by Marie | Mar 24, 2016 | Bookkeeping 101, Business Types & Accounting, Personal and Business Expenses, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reimbursements and Investments

As a business owner myself, I know that it is unavoidable at times – mixing business with personal funds, but this is not good business practice and should be avoided as much as possible. Why? Because, it is very easy to overlook business expenses that are paid with personal funds, and it is the best way to have IRS auditors going through all your personal affairs even though an issue is a business one. Since those monies do not directly affect the business bank or credit card accounts, you will need to make a concerted effort to track those expenses and record them appropriately on the business books.

Entering business expenses paid for with personal credit card or cash on the business books will depend on the structure of the business:

- For a Sole Proprietor or Single-Member LLC, the expenses should be entered to the relevant expense categories via Owner’s Draw/Equity. You will use this account for monies going in and out of the business by the owner. The Owner’s Draw/Equity accounts may have negative balances from time to time which will look odd on the balance sheet. So, it’s important to prepare a journal entry zero-ing out or offsetting these balances at the end of each month, quarter, or year.

- For a Partnershp or Multi-Member LLC, the expenses should be entered via Member Contribution if the owner is investing it, or loan based on the partnership’s operating agreement.

- For a Corporation, the expenses should be entered as loan if the owner will need to recoup the funds, or Equity Contribution if the owner wants to invest it in the business. If they are to be entered as loan, you will need to make the loan official, with repayment terms, interest, etc. Also, bear in mind that the IRS sometimes re-characterizes loan repayments as dividends – with serious tax implications. In this regard, a CPA should be consulted before deciding how to book these monies in QuickBooks.

In addition to the above mentioned effects of mixing business and personal funds, the mixing of business and personal funds can also pierce the corporate veil, and expose corporate business owners to personal liability which defeats the purpose of having a corporation to begin with. Sole proprietors already have personal liability, but not a corporation as it is an individual entity in itself. Separate business and personal financials at all cost, but if you do not, remember to enter them in their appropriate places and keep a record of receipts in the business files.

by Marie | Mar 20, 2016 | Importing Files & Forms To QuickBooks, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reconciliations, Third Party Applications - QuickBooks Compatible

Reconciling Paypal account in QuickBooks is similar to reconciling a bank or credit card account in QuickBooks. You want to ensure that your beginning balance in QuickBooks matches the beginning balance for the period you are reconciling, and subsequently selecting the period end date then checking off the transactions that are on Paypal transaction printout with its corresponding transaction in QuickBooks.

Manually Entering or Downloading Transactions in QuickBooks Prior to Reconciliation

Depending on the number of transactions you have in Paypal and how you want to track them, will be the deciding factor on the method you use. I have a few clients that need each Paypal transaction to be entered individually because each transaction can be for something different. In this case, I have to produce a Sales Receipt for each one and apply the money to the correct item. I then make a deposit using the Undeposited Funds account just like I would any other deposits.

The one difference is that when you have selected all the items that you are depositing you then need to subtract the total Paypal fees. These should not be subtracted from each person/entity you received funds from because you need to show that you received the full amount of the money. Therefore, on the Make Deposit screen I use the next available empty row to add the Paypal fees. If you have an account that you are using specifically for tracking these, then that account will be used in the From Account column.

In the Memo field you can enter Paypal Fees if you would like, and you can insert “PP” for Paypal in the “Payment Method” field. The key to this working is when you enter the cost for the fees in the “Amount” column, they need to be entered as negative numbers. The total deposit should equal the amount that was transferred from PayPal into your bank account. This way the full cost of whatever was purchased will show in their proper accounts and the proper Expense account will be increased by the Paypal Fees.

If you usually have a lot of transactions for Paypal, you may choose to use Simple Port to import your Paypal transactions to QuickBooks. Once you have set the PayPal download to the correct format you will never have to do it again, and when it is configured correctly, Simple Port imports each transaction as a sales receipt, makes the deposit, and records the PayPal fees. The setup process can be a bit daunting, but they do offer free phone help and support and once they are through, your settings will be perfect and you won’t need to change them again. It has helped me tremendously with clients that have hundreds of Paypal transactions to contend with. Within 30 minutes, I usually get about 600 PayPal transactions into QuickBooks if I have to separate by sales tax jurisdiction, and less than 10 minutes if sales tax is not an issue.

Reconciling Paypal Account With QuickBooks

Now, all you have to do is go to Banking, Reconcile, select the Paypal Account from the dropdown menu, insert the period end date, ending balance and click Ok. Check off each transaction on the statement with its corresponding transaction in QuickBooks. When you are through, the difference at the bottom of the reconcile window should be $0.00. If it is not, then you will need to locate the discrepancy. If you do not see the transactions in QuickBooks, even though they are on the Paypal printout, you will need to manually enter them.

Conversely, if there are transactions in QuickBooks for the period you are reconciling but not on the Paypal printout, you will need to query them and delete or transfer them to the account for which they belong. This can sometimes occur when the download/import is not the option used to enter transactions in QuickBooks.

Note: To get the Paypal report that includes Paypal fees as well as a running balance, go to Activity, Activity (including balance & fees), and run a report for the period.

How to Download Paypal Transactions to QuickBooks

How to Download Paypal Transactions to QuickBooks

by Marie | Mar 20, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, Financial Statements & Reports, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

