by Marie | Oct 4, 2016 | Classes & Location, Company Setup & Management, Financial Statements & Reports, Preferences & Customization, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

The main difference between class and account, is that every transaction must have an account assigned to it, while it’s optional to assign a class. So think of the class list as having a second chart of accounts which you can apply to transactions to group them into categories different from those provided by the Chart of Accounts.

Accounts mostly organize transactions into financial categories – income, expenses, receivables, payables etc., but classes let you organize transactions into any categories you want, and you have full control over what those categories are. The Class list is empty when you first create a QuickBooks company file, so you can set up any number of classes you want in it. Most often you’ll use classes for grouping transactions into management information categories as opposed to the financial accounting categories provided by the Chart of Accounts.

As a general rule, use accounts to identify the “what” of a transaction and classes to identify the “why” or “what for”. For example, if you buy Office Supplies for multiple departments and you want to keep track of each department’s use, the “what” is office supplies; the “what for” is the various departments – administrative, sales, production, etc. So office supplies (expense) should be an account and each department should be set up as a class.

Creating lots of sub-accounts is a common mistake among new QuickBooks users; however, it should be avoided at all cost. To illustrate the problem, consider this fragment from a simple chart of accounts:

Office Supplies

Marketing

Accounting

Now here is the same fragment of the chart of accounts, but with sub-accounts added:

Office Supplies

Administrative Department

Sales Department

Production Department

Marketing

Website

Events

Accounting

Bookkeeping

Audit Prep

As you can see in the illustration, the account list can become exponentially long which will produce very lengthy, unattractive financial reports. The Classes list in QuickBooks can have up to five levels (classes and subclasses), which gives you more functionality and flexibility in using the class feature. To have class information arranged in reports in a way that provides the most benefit, it does help to give some thought as to how the list should be structured.

To Turn on Class Tracking in QuickBooks Windows – Pro, Premier, Enterprise:

- Click on Edit, then Preferences in the main menu to open the Preferences window.

- Click on the Accounting icon in the left pane of the Preferences window.

- Select the Company Preferences tab in the right pane.

- Checkmark the Use class tracking item on the Company Preferences tab.

- Click OK to close the Preferences window.

To Turn on Class Tracking in QuickBooks Mac:

- Click on QuickBooks, then Preferences in the main menu to open the Preferences window.

- Click on the Transactions under Workflow and check the box that says Use class tracking.

- Click OK.

To Turn on Class Tracking in QuickBooks Online:

There are four (4) levels of Quickbooks Online subscription: 1) Simple Start, 2) Essential, 3) Online Plus, 4) Advanced. Class tracking is only available in the Online Plus and Advanced editions.

- Click on the Gear icon at top right of screen (your company name) and select Account and Settings under the Your Company tab

- Click the Advanced button in the left menu bar, then click the pencil icon at Categories to edit preference.

- Check the box at Track classes (You may also want to check the box at Warn me when a transaction isn’t assigned a class)

- Click Save.

After completing these steps, a Class column will appear in many of QuickBooks’ form windows. In some cases such as for invoices, you may have to customize the form’s template to have the Class column appear.

by Marie | Oct 2, 2016 | Company Setup & Management, Financial Statements & Reports, QuickBooks for Mac, QuickBooks for Windows

I do not recommend deleting memorized reports in QuickBooks as it has been known to cause the file to be corrupted.

One alternative is to create a folder called something like “Inactive” or “Old” and move the unwanted memorized reports there instead. Of course, this does not always happen as I have had a lot of clients do this without a problem, but it has happened multiple times in the past and you don’t know when it will happen and you certainly do not want your files getting corrupted.

How to Delete a Memorized Report in QuickBooks Windows – Pro, Premier, Enterprise

- Go to Report, then select Memorized Report List

- Select the report you want to delete in order to highlight it, then click the Memorized Report dropdown at bottom left and select Delete Memorized Report.

- Click Ok.

How to Delete a Memorized Report in QuickBooks Mac

- Go to Report, then select Report Center and click Memorized Reports

- Select the report you want to delete in order to highlight it, then click the X to the left of it.

- Click Ok.

by Marie | Mar 25, 2016 | Bookkeeping 101, Customer Setup & Management, Financial Statements & Reports

Accounts Receivable is a current asset that is only established in the form of Income to be received from a Customer that has been Invoiced. It is the amount a company has a right to collect because it sold goods or services on credit to a customer. In general, when a customer is Invoiced for goods or services you provide them, the total Invoice amount will be shown on both the Income or Profit and Loss Statement, as well as the Balance Sheet.

If a downpayment or deposit was received for the goods or services, the total Invoice amount would still be shown on the Income Statement; however, the deposit would be applied to the Invoice and entered or deposited in the bank account in which it was actually deposited, while the remaining balance that is owing and unpaid would be entered in the Accounts Receivable account. In other words, any monies that a company is owed by a customer, is a receivable.

It is very important for a company to monitor its Accounts Receivable and to immediately follow up with any customer who has not paid as agreed as per the terms of agreement be it 15 days, 30 days, etc. There is an aging of accounts receivable report tool in software such as QuickBooks that will help to monitor each customer’s Accounts Receivable, and as a general rule, the older a Receivable gets, the less likely it will be collected in full.

