Should I be Issuing Customers Sales Receipts or Invoices in QuickBooks?

Yesterday while consulting with my newest client ![]() , the renowned owner of an upscale beauty Salon here in New York City, she asked a question that I was not expecting to hear asked. Meaning, I thought this would be something everyone knew the answer to. I mean, I did give her an answer, you know explained fully, but not before pausing and digesting it. So, I had to poll my Facebook group on this one, as I often do. Lo and behold, a whopping 68%

, the renowned owner of an upscale beauty Salon here in New York City, she asked a question that I was not expecting to hear asked. Meaning, I thought this would be something everyone knew the answer to. I mean, I did give her an answer, you know explained fully, but not before pausing and digesting it. So, I had to poll my Facebook group on this one, as I often do. Lo and behold, a whopping 68% ![]() did not know the difference. I was wrong! I know we all have things in different fields of studies that we are not knowledgeable about but as far as the extent of common knowledge, what is and isn’t, do vary. So, in light of finding that out, I have decided to answer this specific question, “Should I be issuing customers sales receipts or Invoices in QuickBooks?” here so that others may be able to find the answer. That’s what I am about here at Step by Step QuickBooks Tutorial!

did not know the difference. I was wrong! I know we all have things in different fields of studies that we are not knowledgeable about but as far as the extent of common knowledge, what is and isn’t, do vary. So, in light of finding that out, I have decided to answer this specific question, “Should I be issuing customers sales receipts or Invoices in QuickBooks?” here so that others may be able to find the answer. That’s what I am about here at Step by Step QuickBooks Tutorial!

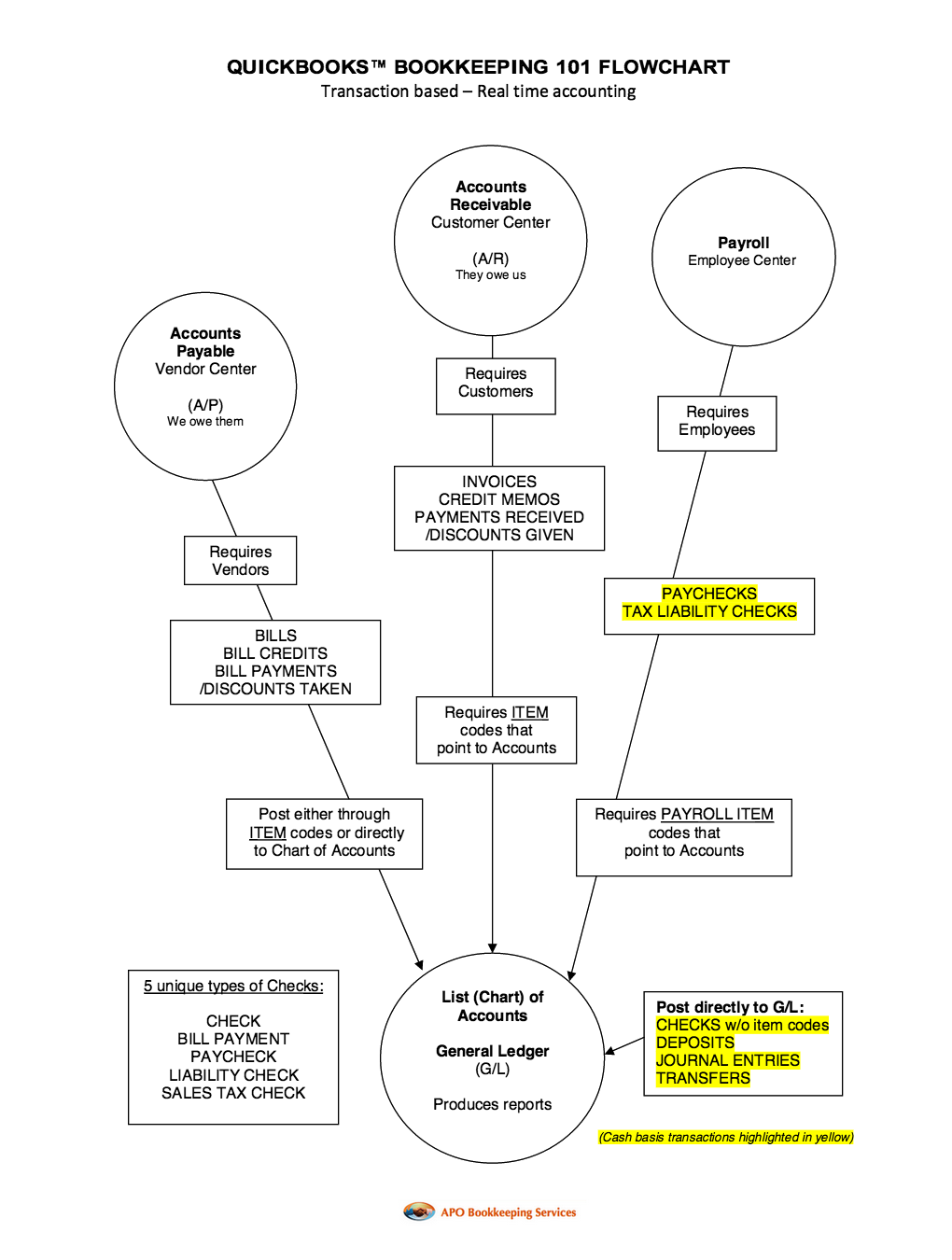

So, here’s the deal! If you are a business offering goods and/or services on credit to your customers, or allow for partial payments/payment deposits, then you should create and issue your customers Invoices. This will allow you to track your customers balances for Individual Invoices in the accounts receivables ledger, as well as have a comprehensive view of your total outstanding customer receivables. The Invoice connects the sales transactions to accounts receivables; the sales receipt on the other hand, does not.

If you require full payment at time of sale/service, then you should issue your customers Sales Receipts. Sales Receipts do not affect accounts receivables and thus will not allow for the tracking of any customer balances.

Businesses, such as my client’s beauty salon, that operate on a “buy/now pay/now” basis, do not need to Invoice their customers since they will not need to track payments owing to them – there won’t be any. Instead, they should issue sales receipts which is for the total amount of the sale. Thanks to today’s technological advancement, these businesses have the option of using a Point of Sale system, and most can be linked to an accounting software such as Intuit’s QuickBooks, and have the transactions easily downloaded to QuickBooks instead of manually.

So there you have it! Use an Invoice when you need to track customer balances, and a Sales receipt when you do not.

Don’t forget to like us on Facebook, follow us on Twitter and Linked In, plus One us on Google +, and leave a comment right here on this blog. Tall order, thank you!

Recent Comments