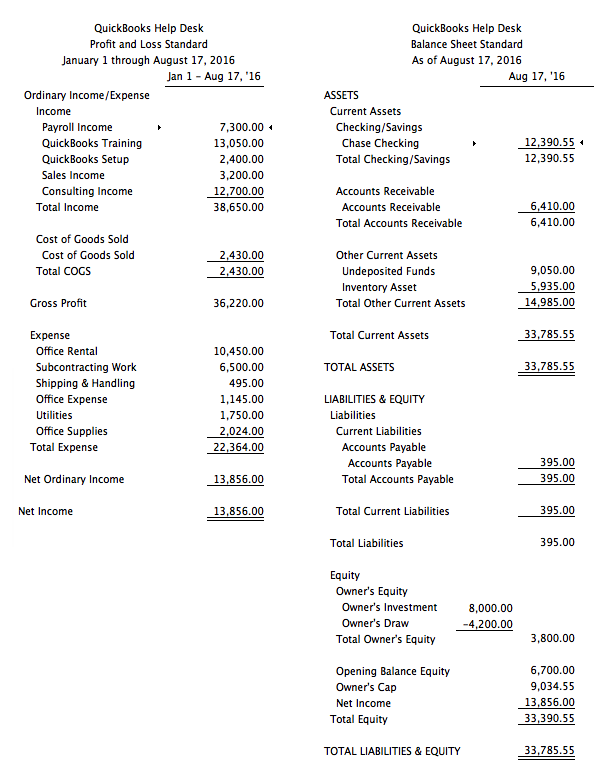

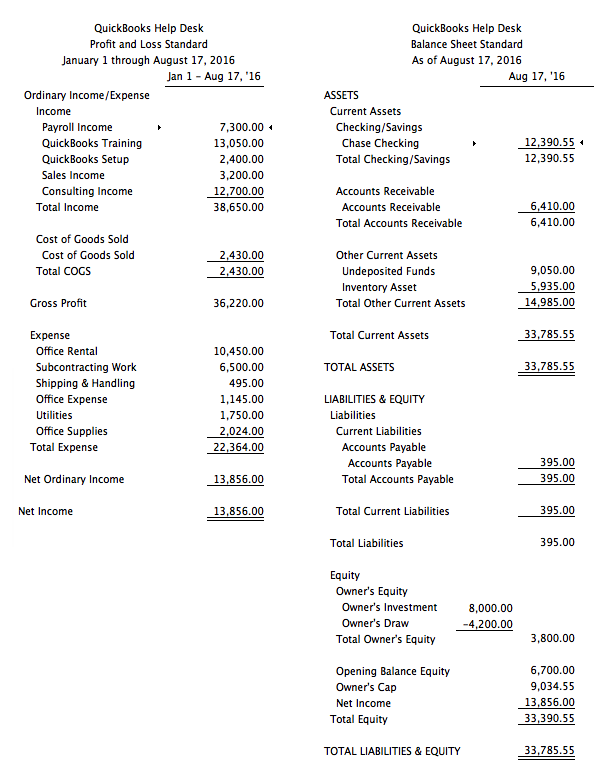

Your Profit and Loss Report is not showing Owner’s Draw because Owner’s Draw does not belong on a Profit & Loss Report and should not be there. Owner’s draws are not expenses so they do not belong on the Profit & Loss report. They are equity transactions shown at the bottom of the Balance Sheet.

The fact that you are asking this question, tells me that you do not have basic accounting knowledge, and you should not be doing any form of bookkeeping or accounting without this basic knowledge. You need basic understanding of a Chart of Accounts and how certain accounts feed to either a Balance Sheet or Profit & Loss report. Balance Sheet accounts, such as bank account, loan, and equity fluctuate as time goes on and a Balance Sheet is a snapshot of the balances in the accounts on the day requested. Income and Expense accounts accumulate figures and usually increase until closed out at year end, and the cycle starts again for each new year. That is why a Profit and Loss asks for a date range or period, while the Balance Sheet uses an “as at” date.

Profit & Loss Reports show:

- Revenue or Gross Sales

- Expenditures

- the resulting Profit or Loss

Balance Sheet Reports show:

- Assets

- Liabilities

- Equity

Regardless of the software – QuickBooks or others, none will make sense until you understand how the puzzle works and the unique ways certain kinds of companies must flow. If you do not know what you are doing, you could end up making a huge mess that will be very costly to clean up and reconcile. There are many bookkeeping and accounting classes out there, and it will be well worth your while to take a basic accounting course at your local community college. If you are a bookkeeper for a company, your employer may be willing to pay for this class since it will be a direct benefit to his/her business.

Also, since you are using the term “Owner Draw”, it tells me that the entity is a Sole Proprietorship. If the entity is not a Sole Proprietor, you should not be using an Owner’s Draw account. These are things that you will learn in a basic accounting class.

Key Differences Between Balance Sheet and Profit & Loss Account

- The Balance Sheet is prepared at a particular date, usually the end of financial year, while the Profit and Loss account is prepared for a particular period.

- The Balance Sheet reveals the entity’s financial position, whereas the Profit and Loss account discloses the entity’s financial performance.

- A balance Sheet gives an overview on assets, equity and liabilities of the company, but the Profit and Loss account is a depiction of entity’s revenue and expenses.

- The major difference between the two entities is that the Balance Sheet is a statement while the Profit and Loss account is an account.

- The Balance sheet is prepared on the basis of the balances transferred from the Profit and Loss account.

by Marie | Mar 20, 2016 | Bookkeeping 101, Importing Files & Forms To QuickBooks, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Third Party Applications - QuickBooks Compatible

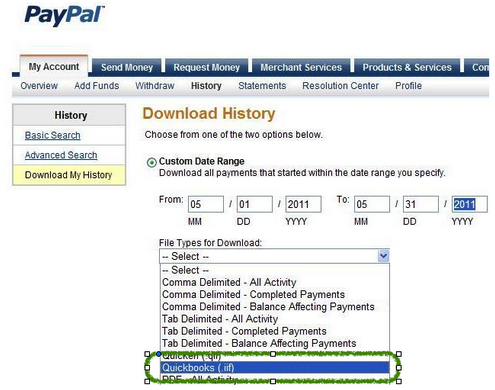

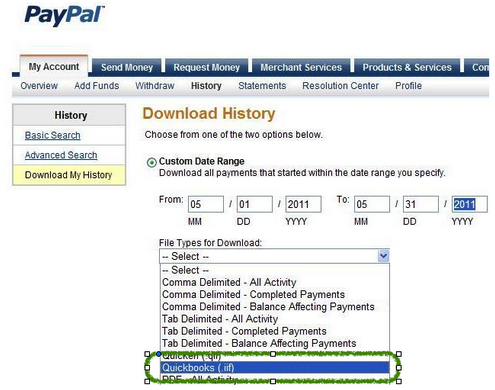

There are two ways to download Paypal transactions to QuickBooks: 1) via .iif file and 2) via .csv or Excel. I do not recommend the IIF approach as it does not allow for editing before uploading to QuickBooks, and Paypal transactions are not as seamless as bank transactions – they require editing. Instead, export the reports to Excel where you will be able to do the necessary editing before uploading to QuickBooks.