While Current Assets are cash or cash equivalent, such as Accounts Receivable and Inventory, Other Current Assets are small less significant items on a balance sheet lumped together because they do not include the major current assets, and as such are not important enough to be listed separately. They are not cash or cash equivalents, and represent a limited source of liquidity for a company – for example advances paid to suppliers or employees. Notations are usually available for the breakdown of these minor assets.

by Marie | Mar 20, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, Financial Statements & Reports, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

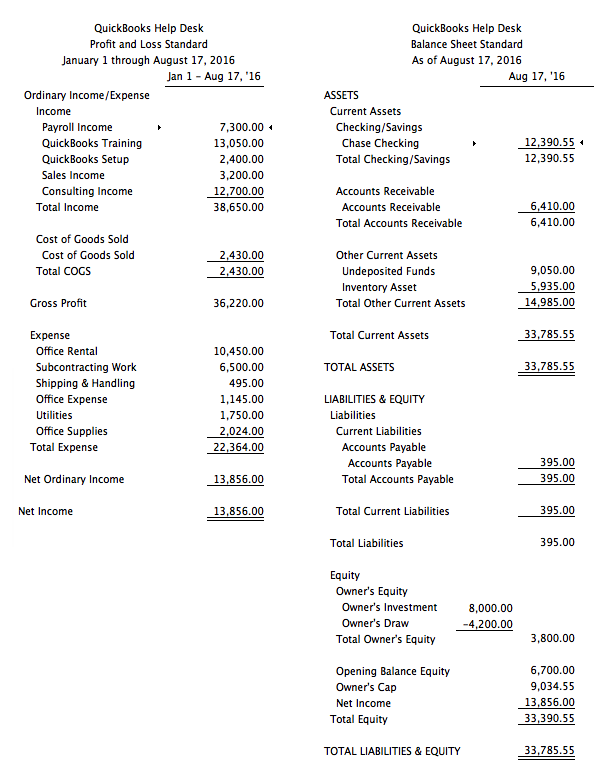

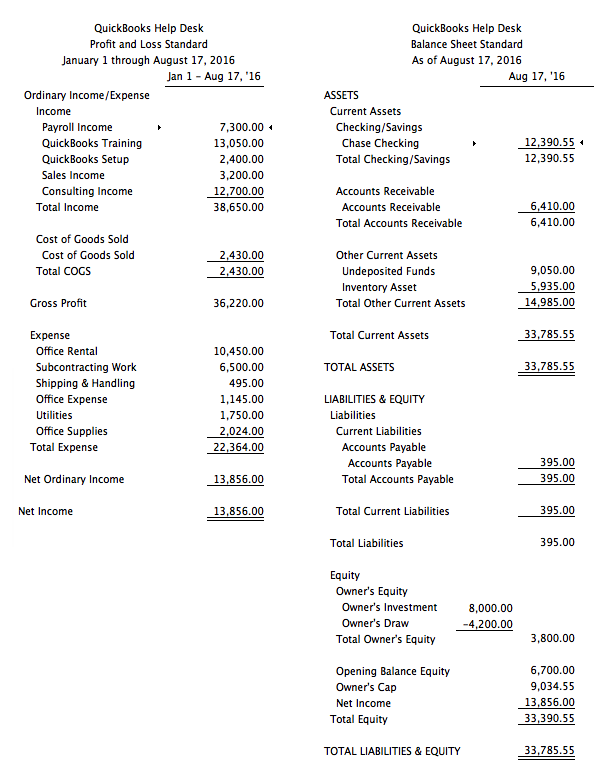

Your Profit and Loss Report is not showing Owner’s Draw because Owner’s Draw does not belong on a Profit & Loss Report and should not be there. Owner’s draws are not expenses so they do not belong on the Profit & Loss report. They are equity transactions shown at the bottom of the Balance Sheet.

The fact that you are asking this question, tells me that you do not have basic accounting knowledge, and you should not be doing any form of bookkeeping or accounting without this basic knowledge. You need basic understanding of a Chart of Accounts and how certain accounts feed to either a Balance Sheet or Profit & Loss report. Balance Sheet accounts, such as bank account, loan, and equity fluctuate as time goes on and a Balance Sheet is a snapshot of the balances in the accounts on the day requested. Income and Expense accounts accumulate figures and usually increase until closed out at year end, and the cycle starts again for each new year. That is why a Profit and Loss asks for a date range or period, while the Balance Sheet uses an “as at” date.

Profit & Loss Reports show:

- Revenue or Gross Sales

- Expenditures

- the resulting Profit or Loss

Balance Sheet Reports show:

- Assets

- Liabilities

- Equity

Regardless of the software – QuickBooks or others, none will make sense until you understand how the puzzle works and the unique ways certain kinds of companies must flow. If you do not know what you are doing, you could end up making a huge mess that will be very costly to clean up and reconcile. There are many bookkeeping and accounting classes out there, and it will be well worth your while to take a basic accounting course at your local community college. If you are a bookkeeper for a company, your employer may be willing to pay for this class since it will be a direct benefit to his/her business.

Also, since you are using the term “Owner Draw”, it tells me that the entity is a Sole Proprietorship. If the entity is not a Sole Proprietor, you should not be using an Owner’s Draw account. These are things that you will learn in a basic accounting class.

Key Differences Between Balance Sheet and Profit & Loss Account

- The Balance Sheet is prepared at a particular date, usually the end of financial year, while the Profit and Loss account is prepared for a particular period.

- The Balance Sheet reveals the entity’s financial position, whereas the Profit and Loss account discloses the entity’s financial performance.

- A balance Sheet gives an overview on assets, equity and liabilities of the company, but the Profit and Loss account is a depiction of entity’s revenue and expenses.

- The major difference between the two entities is that the Balance Sheet is a statement while the Profit and Loss account is an account.

- The Balance sheet is prepared on the basis of the balances transferred from the Profit and Loss account.

Recent Comments