by Marie | Mar 20, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, Financial Statements & Reports, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

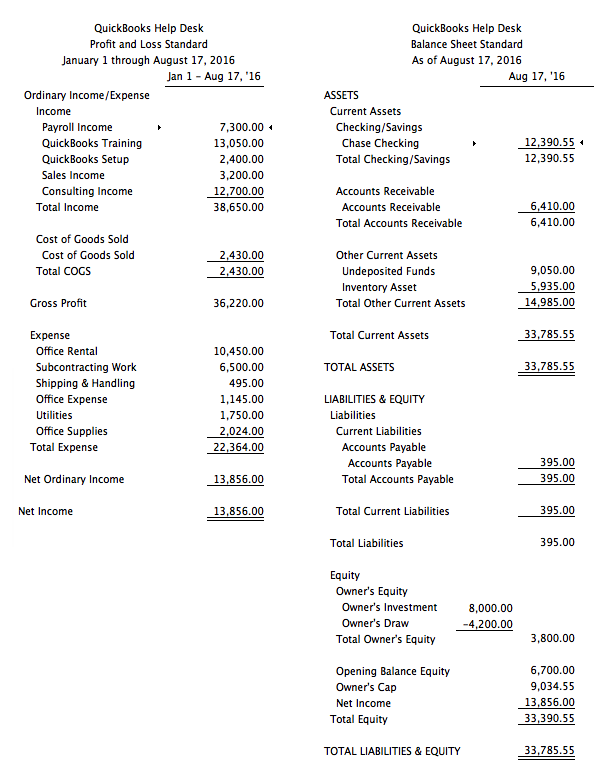

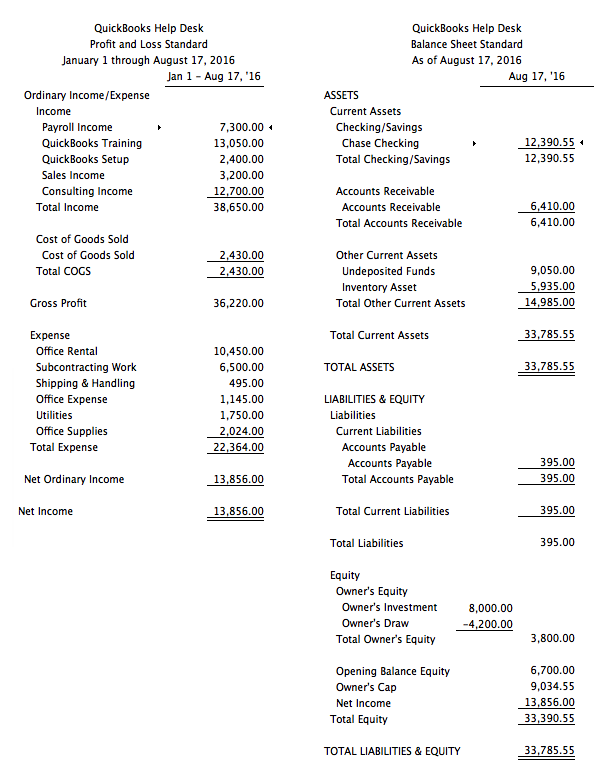

Your Profit and Loss Report is not showing Owner’s Draw because Owner’s Draw does not belong on a Profit & Loss Report and should not be there. Owner’s draws are not expenses so they do not belong on the Profit & Loss report. They are equity transactions shown at the bottom of the Balance Sheet.

The fact that you are asking this question, tells me that you do not have basic accounting knowledge, and you should not be doing any form of bookkeeping or accounting without this basic knowledge. You need basic understanding of a Chart of Accounts and how certain accounts feed to either a Balance Sheet or Profit & Loss report. Balance Sheet accounts, such as bank account, loan, and equity fluctuate as time goes on and a Balance Sheet is a snapshot of the balances in the accounts on the day requested. Income and Expense accounts accumulate figures and usually increase until closed out at year end, and the cycle starts again for each new year. That is why a Profit and Loss asks for a date range or period, while the Balance Sheet uses an “as at” date.

Profit & Loss Reports show:

- Revenue or Gross Sales

- Expenditures

- the resulting Profit or Loss

Balance Sheet Reports show:

- Assets

- Liabilities

- Equity

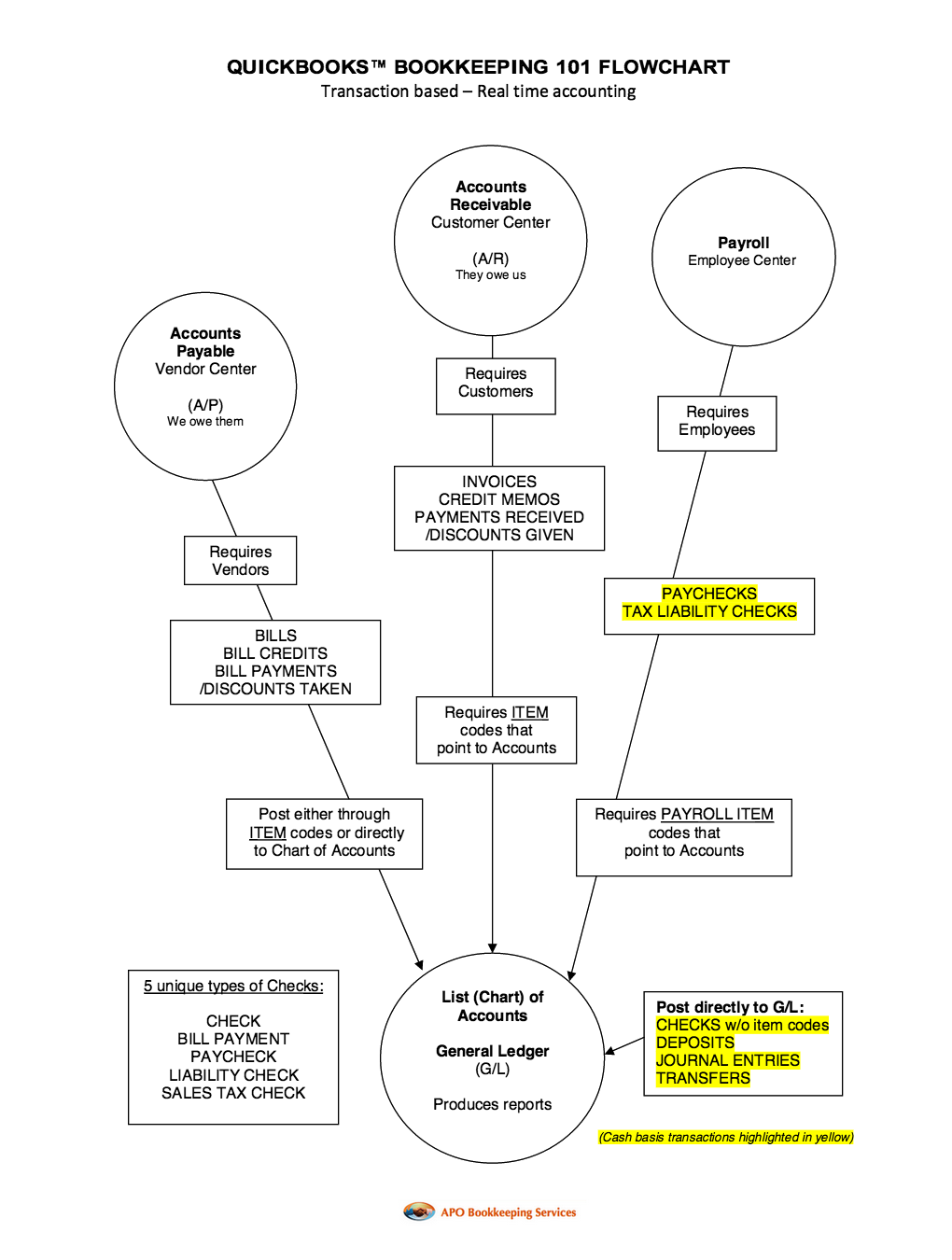

Regardless of the software – QuickBooks or others, none will make sense until you understand how the puzzle works and the unique ways certain kinds of companies must flow. If you do not know what you are doing, you could end up making a huge mess that will be very costly to clean up and reconcile. There are many bookkeeping and accounting classes out there, and it will be well worth your while to take a basic accounting course at your local community college. If you are a bookkeeper for a company, your employer may be willing to pay for this class since it will be a direct benefit to his/her business.

Also, since you are using the term “Owner Draw”, it tells me that the entity is a Sole Proprietorship. If the entity is not a Sole Proprietor, you should not be using an Owner’s Draw account. These are things that you will learn in a basic accounting class.

Key Differences Between Balance Sheet and Profit & Loss Account

- The Balance Sheet is prepared at a particular date, usually the end of financial year, while the Profit and Loss account is prepared for a particular period.

- The Balance Sheet reveals the entity’s financial position, whereas the Profit and Loss account discloses the entity’s financial performance.

- A balance Sheet gives an overview on assets, equity and liabilities of the company, but the Profit and Loss account is a depiction of entity’s revenue and expenses.

- The major difference between the two entities is that the Balance Sheet is a statement while the Profit and Loss account is an account.

- The Balance sheet is prepared on the basis of the balances transferred from the Profit and Loss account.

by Marie | Mar 20, 2016 | Bookkeeping 101, Importing Files & Forms To QuickBooks, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Third Party Applications - QuickBooks Compatible

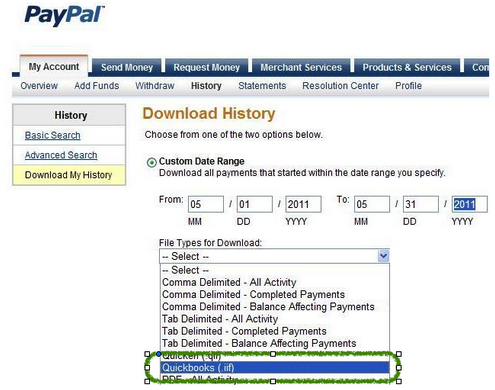

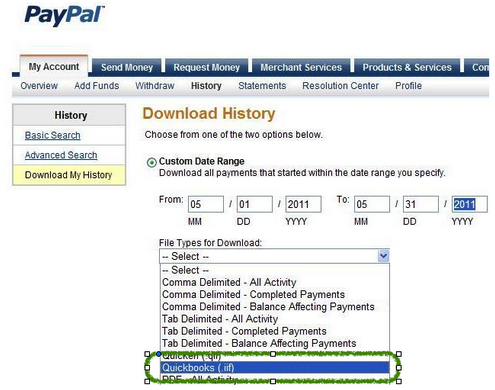

There are two ways to download Paypal transactions to QuickBooks: 1) via .iif file and 2) via .csv or Excel. I do not recommend the IIF approach as it does not allow for editing before uploading to QuickBooks, and Paypal transactions are not as seamless as bank transactions – they require editing. Instead, export the reports to Excel where you will be able to do the necessary editing before uploading to QuickBooks.

How to Import Paypal Transactions into QuickBooks

- Log in to your PayPal account

- Click the Activity tab, and select your date range

- Click the small Download link to the top right corner of the screen to get to the Download History screen

- Choose your date range, either Custom Date Range or Last Download to Present from the drop-down list

- Choose File Type to Download, file would be QuickBooks (.iif)

- Click Download History

- When prompted to enter the account names, enter the account names exactly as they appear in the Company’s Chart of Accounts:

- Name of PayPal Account

- Name of Other Expenses Account

(Be sure that the expense account being used is not a sub-account of another expense account or it will be turned into a bank account when it is imported into QuickBooks).

(If Accounts Payable balances are being paid by PayPal transactions, you can enter the name of your Accounts Payable account here, but the Vendor names in PayPal must match the names in QuickBooks).

- Name of Other Income Account

(Also, be sure that the income account being used is not a sub-account of another income account or it will be turned into a bank account when it is imported into QuickBooks).

(If Accounts Receivable balances are being paid by PayPal transactions, you can enter the name of your Accounts Receivable account here, but the Customer names in PayPal must match the names in QuickBooks).

Note: You will have to fill in all of the boxes, or you will receive a message from PayPal stating: You must complete the above fields to download your log.

- Save the iif to the desktop

- From the QuickBooks File menu, select Utilities, Import then IIF Files

- Select the iif file located on the Desktop, and click Open

by Marie | Mar 19, 2016 | Bookkeeping 101, Business Types & Accounting, QuickBooks Compatibility & Industry Types

There are a few specific challenges with using QuickBooks for law firm accounting:

- Tracking advanced costs correctly when paid out of the Operating account

- Billing for those advanced costs to the client

- Tracking and billing for time, using as much or as little detail as required by the particular firm

- Tracking and billing for miscellaneous costs for example, phone, fax, copies, etc that are not directly billable to the client

- And most importantly, tracking and reporting the trust accounting to meet the requirements of the state/bar

For trust accounting, you need to be able to answer “yes” to the following questions:

- Does the trust bank account balance matches with the trust liability account balance as at any given date?

- Do you have a detailed ledger, for each client, which shows the specifics of the ins and outs of the trust monies as at any given date?

- Do you have a report listing each client’s trust balance, the total of which equals the trust bank account balance as at any given date?

All of the above can be accomplished using QuickBooks PC or Mac, but specific procedures need to be followed and reports need to be created to meet the required standards. (I do not recommend using QuickBooks Online for trust accounting, due to the reporting limitations of that program). Trust accounting in QuickBooks is a little tricky and needs to be tracked using specific procedures in order to get good reporting for the Funds Held in Trust (escrow) detail by client. Here is my general procedure for tracking trust accounts in QuickBooks:

Deposit the retainer/settlement check into the Trust/Escrow bank account, using a Funds Held in Trust (Escrow) liability account with the client name in the name field. I do this directly in the Make Deposit form, but you can enter a sales receipt, using an item which points to the liability account.