How to Import Paypal Transactions into QuickBooks

- Log in to your PayPal account

- Click the Activity tab, and select your date range

- Click the small Download link to the top right corner of the screen to get to the Download History screen

- Choose your date range, either Custom Date Range or Last Download to Present from the drop-down list

- Choose File Type to Download, file would be QuickBooks (.iif)

- Click Download History

- When prompted to enter the account names, enter the account names exactly as they appear in the Company’s Chart of Accounts:

- Name of PayPal Account

- Name of Other Expenses Account

(Be sure that the expense account being used is not a sub-account of another expense account or it will be turned into a bank account when it is imported into QuickBooks).

(If Accounts Payable balances are being paid by PayPal transactions, you can enter the name of your Accounts Payable account here, but the Vendor names in PayPal must match the names in QuickBooks).

- Name of Other Income Account

(Also, be sure that the income account being used is not a sub-account of another income account or it will be turned into a bank account when it is imported into QuickBooks).

(If Accounts Receivable balances are being paid by PayPal transactions, you can enter the name of your Accounts Receivable account here, but the Customer names in PayPal must match the names in QuickBooks).

Note: You will have to fill in all of the boxes, or you will receive a message from PayPal stating: You must complete the above fields to download your log.

- Save the iif to the desktop

- From the QuickBooks File menu, select Utilities, Import then IIF Files

- Select the iif file located on the Desktop, and click Open

by Marie | Mar 19, 2016 | Banking Setup & Management, Importing Files & Forms To QuickBooks, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reconciliations

Obviously, if you are merging two bank or credit card accounts, it means they are for the same credit card or bank account. You have either lost or misplaced your credit card and have received a new one, or have had your current bank account changed due to fraud, etc. and now having trouble with the banking downloads in QuickBooks.

Not sure why merging two bank or credit card accounts unreconciles previous reconciliations in QuickBooks, but it does. So, if there are a lot of transactions in the old credit card account, do not use this method. Instead, create a new bank or Credit Card account, move the balance over and make a note in the old account to indicate that it is the old one. When you link this new bank or CC account in QuickBooks with the bank or credit card company, all the new transactions will come in so you can reconcile from there. This is the best option as it does not change previous reconciliations in any way.

How to Merge Credit Card Accounts That are Setup for Online Banking

Before you embark on this merger, be sure that there are no pending transactions to send and no unmatched transactions in the old account. Also, do not deactivate the old account from online banking services. Deactivating online services can cause errors to occur during the merge process.

1) Create a new account:

a) From the Company menu, click Chart of Accounts

b) In the Chart of Accounts, click the Account drop-down and select New

c) In the Add New Account window, choose Bank and click Continue

d) Enter a name for the account. (Be sure to give the account a new name. You can change the name back when you have completed the merge)

e) Click Save & Close

2) Set up Online Banking and connect the new account to the appropriate financial institution

3) Accept any transactions that downloaded and record them into the register

4) You should now have both accounts connected for Online Banking. To avoid issues, you must merge the old account into the new account

5) In the Chart of Accounts, select the old account that will be merged into the new account, click the Account button in the lower left corner of the window, then select Edit Account

6) Change the Account Name to the exact name of the new account that you are merging into

7) Click YES when prompted by the Merge warning dialog box

8) The new account should have the entire transaction history of the old account along with any newly downloaded transactions

9) If appropriate, you can now rename the new account to the most appropriate name:

a) If you performed the merge because your credit card company has changed names, then name the account whatever is most appropriate for the credit card company new name

b) If you performed the merge because you are switching from direct connect to web connect (or vice versa) or as a troubleshooting step, then it may be appropriate to change back to the original account name

10) Because previous reconciliations were undone by the merge, mark all transactions as cleared, then refer to the previous reconciliation record that you saved from the old account and uncheck those transactions that were not previously reconciled as well as any new transactions downloaded when the new account was created.

11) Re-create pending transactions and recurring or memorized transactions as appropriate.

by Marie | Mar 2, 2016 | Bookkeeping 101, Employee Setup & Management, Payroll Setup & Management, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

