly to a bank account register without realizing that they were already entered, and are in the “undeposited funds” account waiting to be deposited to the bank from there.

The fix will depend on the number of transactions involved. If not many deposit entries, here is what you do:

Few Deposits Fix

Few Deposits Fix

1) Locate the previous corresponding deposits in the bank account register and make note of their dates.

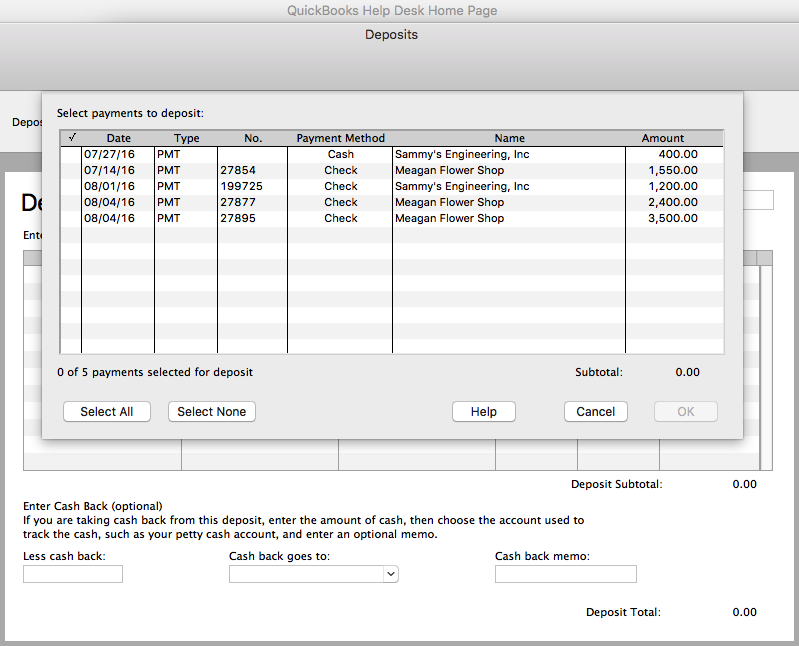

2) Make sure they are each the same amount as the deposits in the “Make Deposit” window. (You want to keep the deposits in the month they belong so as not to throw off the previous reconciliations).

3) Check to ensure that the dates in the “Make Deposit” window match the dates in the register, or at the very least, are in the same month. (The aim is to remove the entries from the “make Deposit” window without throwing off the previous reconciliations).

4) Now, go ahead and make the deposit(s) from the “Make Deposit” window for each amount(s) that were previously entered in the register, making sure you change the deposit date to reflect the previous deposit in the register as well.

5) Go back to the bank register and delete the previous deposits that were reconciled. (NOTE: Your deposits that you just made from the “Make Deposit” window should be shown either above or below the previous corresponding deposit with the same date).

6) Next, for QuickBooks Mac Pro or QuickBooks Online: checkmark each corresponding deposit that you have just deposited, as reconciled. (With the exception of the switching of the deposits, the previous reconciliations will remain the same, with accurate opening balances for each month). For QuickBooks Windows Pro/Premier: undo the previous reconciliation(s) to the first month affected by the deposits you deleted, and re-reconcile from there onward. All the deposits you entered will be there in the reconcile window for you to check off, and you will be in balance in minutes if you deposited them all accurately. (You can use the “Mark All” feature in the reconcile window by checking the box “Hide transactions after statement end date” and clicking “Mark All”. In most cases, this will reconcile the account for that month and show a $0 difference in the reconcile window. If there is a difference, and it is not obvious what amount(s) is throwing it off, use the “Unmark All” button and reconcile one by one with the statement.)

As you can see, if the deposits in the “Make Deposit” window are a lot – possibly spanning multiple years, the above-mentioned method of clearing the deposits from the “Make Deposit” window would be very time consuming and impractical.

If there are a multitude of deposits here is what you do:

Too Many Deposits Fix

Too Many Deposits Fix

1) First, you want to check to see if the deposits that were previously entered directly into the bank register that made the accounts reconcile, and the invoice that the payments in the “Make Deposit” window are for, went to the same Income account. So, locate the previous deposits as well as the corresponding Invoice(s) and check to see where they went. (If there is only one Income account, then they most likely went to the same account).

2) Go ahead and make the deposit(s) for each year, using the year end date for each year’s total deposit. (It’s always good practice to make adjustments at the beginning or ending of a period).

3) Next, create a journal entry for each year end with the total deposit amount you just put in for each year.

- Debit the Income Account associated with the deposit(s)

- Credit the bank account that the deposits were made to

This will reduce the amount in the bank account as well as the Income account – as it should, and the “Make Deposit” window will now be cleared. When next you go to reconcile, the journal entry amounts for the deposits will be in the reconcile window. Check each on the debit and corresponding credit side to remove them from the reconcile window. This of course will be a zero effect on your current reconciliation.

Because there were transactions left in the undeposited funds, the revenue for the period(s) associated with those deposits were overstated. It is possible that they were already taken care of by the CPA or tax preparer as far as tax filing; however, you will need to bring this to their attention if taxes were already filed for the affected period(s). Although you have already corrected this on the books in QuickBooks, amended returns may need to be filed, to make the correction tax-wise.

Using the “Too Many Deposits Fix” option above will allow your financials to be accurate, but not your books in the sense that the deposits were not broken down in months which will throw monthly reports off. Using the “Few Deposits Fix” option above will allow your books as well as your financials to be accurate on either the cash or accrual basis.

Recent Comments