Deposit the retainer/settlement check into the Trust/Escrow bank account, using a Funds Held in Trust (Escrow) liability account with the client name in the name field. I do this directly in the Make Deposit form, but you can enter a sales receipt, using an item which points to the liability account.

Write checks for any disbursements of those funds, using the Funds Held in Trust (Escrow) account on the expense tab of that check – with the client name in the name field on that line. Or, if you want the detail of how those disbursements are made, create separate items, all pointing to that account, to indicate what that “paid out” is for – taxes, insurance, fees, etc.

Write checks for any disbursements of those funds, using the Funds Held in Trust (Escrow) account on the expense tab of that check – with the client name in the name field on that line. Or, if you want the detail of how those disbursements are made, create separate items, all pointing to that account, to indicate what that “paid out” is for – taxes, insurance, fees, etc.

If applicable, invoice the client for the professional fees – time or flat fee billings, and any advanced costs – previously paid out of the operating account, as separate items.

If applicable, invoice the client for the professional fees – time or flat fee billings, and any advanced costs – previously paid out of the operating account, as separate items.

Cut a check from the Trust/Escrow bank account to the law firm, using the Funds Held in Trust (Escrow) account on the expense tab of that check – with the client name in the name field on that line.

Cut a check from the Trust/Escrow bank account to the law firm, using the Funds Held in Trust (Escrow) account on the expense tab of that check – with the client name in the name field on that line.

Receive the payment using the “Receive payment” option, with the client name, and attach that payment to the open invoice.

Receive the payment using the “Receive payment” option, with the client name, and attach that payment to the open invoice.

Deposit the funds into the operating checking account – either directly from the payment, or via Undeposited Funds.

Deposit the funds into the operating checking account – either directly from the payment, or via Undeposited Funds.

I have created a group of memorized reports to show the client trust activity and balances to use when reconciling and reporting client balances and/or the bank statement. These provide the necessary 3-way reconciliation as at any given date:

Trust Bank = Funds Held in Trust (liability) = Total of individual Client Fund Balances with ledger detail

These are two completely separate areas of your business and the transactions need to be recorded as such, so much so that some law firms track their trust accounting in a separate QuickBooks file – although I do not see the need for this myself.

Note: There is no way to automatically show the trust balance on an invoice; however, you can create a custom field, or enter a line in the description field, noting the remaining trust fund balance. The amount will have to be manually entered on each invoice. If you put the amount remaining in the memo field, it will not print on the invoice, but will show up on statements and in the customer center.

So, is QuickBooks an ideal accounting software for a law firm? My answer is no, but it can definitely be used.

by Marie | Mar 2, 2016 | Bookkeeping 101, Employee Setup & Management, Payroll Setup & Management, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