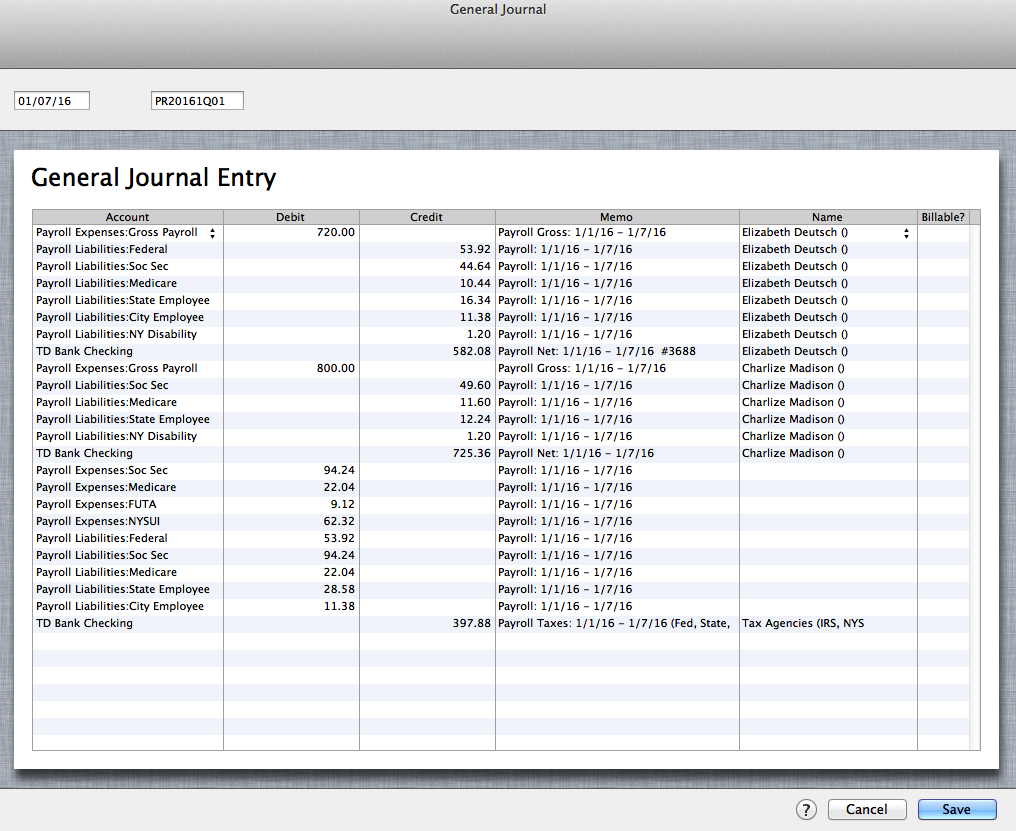

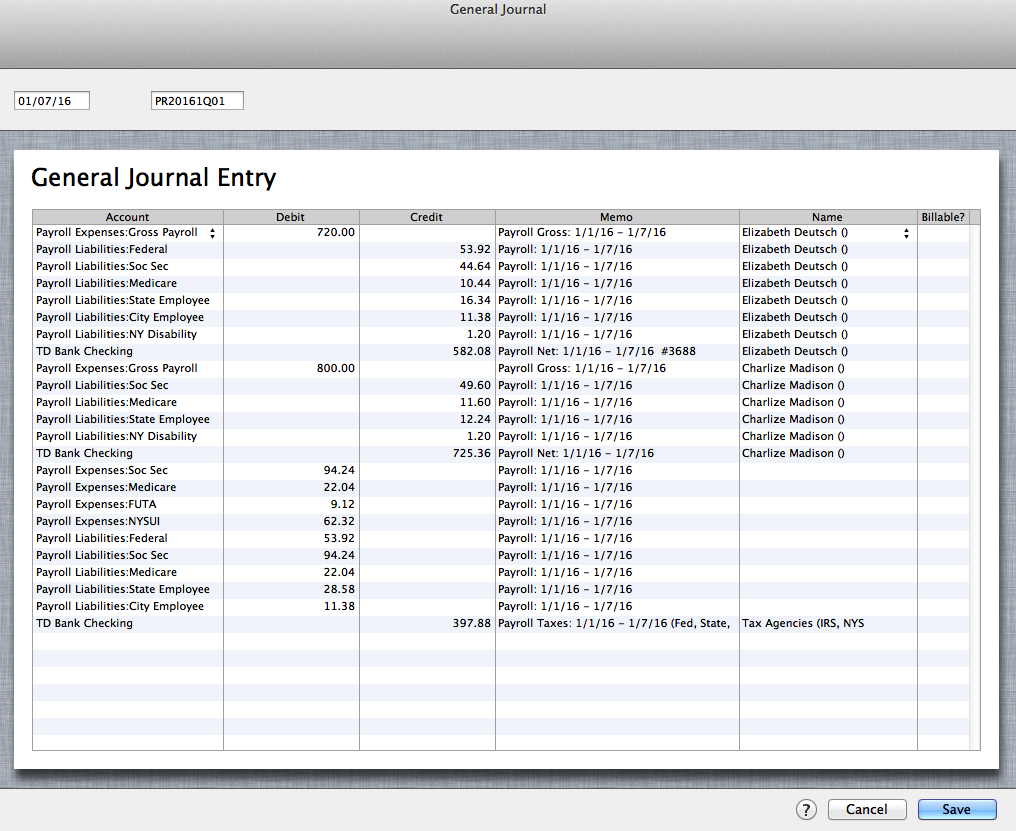

The best and most accurate way to enter third party payroll into QuickBooks is to enter them via Journal Entries. First, you want to setup the expense as well as the liability items of the payroll in the Chart of Accounts. Then you want to enter one journal entry for each pay period, using the payroll items you created in the Chart of Accounts on their correct debit and credit sides, making sure you enter the actual check dates of the paychecks. You will include the employees names in the Name field, and a memo with the pay period as well as net, gross or taxes on each transaction line.

Entering Third Party Payroll into QuickBooks:

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses

Payroll Expenses

Gross Payroll

Soc Sec Company

Medicare Company

FUTA

NYSUI

Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Payroll Liabilities

Federal Withholding

Soc Sec Employee

Medicare Employee

State Employee NYS

City Employee NYC

NY Disability

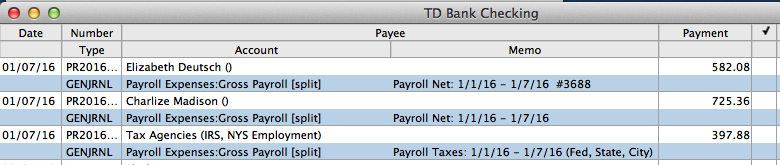

The Result: (click image to enlarge)

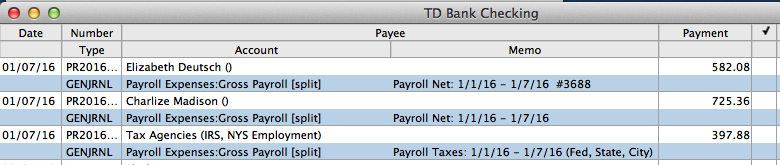

In Bank Register: (click image to enlarge)

Entering third party payroll this way will allow every aspect of the payroll to be accurately accounted for; each paycheck will be listed separately with the gross, employee paid taxes, employer paid taxes, and the net payroll. The paychecks as well as the tax payments made will be easily tracked in the bank account register, and the amounts in QuickBooks will be on par with the third party company figures. Entering third party payroll this way will also make it easily identifiable in the reconcile window when you go to reconcile your bank account, and will show a balance on the balance sheet for any withholding that was not paid over to the relevant tax authority.

RELATED:

by Marie | Feb 26, 2016 | Banking Setup & Management, Bookkeeping 101, Deposits & Undeposited Funds, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reconciliations

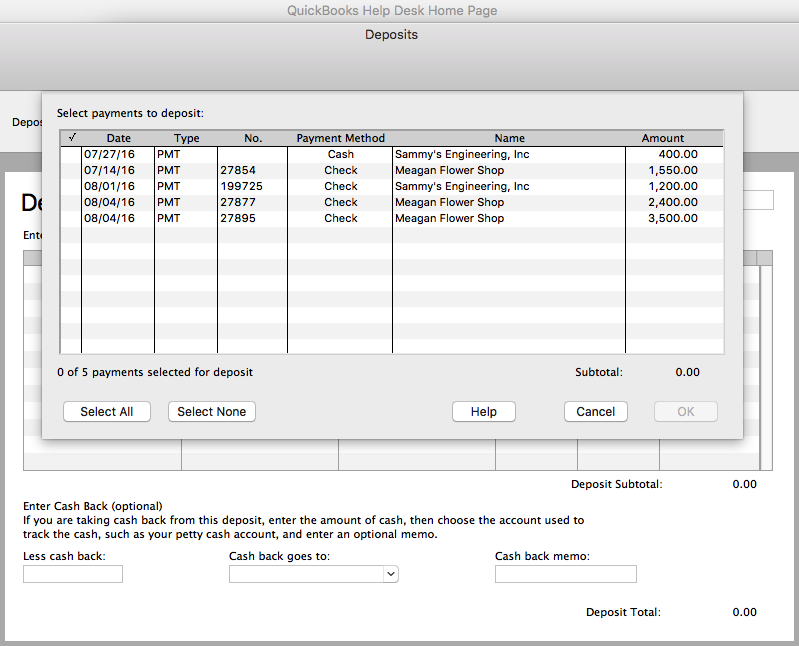

Since the accounts were reconciled for the period in which the deposits relate, it means that the same revenues were reentered directly to a bank account register without realizing that they were already entered, and are in the “undeposited funds” account waiting to be deposited to the bank from there.

The fix will depend on the number of transactions involved. If not many deposit entries, here is what you do:

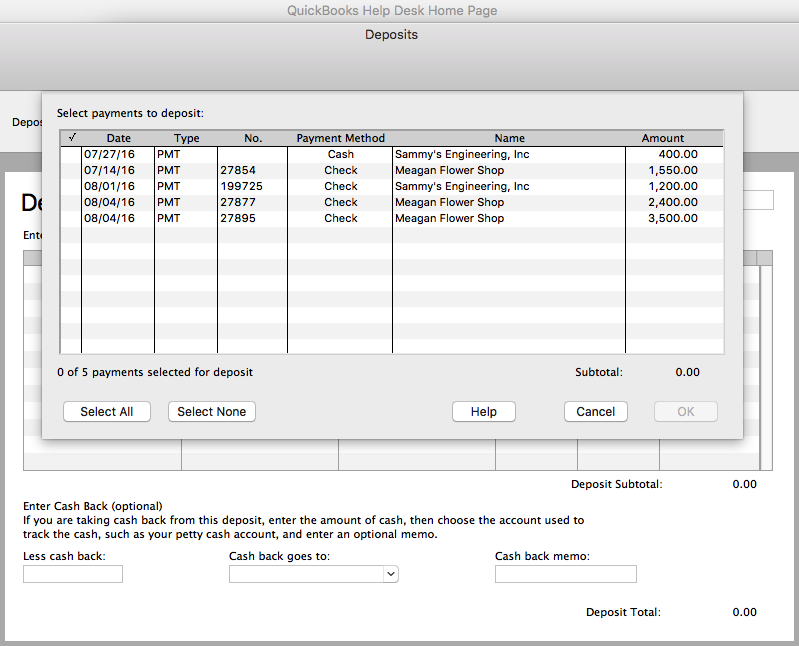

Few Deposits Fix

Few Deposits Fix

1) Locate the previous corresponding deposits in the bank account register and make note of their dates.

2) Make sure they are each the same amount as the deposits in the “Make Deposit” window. (You want to keep the deposits in the month they belong so as not to throw off the previous reconciliations).

3) Check to ensure that the dates in the “Make Deposit” window match the dates in the register, or at the very least, are in the same month. (The aim is to remove the entries from the “make Deposit” window without throwing off the previous reconciliations).

4) Now, go ahead and make the deposit(s) from the “Make Deposit” window for each amount(s) that were previously entered in the register, making sure you change the deposit date to reflect the previous deposit in the register as well.

5) Go back to the bank register and delete the previous deposits that were reconciled. (NOTE: Your deposits that you just made from the “Make Deposit” window should be shown either above or below the previous corresponding deposit with the same date).