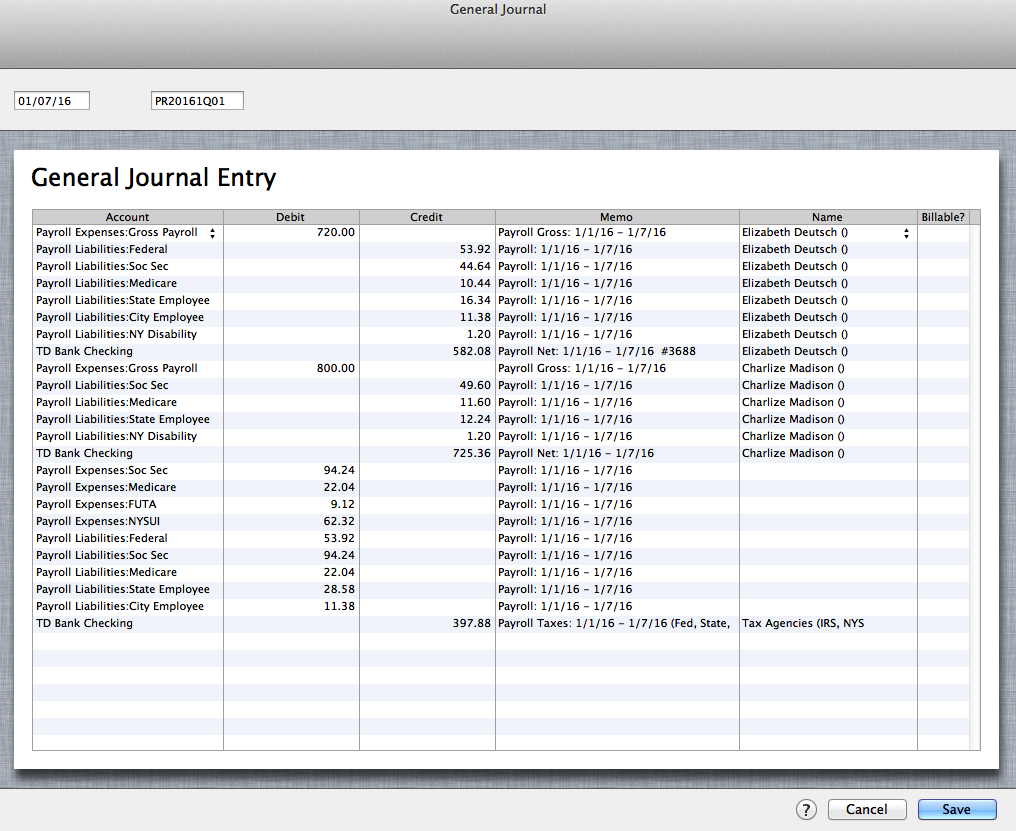

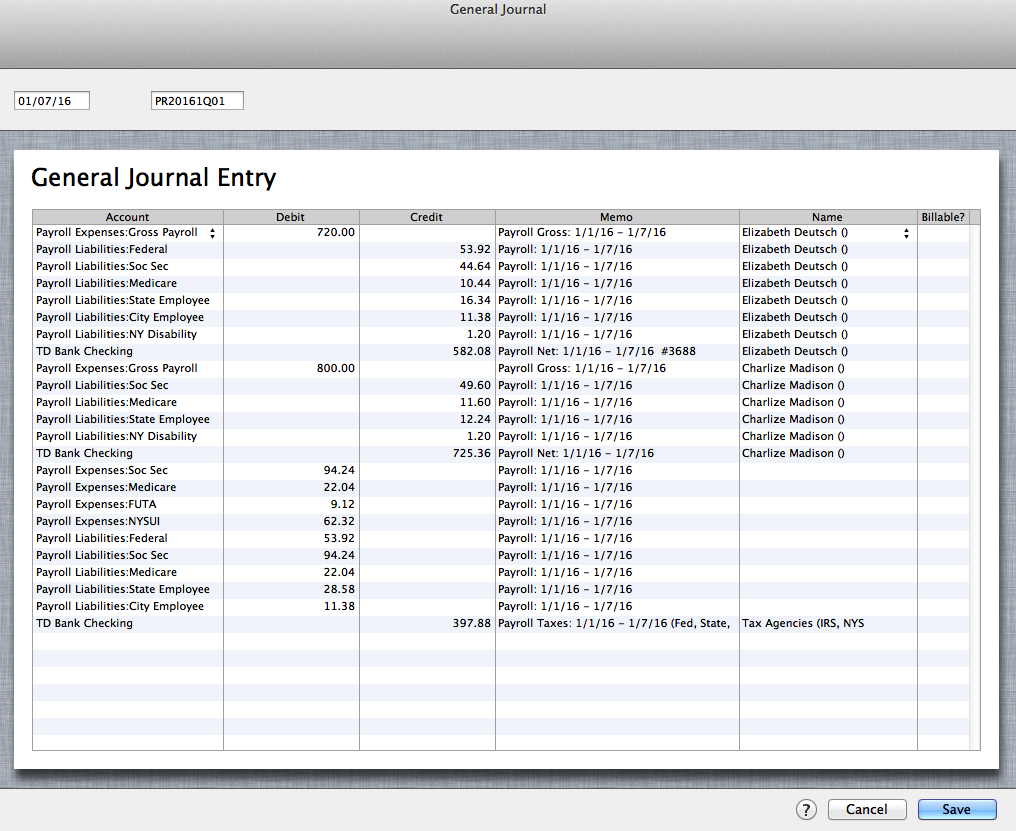

The best and most accurate way to enter third party payroll into QuickBooks is to enter them via Journal Entries. First, you want to setup the expense as well as the liability items of the payroll in the Chart of Accounts. Then you want to enter one journal entry for each pay period, using the payroll items you created in the Chart of Accounts on their correct debit and credit sides, making sure you enter the actual check dates of the paychecks. You will include the employees names in the Name field, and a memo with the pay period as well as net, gross or taxes on each transaction line.

Entering Third Party Payroll into QuickBooks:

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses

Payroll Expenses

Gross Payroll

Soc Sec Company

Medicare Company

FUTA

NYSUI

Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Payroll Liabilities

Federal Withholding

Soc Sec Employee

Medicare Employee

State Employee NYS

City Employee NYC

NY Disability

The Result: (click image to enlarge)

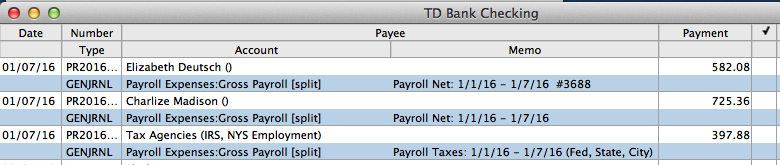

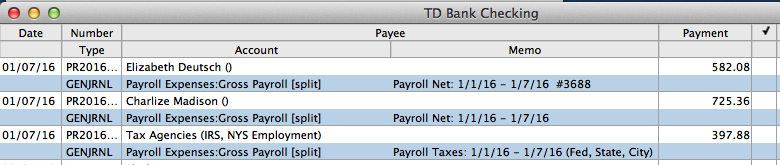

In Bank Register: (click image to enlarge)

Entering third party payroll this way will allow every aspect of the payroll to be accurately accounted for; each paycheck will be listed separately with the gross, employee paid taxes, employer paid taxes, and the net payroll. The paychecks as well as the tax payments made will be easily tracked in the bank account register, and the amounts in QuickBooks will be on par with the third party company figures. Entering third party payroll this way will also make it easily identifiable in the reconcile window when you go to reconcile your bank account, and will show a balance on the balance sheet for any withholding that was not paid over to the relevant tax authority.

RELATED:

by Marie | Feb 26, 2016 | Banking Setup & Management, Bookkeeping 101, Deposits & Undeposited Funds, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reconciliations

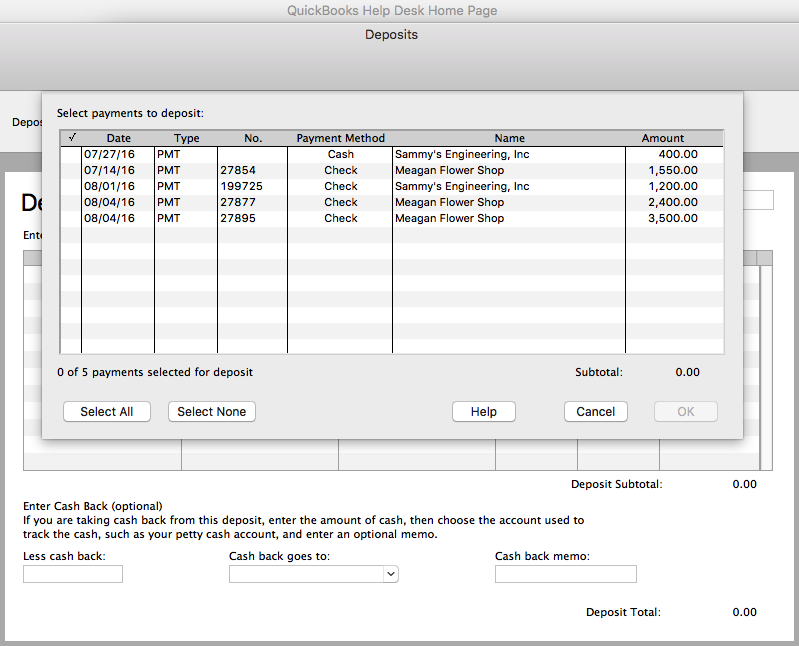

Since the accounts were reconciled for the period in which the deposits relate, it means that the same revenues were reentered directly to a bank account register without realizing that they were already entered, and are in the “undeposited funds” account waiting to be deposited to the bank from there.

The fix will depend on the number of transactions involved. If not many deposit entries, here is what you do:

Few Deposits Fix

Few Deposits Fix

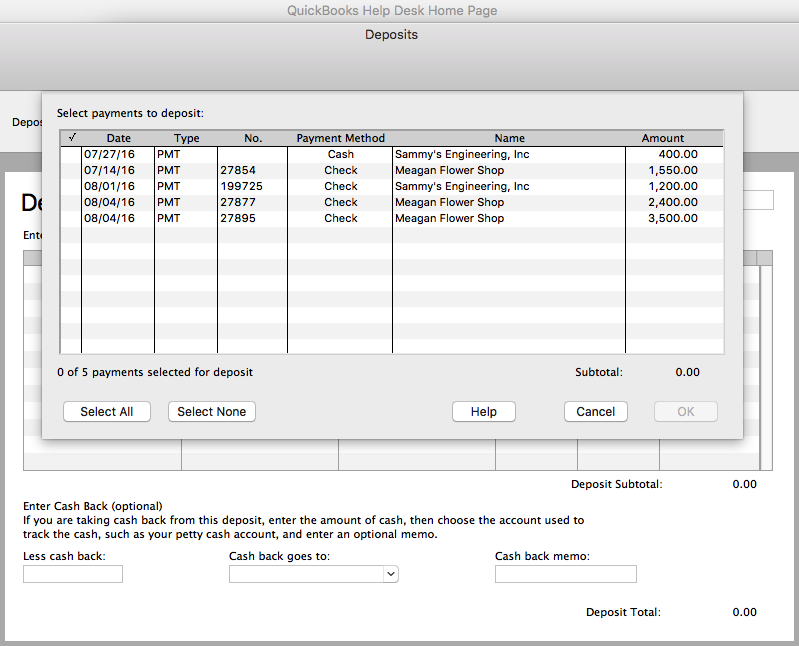

1) Locate the previous corresponding deposits in the bank account register and make note of their dates.