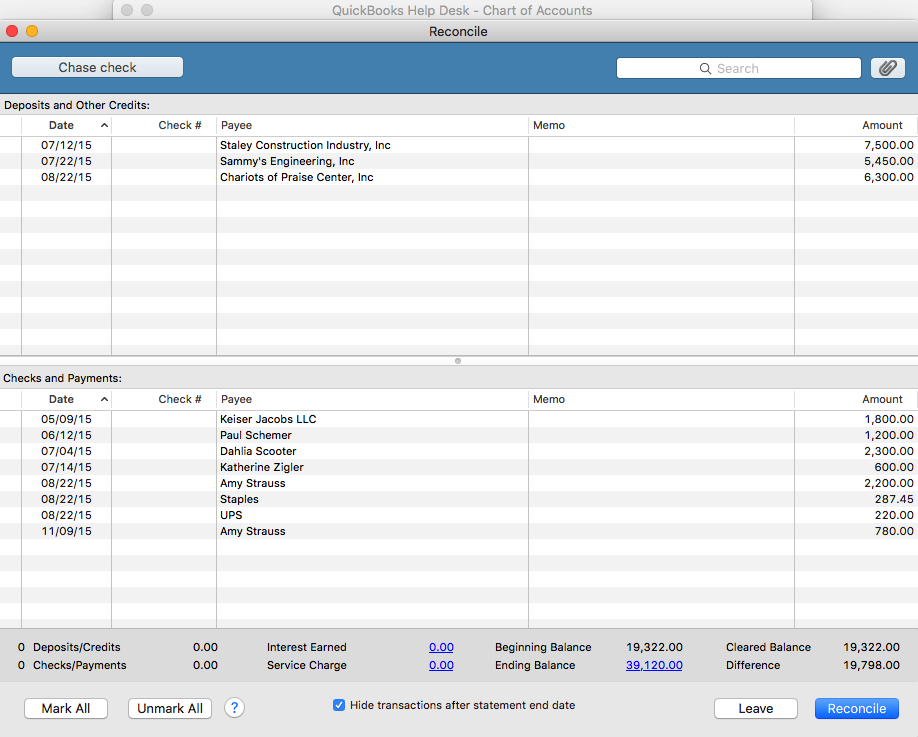

6) Next, for QuickBooks Mac Pro or QuickBooks Online: checkmark each corresponding deposit that you have just deposited, as reconciled. (With the exception of the switching of the deposits, the previous reconciliations will remain the same, with accurate opening balances for each month). For QuickBooks Windows Pro/Premier: undo the previous reconciliation(s) to the first month affected by the deposits you deleted, and re-reconcile from there onward. All the deposits you entered will be there in the reconcile window for you to check off, and you will be in balance in minutes if you deposited them all accurately. (You can use the “Mark All” feature in the reconcile window by checking the box “Hide transactions after statement end date” and clicking “Mark All”. In most cases, this will reconcile the account for that month and show a $0 difference in the reconcile window. If there is a difference, and it is not obvious what amount(s) is throwing it off, use the “Unmark All” button and reconcile one by one with the statement.)

As you can see, if the deposits in the “Make Deposit” window are a lot – possibly spanning multiple years, the above-mentioned method of clearing the deposits from the “Make Deposit” window would be very time consuming and impractical.

If there are a multitude of deposits here is what you do:

Too Many Deposits Fix

Too Many Deposits Fix

1) First, you want to check to see if the deposits that were previously entered directly into the bank register that made the accounts reconcile, and the invoice that the payments in the “Make Deposit” window are for, went to the same Income account. So, locate the previous deposits as well as the corresponding Invoice(s) and check to see where they went. (If there is only one Income account, then they most likely went to the same account).

2) Go ahead and make the deposit(s) for each year, using the year end date for each year’s total deposit. (It’s always good practice to make adjustments at the beginning or ending of a period).

3) Next, create a journal entry for each year end with the total deposit amount you just put in for each year.

- Debit the Income Account associated with the deposit(s)

- Credit the bank account that the deposits were made to

This will reduce the amount in the bank account as well as the Income account – as it should, and the “Make Deposit” window will now be cleared. When next you go to reconcile, the journal entry amounts for the deposits will be in the reconcile window. Check each on the debit and corresponding credit side to remove them from the reconcile window. This of course will be a zero effect on your current reconciliation.

Because there were transactions left in the undeposited funds, the revenue for the period(s) associated with those deposits were overstated. It is possible that they were already taken care of by the CPA or tax preparer as far as tax filing; however, you will need to bring this to their attention if taxes were already filed for the affected period(s). Although you have already corrected this on the books in QuickBooks, amended returns may need to be filed, to make the correction tax-wise.

Using the “Too Many Deposits Fix” option above will allow your financials to be accurate, but not your books in the sense that the deposits were not broken down in months which will throw monthly reports off. Using the “Few Deposits Fix” option above will allow your books as well as your financials to be accurate on either the cash or accrual basis.

by Marie | Feb 23, 2016 | Banking Setup & Management, Bookkeeping 101, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reconciliations