2) Make sure they are each the same amount as the deposits in the “Make Deposit” window. (You want to keep the deposits in the month they belong so as not to throw off the previous reconciliations).

3) Check to ensure that the dates in the “Make Deposit” window match the dates in the register, or at the very least, are in the same month. (The aim is to remove the entries from the “make Deposit” window without throwing off the previous reconciliations).

4) Now, go ahead and make the deposit(s) from the “Make Deposit” window for each amount(s) that were previously entered in the register, making sure you change the deposit date to reflect the previous deposit in the register as well.

5) Go back to the bank register and delete the previous deposits that were reconciled. (NOTE: Your deposits that you just made from the “Make Deposit” window should be shown either above or below the previous corresponding deposit with the same date).

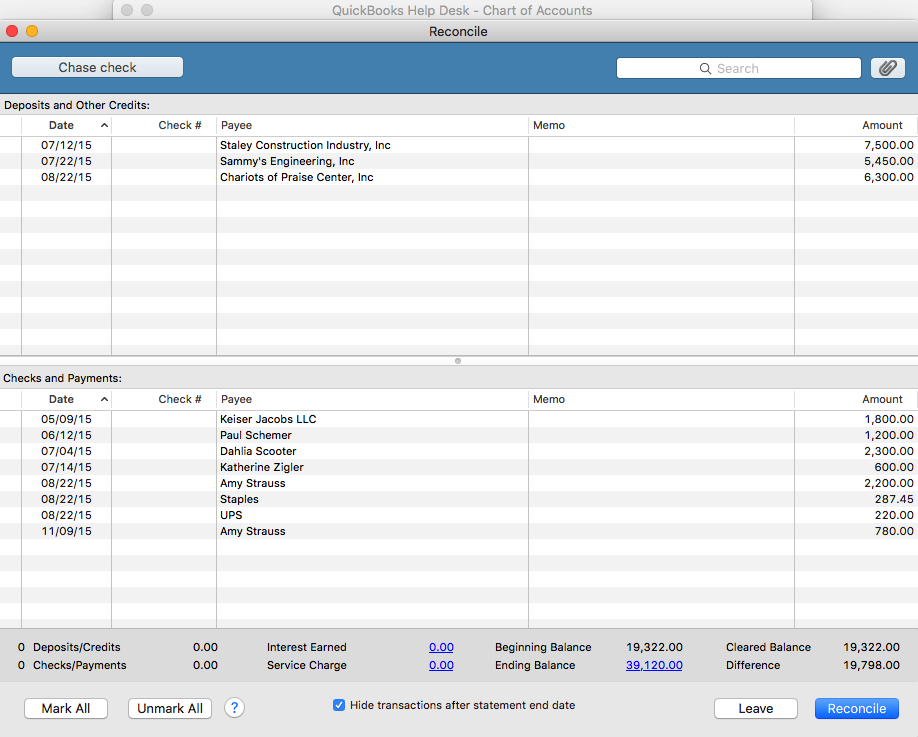

6) Next, for QuickBooks Mac Pro or QuickBooks Online: checkmark each corresponding deposit that you have just deposited, as reconciled. (With the exception of the switching of the deposits, the previous reconciliations will remain the same, with accurate opening balances for each month). For QuickBooks Windows Pro/Premier: undo the previous reconciliation(s) to the first month affected by the deposits you deleted, and re-reconcile from there onward. All the deposits you entered will be there in the reconcile window for you to check off, and you will be in balance in minutes if you deposited them all accurately. (You can use the “Mark All” feature in the reconcile window by checking the box “Hide transactions after statement end date” and clicking “Mark All”. In most cases, this will reconcile the account for that month and show a $0 difference in the reconcile window. If there is a difference, and it is not obvious what amount(s) is throwing it off, use the “Unmark All” button and reconcile one by one with the statement.)

As you can see, if the deposits in the “Make Deposit” window are a lot – possibly spanning multiple years, the above-mentioned method of clearing the deposits from the “Make Deposit” window would be very time consuming and impractical.

If there are a multitude of deposits here is what you do:

Too Many Deposits Fix

Too Many Deposits Fix

1) First, you want to check to see if the deposits that were previously entered directly into the bank register that made the accounts reconcile, and the invoice that the payments in the “Make Deposit” window are for, went to the same Income account. So, locate the previous deposits as well as the corresponding Invoice(s) and check to see where they went. (If there is only one Income account, then they most likely went to the same account).

2) Go ahead and make the deposit(s) for each year, using the year end date for each year’s total deposit. (It’s always good practice to make adjustments at the beginning or ending of a period).

3) Next, create a journal entry for each year end with the total deposit amount you just put in for each year.

- Debit the Income Account associated with the deposit(s)

- Credit the bank account that the deposits were made to

This will reduce the amount in the bank account as well as the Income account – as it should, and the “Make Deposit” window will now be cleared. When next you go to reconcile, the journal entry amounts for the deposits will be in the reconcile window. Check each on the debit and corresponding credit side to remove them from the reconcile window. This of course will be a zero effect on your current reconciliation.

Because there were transactions left in the undeposited funds, the revenue for the period(s) associated with those deposits were overstated. It is possible that they were already taken care of by the CPA or tax preparer as far as tax filing; however, you will need to bring this to their attention if taxes were already filed for the affected period(s). Although you have already corrected this on the books in QuickBooks, amended returns may need to be filed, to make the correction tax-wise.

Using the “Too Many Deposits Fix” option above will allow your financials to be accurate, but not your books in the sense that the deposits were not broken down in months which will throw monthly reports off. Using the “Few Deposits Fix” option above will allow your books as well as your financials to be accurate on either the cash or accrual basis.

by Marie | Feb 23, 2016 | Banking Setup & Management, Bookkeeping 101, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reconciliations

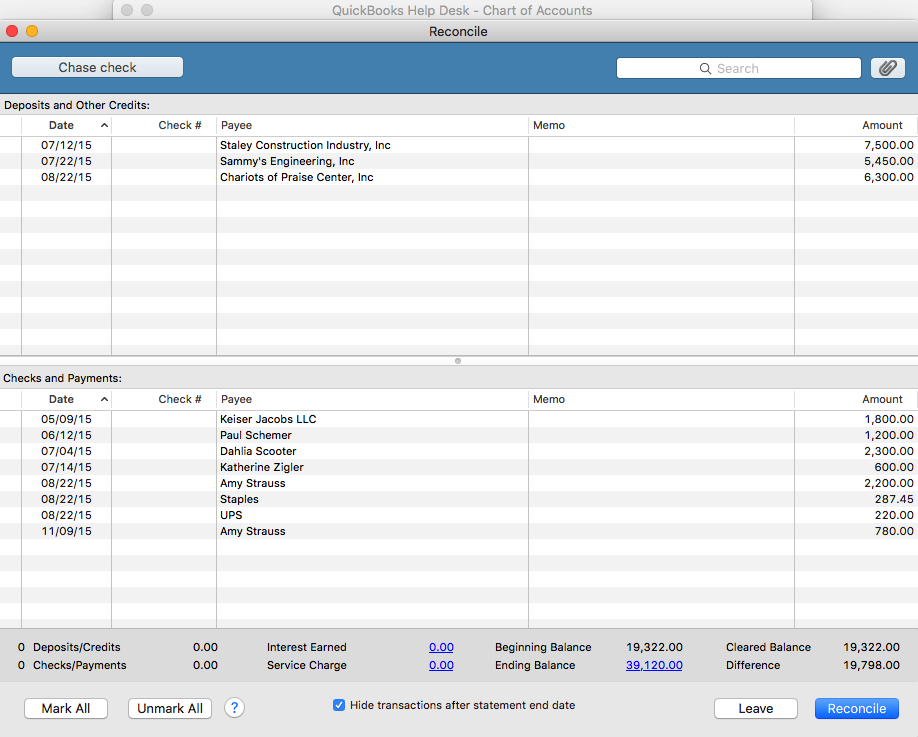

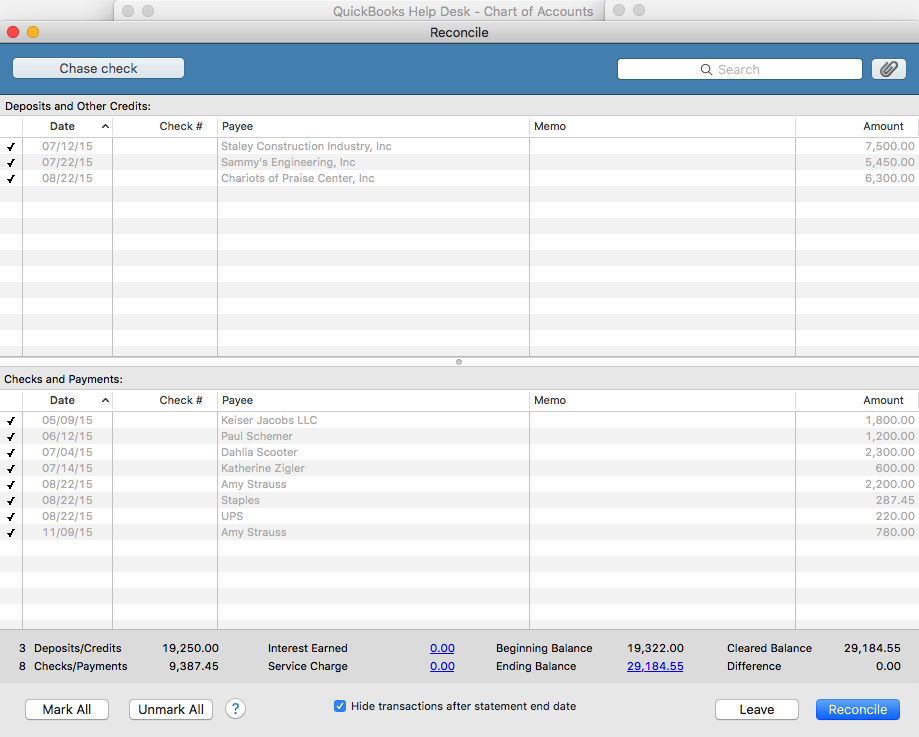

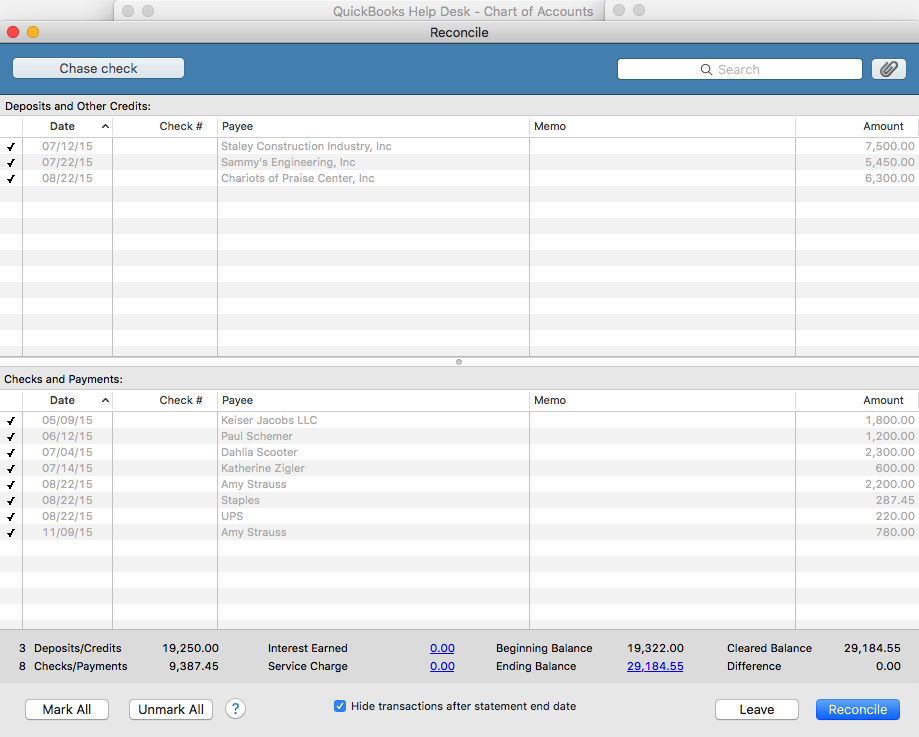

If you are using QuickBooks Pro for Mac or Windows, go to Banking then Reconcile and select the bank account you are looking to reconcile from the dropdown menu. (If you are using QuickBooks Online, click on the gear icon at top right of screen where your company name is, then Reconcile and select the bank account from the dropdown menu).

Next, enter the statement ending date and the statement ending balance, and the bank service charge and interest earned – if any. The beginning balance should be the same as the beginning balance on the statement. If it is the same, click ok and start your reconciliation process. Click on each item that matches with the same item on the statement for both debits and credits. You may also check the button that says, “Hide transactions after statement end date” then select “Mark All”.

When your account is reconciled, there should not be a difference. The amount at the “Difference” button should show $0.00. If it shows a balance, it means that there is a discrepancy, and you will need to go over each transaction to locate the discrepancy. The difference could be one or more transactions that are entered with the incorrect amount such as $2,900 entered as $2,090, or a transaction entered on the debit side when it should have been on the credit side – and vice versa.