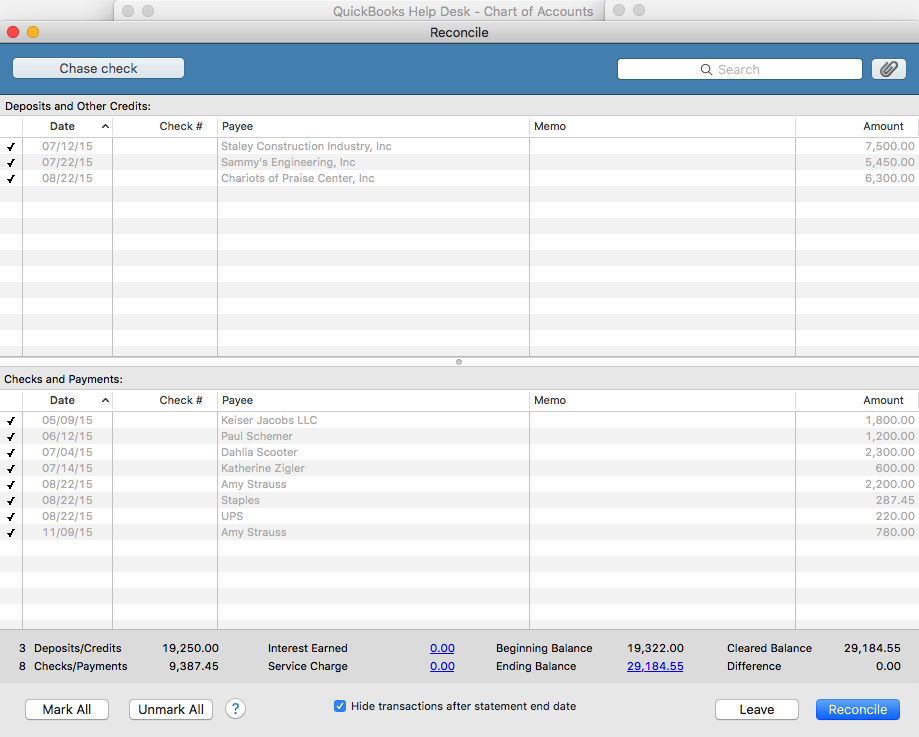

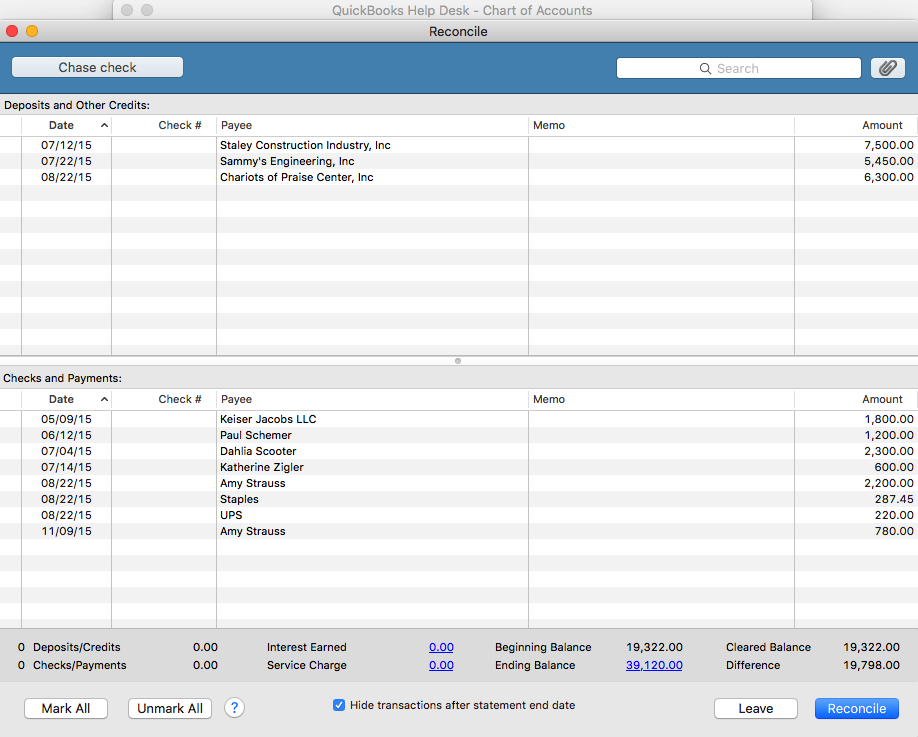

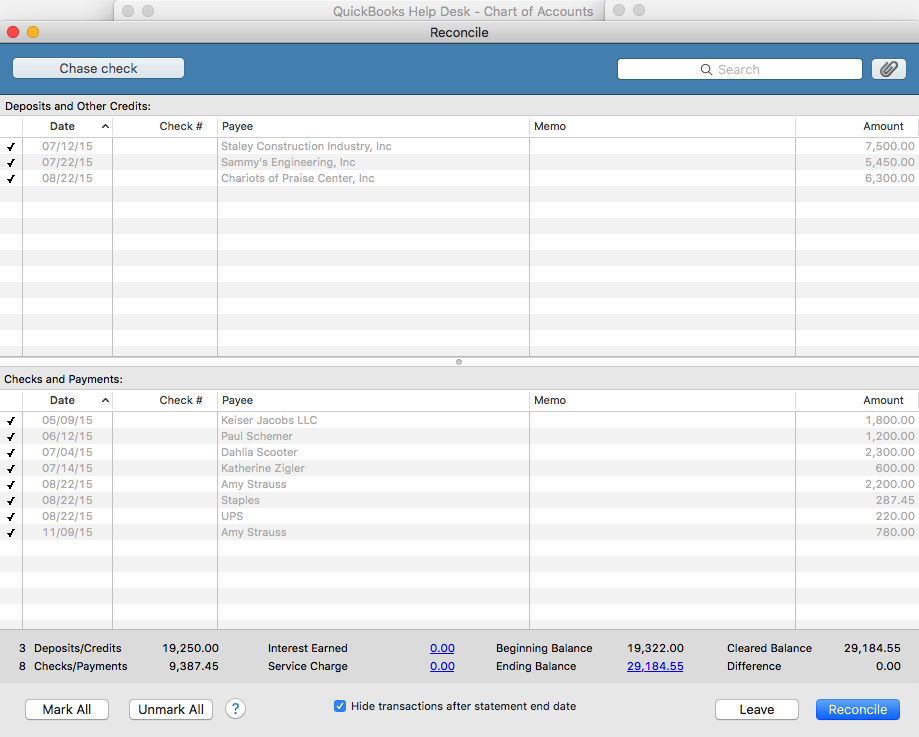

If you are using QuickBooks Pro for Mac or Windows, go to Banking then Reconcile and select the bank account you are looking to reconcile from the dropdown menu. (If you are using QuickBooks Online, click on the gear icon at top right of screen where your company name is, then Reconcile and select the bank account from the dropdown menu).

Next, enter the statement ending date and the statement ending balance, and the bank service charge and interest earned – if any. The beginning balance should be the same as the beginning balance on the statement. If it is the same, click ok and start your reconciliation process. Click on each item that matches with the same item on the statement for both debits and credits. You may also check the button that says, “Hide transactions after statement end date” then select “Mark All”.

When your account is reconciled, there should not be a difference. The amount at the “Difference” button should show $0.00. If it shows a balance, it means that there is a discrepancy, and you will need to go over each transaction to locate the discrepancy. The difference could be one or more transactions that are entered with the incorrect amount such as $2,900 entered as $2,090, or a transaction entered on the debit side when it should have been on the credit side – and vice versa.

Also, a good thing to do at this point, is to double check to ensure the beginning and ending balance in the reconcile window matches with the beginning and ending balances on the bank statement. You may click the “Unmark All” button so you can mark them individually as you cross check each item with your statement.

If you recognize the transaction that is causing the discrepancy, and feel that you have already entered it, use the “Find” feature to try and locate it. Go to Edit then Find and search for the amount. It may have been mistakenly entered with the wrong date and thus hiding in another month or period.

If you previously did a reconciliation and it was accurate, and now you want to continue reconciling current months but the beginning balance is off, click on the “Discrepancy Report” button to see what transactions were changed since your last reconciliation. If it was deleted, you will need to reenter it. If it was unchecked in the register – which makes it un-reconciled, you will need to recheck it in the register. After doing so, your beginning balance will be back on par with your statement again.

TIP:

I highly recommend using the “Download Transactions” feature in QuickBooks. Not only will it save you time entering data, but it will help you to avoid entering incorrect transaction amounts as well as making incorrect debit or credit entries.

by Marie | Feb 22, 2016 | Bookkeeping 101, Customer Setup & Management, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

The way you record this payment will depend on your reporting method – Cash or Accrual. However, there is no Bad Debt in cash basis accounting and you therefore must be using an accrual basis system since there was a previous bad debt allocation.

The best way to record this payment is to enter a sales receipt. This will keep your books clean and will not affect historical data for periods already closed out. This payment will also be counted as this year’s income, as it should, when entered this way.