Also, a good thing to do at this point, is to double check to ensure the beginning and ending balance in the reconcile window matches with the beginning and ending balances on the bank statement. You may click the “Unmark All” button so you can mark them individually as you cross check each item with your statement.

If you recognize the transaction that is causing the discrepancy, and feel that you have already entered it, use the “Find” feature to try and locate it. Go to Edit then Find and search for the amount. It may have been mistakenly entered with the wrong date and thus hiding in another month or period.

If you previously did a reconciliation and it was accurate, and now you want to continue reconciling current months but the beginning balance is off, click on the “Discrepancy Report” button to see what transactions were changed since your last reconciliation. If it was deleted, you will need to reenter it. If it was unchecked in the register – which makes it un-reconciled, you will need to recheck it in the register. After doing so, your beginning balance will be back on par with your statement again.

TIP:

I highly recommend using the “Download Transactions” feature in QuickBooks. Not only will it save you time entering data, but it will help you to avoid entering incorrect transaction amounts as well as making incorrect debit or credit entries.

by Marie | Feb 22, 2016 | Bookkeeping 101, Customer Setup & Management, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online

The way you record this payment will depend on your reporting method – Cash or Accrual. However, there is no Bad Debt in cash basis accounting and you therefore must be using an accrual basis system since there was a previous bad debt allocation.

The best way to record this payment is to enter a sales receipt. This will keep your books clean and will not affect historical data for periods already closed out. This payment will also be counted as this year’s income, as it should, when entered this way.

For Accrual Basis:

If you wrote off the original invoice as a bad debt in a prior year, you should enter a sales receipt – especially if sales tax is involved. The income should be recorded as “Other Income” instead of “Sales”, since the original “Sale” was recorded in a prior year and subsequently written off. The sales tax, if any, was also recorded in a prior period and was written off; however, it was never collected and possibly never paid to the state. The sales tax should be recorded as current, and paid with the next sales tax return and payment that is made. If the sales tax was paid to the state, it was probably adjusted or recovered in a later period when the original invoice was written off, which means the sales tax needs to be remitted to the state – again, since it has now been collected.

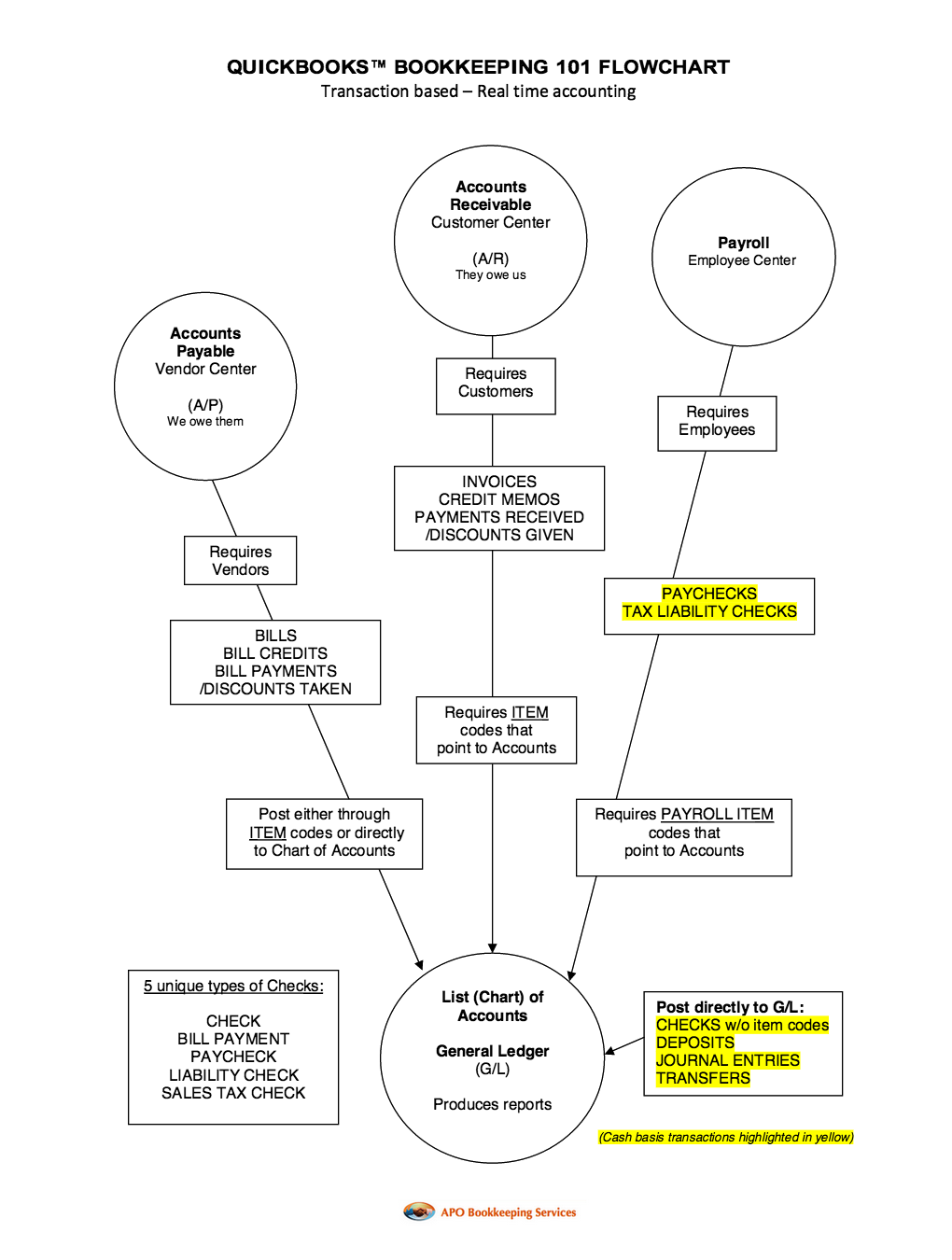

by Marie | Feb 21, 2016 | Bookkeeping 101

by Marie | Feb 21, 2016 | Bookkeeping 101, Chart of Accounts Setup & Management, Personal and Business Expenses, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reimbursements and Investments

The correct way to enter business expenses that you have paid for with your personal credit card, debit card, or cash in your company’s QuickBooks, will be based on whether you want to invest this money in your company or reimburse yourself for it, as well as the type of business structure your company is setup as – Sole proprietor, Single member LLC, Multi member LLC, or Corporation. With QuickBooks, there are usually more than one ways to deal with various scenarios. Here are a few to deal with this one:

Option 1 – Reimburse Yourself

- Setup yourself in QuickBooks as a vendor and create a bill for your expenses, allocating them to the relevant business expenses the funds were used for. Then, pay yourself with a check using the “Pay Bill” feature when you are ready to take your reimbursement. This option can be used regardless of your business structure.