For Accrual Basis:

If you wrote off the original invoice as a bad debt in a prior year, you should enter a sales receipt – especially if sales tax is involved. The income should be recorded as “Other Income” instead of “Sales”, since the original “Sale” was recorded in a prior year and subsequently written off. The sales tax, if any, was also recorded in a prior period and was written off; however, it was never collected and possibly never paid to the state. The sales tax should be recorded as current, and paid with the next sales tax return and payment that is made. If the sales tax was paid to the state, it was probably adjusted or recovered in a later period when the original invoice was written off, which means the sales tax needs to be remitted to the state – again, since it has now been collected.

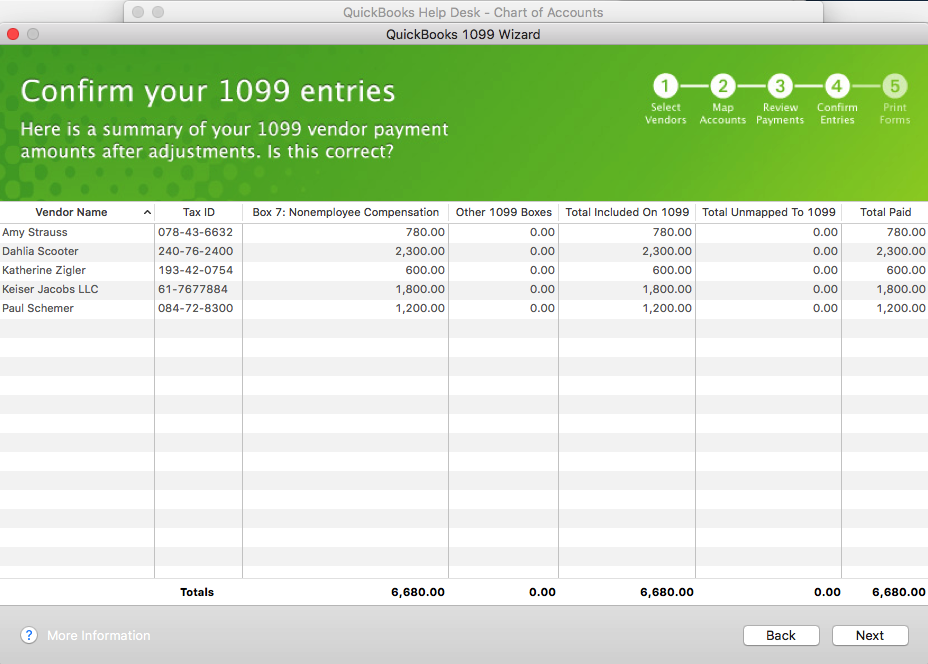

by Marie | Feb 21, 2016 | 1099 Contractor Setup & Printing, Generating & Prinitng Tax Forms, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Vendor Setup & Management

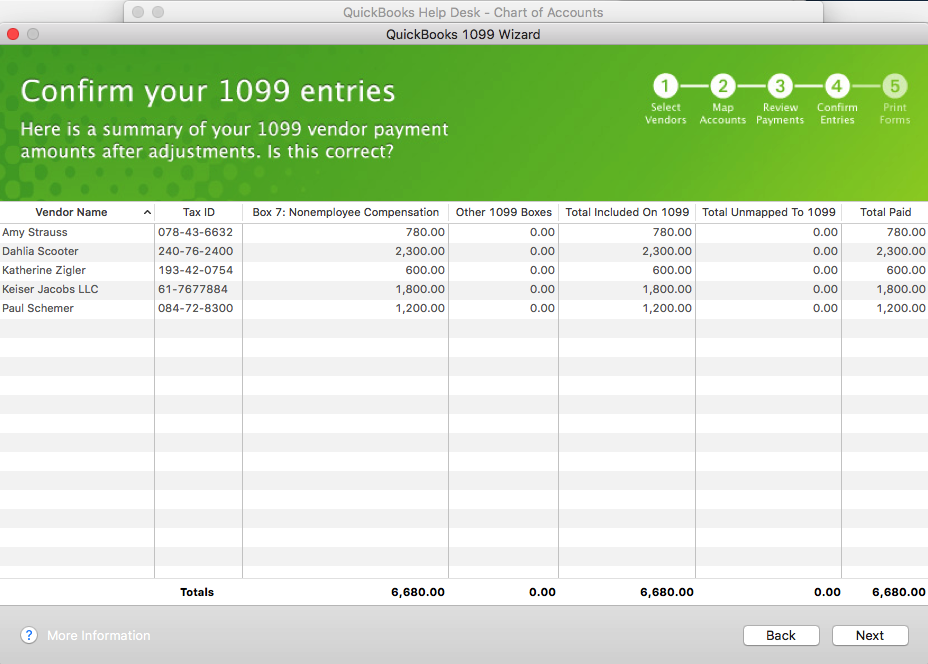

This is a question I have been asked multiple times during this 1099 preparation season, and as such have decided to address it here.

- In order for QuickBooks to generate your 1099 forms, you will need to ensure that the vendor accounts are accurately setup with the tax id option checked, and the account(s) used for each vendor mapped in the 1099 setup window notifying your QuickBooks to include them. Nothing will show up on the 1099 reports unless the vendor accounts are mapped, the tax id option checked, and the appropriate box chosen for each account mapped. Here is the Step by Step Instructions on how to accurately setup your 1099’s in QuickBooks.

- Another important thing to note, is that payments made to vendors using a credit card, debit card, or other third party payment network such as Paypal, should not be included on the vendor’s 1099 form. These companies will be sending their form 1099k to the IRS which will include the payments they made on your behalf. QuickBooks has made it easier to track and separate such payments; however, you have to ensure you include the payment number detail in the check number field when you enter vendor payments in QuickBooks. See Intuit’s Marking Payments for Exclusions from From 1099-Misc

According to Intuit, you can enter any of these notations in your check number field to identify to you what methods of payments were used, as well as allow QuickBooks to exclude payments from 1099’s based on information entered in this field. They are:

- Debit

- Debitcar

- DBT

- DBT card

- DCard

- Debit cd

- Visa

- Masterc

- MC

- MCard

- Chase

- Discover

- Diners

- PayPal

Also, I recommend generating a “Transaction by Vendor” report for each vendor to ensure that the numbers tally with the 1099’s before printing them. You want to ensure accuracy in all aspects of your business.

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Recent Comments