- Create a Current Liability account and call it something like “Owed to Owner”, then enter the transactions in this account where the credit card and other expenses will be easy to track in the event of an audit, with the exact amounts and vendor details listed. You will then write a check to yourself using this current liability account in order to clear the balance and reimburse yourself. This option is not suitable for a Corporation.

- Fill out an expense report just as you would expect any other employee to do, in order to be reimbursed. All receipts that are company related that the funds were used for, should be attached to this expense report so that all vendor details are part of the company records. In addition, keep a copy of the personal credit card statement in the business files to serve as backup for the expenses. Then, write a check for the expense report total, allocating each expense to its relevant company expense. This option is most suitable for a Corporation. (NOTE: Use the “Write Check” feature only if you are paying the full reimbursement. If you will be taking the reimbursement in portions, you should create a bill with all the expenses listed, then use the “Pay Bill” feature to pay the portion of the bill you want to receive. When you are ready to reimburse yourself for the balance, you will again use the “Pay Bill” feature to complete the payment. Also, be sure to keep receipts as backup for the cash purchases you make with your personal funds on behalf of your business.)

Option 2 – Invest the Funds in Your Business

- Create a Current Liability account and call it something like “Owed to Owner”, then enter the transactions in this account where the credit card expenses will be easy to track in the event of an audit, with the exact amounts and vendor details listed. Next, create an Equity account and call it something like “Owner Contributions”, and transfer the total of all the transactions in the current liability account to this Equity account to invest it in your business. This option is not suitable for a Corporation.

- Create a Liability account and call it something like “Loan from Shareholder”, then enter the individual transactions in this account, so that you will be able to allocate each to its relevant expense. Next, create an Equity account and call it something like “Shareholder Investment”. When you are through entering the transactions in the “Loan from Shareholder” account, transfer the total balance to the “Shareholder Investments” account. This option is most suitable for a Corporation.

Mixing personal funds with business funds is never a good idea! Avoid co-mingling funds at all cost – especially for a Corporation. You could expose yourself to the kind of liability you formed the Corporation to avoid, in the first place.

Get The Help You Need: Sign Up For “One on One” QuickBooks Training:

by Marie | Oct 11, 2015 | Bookkeeping 101

Is your bookkeeping system doing the best job it can for you?

Do you have the right accounting system for your business? Your current bookkeeping system can either be helping or hindering your business right now!

The truth about the financial stance of your business, and its ultimate success depends on two things:

- How well you decided to keep your company’s books, and

- How well you have kept them.

Whether you are just starting out or have been in business a while, evaluating your bookkeeping system to ensure it is the best fit and helping you to maximize your business’s potential, is crucial for your business growth and development. Here are a few questions to ask yourself:

- Is the program software I am using for my business the right fit? The right fit should be easy to use, house all the features your business require, and allow you to gain insight into the wellness of your business through multiple reports.

- How easy is it for me to enter data? The best system for your business should allow for efficiency and save you time.

- Can I understand the language it speaks and the program’s functionality? I mean, is it an integrated system or do I need an accounting background to understand how the separate modules work? Your system should be user-friendly, even if you do not have an accounting background.

- Does it give me useful reporting? A good software system should be able to let you know how much you are making and spending, and why.

- Does my system meet government’s record retention requirements? Whether your information is on paper or is stored in an electronic version, it is your responsibility to retain records that an auditor can access – in the event of a tax audit.

Based on the answers to the above-mentioned questions, you may need to evaluate further:

What would make my business flow more efficiently?

- Do I continue to do my books myself or hire a bookkeeper?

- If I decide to hire, should I opt for a part-time, full-time, on the premises, off the premises, employee or freelance bookkeeper?

- If I decide to continue doing my books myself, should I change my current accounting software program? Should I use online (in the cloud) or offline on my desktop?

And what about your paperwork and documents? Are they trackable? Easy to locate? Do you need a formal filing system or will an informal receipts method work?

Any organized system will let you see if your revenue coming in covers your business expenses (including your draw) with some extra room left for a profit. Even simple systems will let know what your profit margin is.

Your system should let you break down your expenses by type so you can see where your largest outlays are. You need this important information if you are going to control your costs. Cutting costs may make sense in the short run but take the time to think about how will it affect your long range plans for your business.

Projecting your cash flow three to six months into the future will give you a heads up if a cash squeeze is coming, allowing you to be proactive and take action.

If your accounting system is doing its job, you should be able to see where your highest profits are so you can direct your time and money there instead of on the less profitable parts of your business. Or maybe you can brainstorm to see if there is a way to increase your profits in these areas.

Bottom Line:

Not keeping accurate, up-to-date books can give you a false sense of security and business health, and over time run your business into the ground. The way in which you conduct your business as well as keep your books and documents will help or hurt your business statistics on which you rely to make good business decisions.

Deposit the retainer/settlement check into the Trust/Escrow bank account, using a Funds Held in Trust (Escrow) liability account with the client name in the name field. I do this directly in the Make Deposit form, but you can enter a sales receipt, using an item which points to the liability account.

Deposit the retainer/settlement check into the Trust/Escrow bank account, using a Funds Held in Trust (Escrow) liability account with the client name in the name field. I do this directly in the Make Deposit form, but you can enter a sales receipt, using an item which points to the liability account. Write checks for any disbursements of those funds, using the Funds Held in Trust (Escrow) account on the expense tab of that check – with the client name in the name field on that line. Or, if you want the detail of how those disbursements are made, create separate items, all pointing to that account, to indicate what that “paid out” is for – taxes, insurance, fees, etc.

Write checks for any disbursements of those funds, using the Funds Held in Trust (Escrow) account on the expense tab of that check – with the client name in the name field on that line. Or, if you want the detail of how those disbursements are made, create separate items, all pointing to that account, to indicate what that “paid out” is for – taxes, insurance, fees, etc. If applicable, invoice the client for the professional fees – time or flat fee billings, and any advanced costs – previously paid out of the operating account, as separate items.

If applicable, invoice the client for the professional fees – time or flat fee billings, and any advanced costs – previously paid out of the operating account, as separate items. Cut a check from the Trust/Escrow bank account to the law firm, using the Funds Held in Trust (Escrow) account on the expense tab of that check – with the client name in the name field on that line.

Cut a check from the Trust/Escrow bank account to the law firm, using the Funds Held in Trust (Escrow) account on the expense tab of that check – with the client name in the name field on that line. Receive the payment using the “Receive payment” option, with the client name, and attach that payment to the open invoice.

Receive the payment using the “Receive payment” option, with the client name, and attach that payment to the open invoice. Deposit the funds into the operating checking account – either directly from the payment, or via Undeposited Funds.

Deposit the funds into the operating checking account – either directly from the payment, or via Undeposited Funds. Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses

Create the Payroll Expense Items in the Chart of Accounts as sub of Payroll Expenses to record company expenses Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Create the Liability Items in the Chart of Accounts as sub of Payroll Liabilities to record employees withholdings

Few Deposits Fix

Few Deposits Fix

Recent Comments